An Audience With Ewan McCulloch and Paul Cooper

Interviewee:

|

Ewan McCulloch |

|

Paul Cooper |

As emphasis on pooling intensifies, we look to one fruitful partnership, with insights from Ewan McCulloch, Chief Stakeholder Officer at Border to Coast Pension Partnership, and Paul Cooper, Head of Pensions at Durham County Council

Border to Coast was FCA-regulated from the outset. Why was that decision important, and how has it shaped your model?

Paul Cooper (PC): From a partner fund perspective, it was a core part of our design for Border to Coast and the approach we always felt was most appropriate for us. It gave us a very clear idea of what we could expect from the partnership.

It provides credibility, which is reassuring for our committee members and stakeholders. It also provides us assurance on the robustness of governance arrangements and the compliance framework that comes with FCA authorisation – clarity on roles and responsibilities, transparency of reporting, and the duties of the pool to us, its client.

Beyond that, we foresaw FCA authorisation becoming a requirement down the line, so it was a direction of travel that made sense. That direction of travel has continued. Now, as we’re looking to expand our advisory services, our authorisation status supports that.

How does the “one share, one vote” structure help ensure all partner fund voices are heard?

PC: There’s true equality in the partnership – one fund, one vote, and that applies both in our capacity as shareholders and in any client-related matters. The partnership is quite diverse in terms of fund size and geography. Every one of the funds has an equal voice in decision making, whether those be investment decisions, the corporate function of the company, or our responsible investment approach.

Ewan McCulloch (EM): The strength of our partnership is that it’s a partnership of equals; it allows our funds to have difficult conversations in order to produce the best collective solution. We truly believe that we can achieve more together than as individuals.

Our partner funds are always very willing to sit down and clarify what they really need. For example, at the beginning of pooling, they had a huge range of investment strategies – dozens of them. We spent a lot of time building consensus as to what they actually needed. In that conversation, everyone has an equal voice.

Can you walk us through how a new fund idea is taken from concept to launch? What does collaboration look like in that process?

PC: Thinking about the starting position Ewan talks about and the dozens of investment mandates we started with, we had to think about where to compromise individually to get a solution that would deliver risk and return that we collectively felt was appropriate. We’re always cognisant that a huge proportion of return comes down to strategic asset allocation decisions. We also focused on developing those solutions early on where we could save on cost through our combined scale.

Now, we’re in a position that most partner funds can deploy their strategic asset allocation through Border to Coast. We have the building blocks, and we’re now able to look beyond that foundation to the value add that partner funds want from the partnership. That leads to some really interesting solutions from which we can all benefit – UK opportunities or climate opportunities, particularly innovative strategies that Border to Coast has developed in collaboration with all 11 partner funds.

Each partner fund has different views on the future. A fund might come to the table with an idea, and we’ll kick it around, find out if other funds are interested. If multiple funds are interested, we’ll raise that through the company to consider whether we could develop an investment solution.

EM: All of this demonstrates the power of the collective. For example, we recently moved to collective oversight of our investments, and it’s a strength that each partner fund views oversight from a slightly different perspective. Those discussions are richer because we have everybody in the room.

It also preserves resources: the pool doesn’t need to assess investment performance 11 times. Even partner funds that are not invested in a proposition are part of the oversight process, because they’re still shareholders in the company and so it’s appropriate that they take part in reviews.

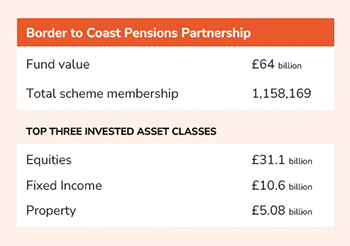

Fund Snapshot

Data as at March 2024

How has the relationship between Border to Coast and Durham evolved over time?

PC: In the early years, the focus was on building. It felt like all we did for a while was develop and launch new funds. It takes time to be able to measure investment performance, so about three years after that we began to have enough performance data to make a meaningful judgement of track record. That meant we could get out of the build phase and place greater focus on the assessment of performance. The streamlined, collective approach that Ewan talks about has helped us assess performance more effectively.

EM: One of the benefits of our partnership is that, while not all partner funds were close at the start of the journey, they have all become very close. Now, they support each other even in non-investment areas. They’re talking about culture, governance, administration, which means the strength of the partnership goes beyond just investment.

PC: Absolutely, and that massively helps with resilience across the partnership. We recognise the challenges facing the LGPS – issues of resilience, recruitment and retention. By working together and building efficient collective approaches to non-investment matters, we can enhance the partnership’s overall resilience. No partner fund is ever alone; we meet challenges together.

How does Border to Coast’s internal investment management model – an “outsourced, in-house” approach – work in practice?

EM: We take a third, a third, a third approach. A third of our portfolios are managed in-house, a third are managed externally, and the final third is our private markets strategy, where we develop investment strategies and appoint external managers to develop specific elements of them. We believe that blended approach gives us the strategic flexibility we need to deliver for our partner funds.

PC: That approach has been really useful for us, because it’s enabled Durham to access to private markets and co-investment opportunities at an institutional scale, which we wouldn’t otherwise be able to achieve. As an average-sized LGPS fund, we retain control over our strategic asset allocation decisions but have access to centralised investment expertise that we simply couldn’t build alone.

EM: The model delivers material fee savings, too, particularly in private markets. We’ll manage in-house where we can add the most value and have the skillsets. Where we don’t think that’s an option, we’ll find the best external solution. The allocations we give to external managers are very large, which means they’re very competitive on price.

What does it take to attract and retain top investment talent within a pool structure?

EM: There are a few selling points. The first and most important is our purpose. We are doing something quite special. The typical LGPS member is a 47-year-old woman earning £18,000. We are not investing to make rich people marginally richer. We are making sure that the LGPS remains an open scheme supporting low-paid public sector workers, and we’re very passionate about that. We really are making a difference.

The second is that our people work in a nimble and innovative framework. We aren’t constrained by traditional commercial pressures. We are investing for the long term; our partner funds are incredibly supportive. Our portfolio managers do not have to be salespeople. They can do the job they love, which is to find great investment opportunities and deliver them.

We want the absolute best candidates who can do the best job and deliver the strongest investment returns. For the right candidate, our purpose and our framework can be real differentiators.

What are the biggest opportunities and challenges for scaling the Border to Coast model today?

PC: The LGPS has been asked to work together more closely to deliver consolidation and scale. For our partnership, that presents a real opportunity. We’ve got a clear set of principles, a desire to collaborate and a mission to build something really special here at Border to Coast.

There are funds that have built fantastic models within their own partnerships and are now being asked to find a new home. Some of those funds would really add value here at Border to Coast and be fantastic partners. It’s an opportunity for us in the LGPS to work together and build something even better than we already have.

EM: We don’t know what the future is going to look like, so the two things we need to be thoughtful about are, how do we maintain a partnership of equals, and how do we maintain our culture of collaboration?

Any fund that shares those beliefs would be a good partner to Border to Coast. We recognise the benefits of partnership and scale. We think there are great benefits if we are joined by other funds, particularly if they bring a different heritage and experience. They’ll bring different perspectives and value as we build the next phase of our journey.

More Related Content...

|

|

|