The liquid real asset

Published: April 1, 2017

Written By:

|

Matthew Sheldon |

Water infrastructure is something that is rarely on investor agendas. Matthew Sheldon of KBI Global Investors explains how pension funds could benefit from investment in the asset class

When most investors think about investing in “real assets”, infrastructure often comes to mind. And when investing in infrastructure, this is often in big transport infrastructure projects like airports, ports, railways, motorways, or telecom projects like fibre optic networks and big power projects such as large electricity power stations. Often, investors invest in these infrastructure projects via illiquid vehicles which force the investors to tie up their funds in single projects, for long lock-up periods.

Others try to get around the liquidity and single-project concentration of risk by investing in infrastructure funds. But that brings its own problems as a large proportion of the funds invested may in practice sit in cash (or in broad market equities) for a considerable time period before actually being invested in projects.

What is very often overlooked is water infrastructure. But in fact water infrastructure is a very big business – and an investable one. According to a McKinsey study,1 almost $12 trillion will be spent in water-related infrastructure projects between 2013 and 2030. This is one of the largest infrastructure categories globally, similar in size to telecom and power. But while many investors have large exposure to power and telecom, most have relatively little exposure to water, and particularly to water equities.

It is easy to see where the $12 trillion needs to be spent.

The existing water infrastructure, in most regions, has been in place for many decades and is breaking at an increasing rate – it is becoming more commonplace to see images of sinkholes and geysers from degraded water pipes, or to hear about large communities being left without drinking water, even in the most developed economies, due to water quality problems.

A large portion of this huge investment opportunity is therefore independent of the economy – it is simply driven by fixing and maintaining the existing infrastructure. Also, incremental supply of water to meet growing global demand is coming from further away or from a starting point of wastewater, seawater, or brackish groundwater.

There are a number of infrastructure opportunities associated with companies providing solutions to these challenges, which can be broadly categorised as follows:

- Increasing water supply and access

- Applying innovation to reduce water consumption

- Repair and maintenance of existing water infrastructure

- Improving water quality

- Cyclical growth opportunities

- Infrastructure investment opportunities from unique once-off regulation

Investing in water infrastructure equities is an excellent way to diversify and very straightforward. Such a decision can be implemented almost immediately and – perhaps more importantly – can similarly be quickly reversed. There is also the additional comfort of investing in securities that are listed on [regulated] stockmarkets, and of course publicly-traded infrastructure stocks have less leverage which is especially beneficial during times of rising interest rates. Finally, there are transparency benefits – portfolio valuations of publicly-traded equities are based on readily available market prices.

Ultimately, this approach to water infrastructure investing is more comprehensive, transparent, liquid and diverse than a typical real assets/infrastructure fund.

So why do most investors lack exposure to this important segment of the infrastructure sector?

Often it is a result of not knowing about the opportunity. Many water companies are down the market cap scale and are somewhat less intensively covered by broker research than large cap companies, which incidentally can create the opportunity for generating alpha (excess return).

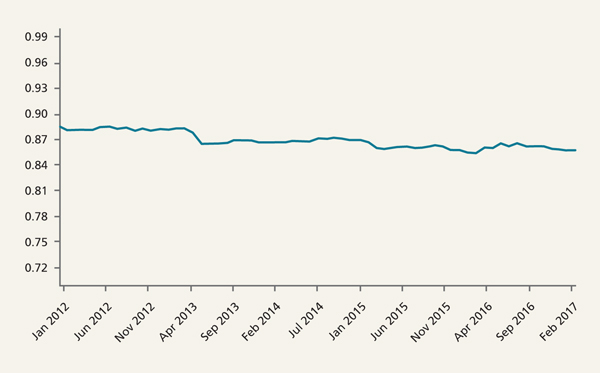

Others may doubt whether there is a strong enough correlation between listed water stocks and infrastructure stocks. But in fact the relationship is robust, as Figure 1 shows, with a correlation of close to 0.85 over time.

Figure 1: Correlation – KBIGI Water to S&P Gbl Infrastructure Horizon: 10 Years

Source: Chart generated by Explica

Increasing water supply and access

There is not really a global water shortage. There is a shortage of clean, fresh, and local water. Among the solutions to add to global supply is desalination whereby salt water or brackish water is treated to produce fresh water suitable for human consumption or industry. Desalination plants still offer one of the most viable ways of supplementing the world’s depleting water supplies and are most widely used in areas of severe water stress such as the Middle East. The construction process involved in these plants is extensive, providing opportunities for companies across different areas of water infrastructure and technology. Water recycling – extensively treating wastewater for re-use in various markets – uses a similar process to desalination and is expected to drive even more investment over the coming decade given its lower energy consumption and total costs.

The dislocation between water supply and demand is evident in many parts of the world but is most prevalent in emerging economies where population growth and urbanisation is most significant. This is being addressed by large scale desalination projects, often near very large cities. On a smaller scale, there are currently several long distance water transfer pipelines under construction in Texas, as a reaction to droughts earlier this decade.

Applying innovation to reduce water consumption

Increasing water supply gets a lot of attention but there is similarly a large opportunity for investors to benefit from infrastructure investments associated with reducing the demand for water. This comes from companies supplying efficient plumbing and irrigation technologies, smart metering, and infrastructure diagnostics and leak detection (one of the more innovative areas to gain traction in the water industry).

Infrastructure diagnostics companies can detect where there are leaks, and problems with structural integrity underground, allowing for cost-efficient strategic repairs that can save municipalities significant amounts of money and avoid critical environmental and social challenges in cities and regions faced with large scale pipe bursts.

Repair and maintenance of existing water infrastructure

As mentioned, the bulk of the activity in the global water sector relates to maintaining the existing infrastructure. These companies represent the epitome of sustainable businesses. Many have been around for over a century providing critical infrastructure such as pumps, valves, hydrants, and various other pieces of equipment to their long standing customer base. In this business, relationships and proven technology form the backbone, and technological obsolescence is a low risk. Similarly, the privately-owned water utilities in which we invest, whether regulated monopolies or operating under long-term concessions, are charged with maintaining and optimising the efficiency of their water infrastructure systems. In return, they earn a reasonable rate of return on their investments over the long term.

Improving water quality

Water and wastewater treatment plants can be large infrastructure projects. With demographic changes resulting in significant amounts of human, industrial and agricultural waste reaching our water supplies, these projects are now essential. Regulation has emerged as a key support to these initiatives as countries look to improve their water quality and restore the water ecology function. In China, for example, pollution from industrialisation has led to more than 70% of Chinese rivers, lakes and groundwater being designated as polluted, leading to an urgent need for wastewater treatment.2 China’s current Five-Year Plan is shifting the focus back to Tier 1 and Tier 2 cities to address their severely contaminated surface and ground water, and is expected to result in significant investment in new plants and the retrofitting of existing plants.

Cyclical growth opportunities

While the so called break-and-fix market is sizable, there are also more cyclical growth opportunities for investing in water infrastructure companies. These include companies involved in manufacturing, distribution, and construction. The various cycles may relate to residential or non-residential construction, or may be more tied to global capital spending in industries ranging from semi-conductors to energy. The variety of end markets and cycles provides multiple ways to benefit from the growing global economy.

Infrastructure investment opportunities from unique once-off regulation

There are a number of companies who are beneficiaries of specific regulations associated with water (which can be very material to earnings growth). The Ballast Water Management Convention is an agreement established to limit the harm caused by invasive species and would require over 50,000 ships globally to be retrofitted with ballast water treatment systems over the next decade. The estimated market from these treatment systems alone is around $36 billion and there are a number of companies well positioned to deliver the required solutions.3

Conclusion

For investors looking at real assets, infrastructure will always be a realistic option, although it is usually subject to considerable liquidity issues. Investing in water infrastructure is something, in contrast, that is rarely on investors’ agenda. But we believe that it offers excellent liquidity, some inflation protection, transparent pricing and valuations, usually lower levels of leverage than seen in most infrastructure investments, exposure to a strong secular growth theme, and considerable ESG impact. It should be on every investor’s radar!

Disclaimers

KBI Global Investors Ltd is regulated by the Central Bank of Ireland and subject to limited regulation by the Financial Conduct Authority in the UK. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. KBI Global Investors (North America) Ltd is a registered investment adviser with the SEC and regulated by the Central Bank of Ireland. KBI Global Investors (North America) Ltd is a wholly-owned subsidiary of KBI Global Investors Ltd. ‘KBI Global Investors’ or ‘KBIGI’ refer to KBI Global Investors Ltd and KBI Global Investors (North America) Ltd.

Important risk disclosure statement

This material is provided for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase any security, product or service including any group trust or fund managed by KBI Global Investors. The information contained herein does not set forth all of the risks associated with this strategy, and is qualified in its entirety by, and subject to, the information contained in other applicable disclosure documents relating to such a strategy. KBI Global Investors’ investment products, like all investments, involve the risk of loss and may not be suitable for all investors, especially those who are unable to sustain a loss of their investment.

Past performance is not necessarily indicative of future results

This introductory material may not be reproduced or distributed, in whole or in part, without the express prior written consent of KBI Global Investors. The information contained in this introductory material has not been filed with, reviewed by or approved by any regulatory authority or self-regulatory authority and recipients are advised to consult with their own independent advisors, including tax advisors, regarding the products and services described therein. The views expressed are those of KBI Global Investors and should not be construed as investment advice. We do not represent that this information is accurate or complete and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The products mentioned in this Document may not be eligible for sale in some states or countries, nor suitable for all types of investors. Past performance may not be a reliable guide to future performance and the value of investments may fall as well as rise. Investments denominated in foreign currencies are subject to changes in exchange rates that may have an adverse effect on the value, price or income of the product. Income generated from an investment may fluctuate in accordance with market conditions and taxation arrangements. In some tables and charts, due to rounding, the sum of the individual components may not appear to be equal to the stated total(s). Additional information will be provided upon request. Performance for periods of more than 1 year is annualised.

1. McKinsey & Company: McKinsey Global Institute McKinsey Infrastructure Practice January 2013

2. http://factsanddetails.com/china/cat10/sub66/item391.html

3. https://www.bccresearch.com/market-research/membrane-and-separation-technology/ballast-water-treatment-markets-report-mst061b.html

More Related Content...

|

|

|