A four-point plan for reducing pension fund deficits

|

Written By: Tracey Milner |

Tracey Milner of AXA Investment Managers outlines approaches that LGPS funds can take to help enhance returns and manage risks

Doesn’t time fly? It is nearly a year since a number of Local Government Pension Scheme (LGPS) funds, their advisers (including consultants and asset managers) and other interested parties responded to the government’s consultation on the “Cost Savings and Efficiencies in the LGPS”.

The main focus of the consultation, amongst other things, was whether there was support for common (or collective) investment vehicles and whether funds should be managing their listed assets on a passive basis. Respondents were also invited to submit any feasible proposals for the reduction of fund deficits. Following the 2015 general election we would expect the new government to revisit the consultation responses. Potentially to this end, the LGPS Scheme Advisory Board has recently submitted a paper¹ to the government on proposals for the management of deficits and recommendations for regulation changes.

In our response to the 2014 consultation we highlighted a number of means of managing scheme deficits. We also noted that cost reduction should not be the measure of success or the main focus of reform. Deficit reduction is about improving funding levels and success should be measured through a combination of factors that – outside of changing the benefit structure and increasing contributions – also include return enhancement and risk management.

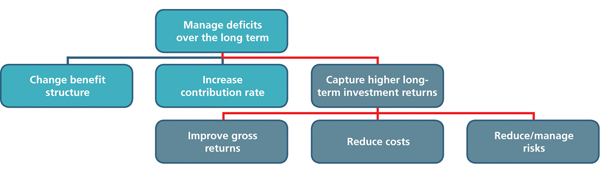

In terms of long-term deficit management, there are generally three “levers” that are available to pension schemes:

- Change the benefit structure

- Increase the contribution rate

- Capture higher long-term investment returns

The “investment” lever can be further broken down into three factors: enhanced gross returns, reduced costs and improved risk management. This is illustrated in Figure 1 below.

Figure 1: “Investment” lever broken down into three factors

Source: AXA Investment Managers

The reforms proposed in the 2014 consultation narrowly focused on solutions that reduce costs, but there are other levers that can be adjusted. We agree with the recommendations of the Scheme Advisory Board: prior to implementing reform, it is of utmost importance that the government recognises the inconsistencies and challenges embedded in the measurement and comparison of funding levels across LGPS funds. As a first step it is essential to obtain an accurate picture of the size of the deficit.

However, we would suggest that it is still appropriate to focus on the investment lever and suggest solutions that can help reduce deficits through return enhancement and risk management. Here we expand on the solutions that we proposed in AXA IM’s response to the 2014 consultation since they remain relevant today.

1. Increased diversification

Funds should be encouraged to seek opportunities to diversify into new asset classes or strategies that offer attractive risk and return characteristics. Diversification may include allocations to alternative investments, but it can also include expanding the opportunity set within “traditional” asset classes to new countries, regions, sectors or themes.

For example, listed real estate has been the natural alternative for investors who seek real estate exposure but lack the means to build a direct portfolio. However, listed property comes with the added cost of increased volatility in the form of equity market risk and the use of leverage. Exploring the option of a blended liquid real estate portfolio, which includes dynamic allocations to listed property company debt and equity can typically be expected to replicate the direct real estate market’s risk-adjusted return performance, while maintaining the added liquidity offered by these publicly traded assets.

2. Allocations to illiquid assets

The LGPS funds are long-term investors and therefore are in a good position to consider opportunities that potentially offer extra expected return in exchange for holding less liquid assets (the “illiquidity premium”). Asset classes such as infrastructure, long lease real estate or alternative credit may be attractive opportunities for LGPS funds that are willing and able to accept some liquidity risk.

For example, investment grade credit currently appears to be offering investors limited upside potential and lower than usual compensation for the risk of default. There is also, over the next few years, a risk of rising interest rates which would hold back returns wherever duration exists. In such an environment, diversification of a traditional credit portfolio to incorporate illiquid asset classes such as lease finance and commercial real estate loans, or more complex lending arrangements, becomes much more important when managing risk. It is also imperative that this diversification is agile and opportunistic enough to weather reversals in trends, changes in market expectation or the credit cycle.²

Efforts to improve collaboration and share best practices within the LGPS are likely to encourage funds to consider including illiquid assets in their investment strategy. As we have seen in the last six months, the collaborations between the Lancashire Pension Fund and the LPFA as well as the Greater Manchester Pension Fund and the LPFA illustrates how funds are working together in their quest to capture the illiquidity premium.

3. Equity volatility management strategies

These strategies can help funds to mitigate losses on their equity allocations. Solutions can be designed to reduce the impact of a large equity market drawdown or to limit the volatility of returns from equity markets. These strategies are often bespoke solutions based on the risk tolerance and investment objectives of a fund, and may typically involve the use of derivative based strategies. Resolving any ambiguities about whether the prevailing investment regulations permit such an approach still needs to be addressed.

The concept of “passive” management was not fully defined in the 2014 consultation paper but we have assumed that it refers to market-cap weighted index replication. Over the past few years, investors have started to recognise the failings and inefficiencies of traditional market-cap weighted indices. When measuring excess return against the market index, “risk” is defined as tracking error or deviation from the benchmark index. Other risk factors, such as drawdown, volatility and liability matching risks are arguably more important to LGPS funds given that the need to review funding levels and contribution rates (and pay benefits) on a regular basis. In equity markets, market-cap weightings are often distorted by participant behaviour and biases – such as allocating more to mega cap stocks that may already have gone through their period of rapid growth. In credit markets, traditional indices are allocated to borrowers or sectors based on the amount of public debt outstanding, exposing investors to a high amount of credit risk. In the last year a number of LGPS funds have recognised these weaknesses and started to implement “smart beta” strategies in both credit and equity. These are low cost strategies that enable funds to manage drawdown and volatility while generating returns that contribute to the longer-term aims of ensuring that there are sufficient assets available to pay pensions when they fall due – rather than addressing the risk that performance might deviate from a market index.

4. Liability risk management strategies

Interest rate and inflation risk have a significant impact on liability values and funding levels. Given that LGPS fund objectives reflect the link between assets and liabilities, Liability Driven Investment (LDI) solutions that offer funds the ability to reduce these liability risks can be expected to form a key element of the investment strategy and deficit management approach going forward. These are bespoke solutions based on the liability profile, risk tolerance and investment objectives of the fund.

For the majority of LGPS funds, an allocation to traditional credit forms an important part of their overall investment strategy. Given the investment characteristics of credit, it is likely that LGPS funds will increasingly rely on these assets to generate returns above Gilts and for the opportunity to reduce risk through diversification. However, as mentioned above, opportunities within the traditional investment grade credit market appear to be offering investors limited upside potential and lower than usual compensation for the risk of default. Thus, the focus should be on getting the credit assessment right, minimising turnover and seeking exposure to those parts of the market that provide the best risk-adjusted yield. This strategy should not blindly follow an index but should look to harvest the maximum amount of yield available in the most cost-effective manner. This type of credit strategy, often referred to as a “buy and maintain” credit strategy, aims to deliver predictable cashflows over the long term and avoid unwanted return erosion caused by credit-related losses, transaction costs and outsized management fees.

These benefits could be amplified if an LDI strategy is implemented alongside the credit strategy, taking on the liability risk management responsibilities mentioned above. Likewise, better outcomes may be achieved if this strategy has greater flexibility to seek opportunities in credit markets to improve diversification and capture the best yield per unit of risk over the long term. As LGPS funds continue to balance the need for return against the need to manage liability risks, blending LDI with a credit strategy could help to “sweat” matching assets harder while those responsible for the governance of LGPS funds enjoy fewer sleepless nights.

This is not an exhaustive list and there are many other investment solutions that have the potential to enhance returns and/or reduce risk. Going forward, any reforms suggested by the new government should help funds to access these solutions, but retain the flexibility for individual funds to implement their own investment decisions based on their own circumstances and strategy.

1. Shadow Advisory Board 1 June 2015 meeting papers draft report. The five recommendations in the paper focus on the standardisation of funding calculations, the reporting of contribution rates payable, the setting of minimum contribution rates and the requirement to set out the recovery plan methodology with the Funding Strategy Statement.

2. Source: AXA IM In Focus – Viewing the credit landscape through an alternative lens – April 2015

More Related Content...

|

|

|