Accessing energy transition opportunities in private markets

|

Written By: Carolyn Tsalo |

Carolyn Tsalos of Russell Investments looks at the risks to investment portfolios presented by climate change and suggests how to mitigate them

The threat of continued climate change presents very real financial risks to investment portfolios, in regard to both existing assets as well as future investments. Opportunities exist today – and the investable universe continues to expand – to commit capital in private markets on a global scale to benefit from the energy transition. Not only can private markets offer compelling opportunities for impact investing in terms of risk/return profile, but they enable strong influence over capital from a project standpoint. This makes it a robust channel for targeting positive impact on environmental and social causes, including climate change.

Why now? How to mitigate climate change risks:

Attractive investment opportunities are emerging: Targets to reduce carbon footprint are becoming more aggressive and the focus on delivering more sustainable energy via renewable sources has accelerated dramatically. Significant investment is needed to support this change (for example, the United Nations estimates that at least $600 billion annual spend is required on renewable energy by 2030 to meet the Paris Agreement targets). We’re identifying strong opportunities to support this change through investment, achieving environmental/ social impact, simultaneously with financial returns. We are seeing the most attractive opportunities within infrastructure and technology assets. These assets specifically target the slowdown of global warming, including wind and solar, as well as more niche opportunities; storage solutions, renewable natural gas, carbon sequestration, electrification, and climate resilience.

Futureproofing your portfolio: These types of assets are helping to support a more sustainable world, as well as acting as a form of a hedge to carbon risk in the broader investment portfolio.

Investing in making a difference: Investing in private markets can offer a more specific and targeted deployment of capital, as well as allowing for the expression of priorities and beliefs. For example, for those with specific environmental, social and governance (ESG) objectives, investing in private markets can be a strong channel to achieve measurable social and environmental impact, alongside any potential financial returns.

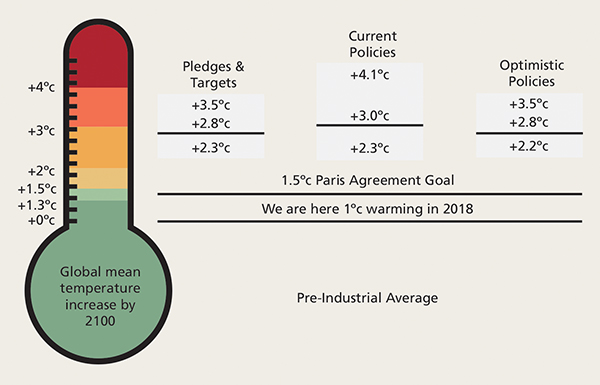

Temperatures are likely to increase by 1.5°C between 2030 and 2052: Recent reports suggest we are significantly overshooting the 1.5°C Paris Target. According to the Intergovernmental Panel on Climate Change, global temperatures are likely to have already increased by 1.5°C between 2030 and 2052. Over the coming years, it is expected that this will have an increasing impact on markets.

Figure 1: Projected global mean temperature rise 2018-2100

Source: Climate Action Tracker, December 2019 Update.

The three key categories which we believe will make the most significant difference towards climate change mitigation are the following:

- 1. Energy revolution: Growth of renewable forms of energy as a principal component to a new energy system. Trillions of dollars of investment capital is required across wind, solar, hydro and other technologies to meet the Paris Agreement targets.

- 2. Decarbonisation of industry: The replacement of fuel sources is needed to support the climate transition and renewable natural gas and methane capture are key vectors. Opportunities exist within bioenergy, carbon capture and to limited extent, hydrogen.

- 3. Incremental electrification: Efficiency comes not just from how energy is supplied, but also how it is used. Various factors including 5G, energy efficiency, electrification of infrastructure and transport are expected to dramatically drive demand for electricity.

Utilising a multi-manager approach

Diversification of the opportunity set: A multi-manager approach provides access to a diverse set of opportunities across the full spectrum of climate-change focused investments, without being restricted by an internal skillset.

First principles approach: A multi-manager approach utilises a wide range of instruments and research, exploiting market inefficiencies and providing greater portfolio risk-return than standalone allocations.

Robust governance: A robust investment process does not conclude upon investment. Continual oversight and interaction with fund managers ensure that managers are consistently aware of the expectations from both a financial and impact perspective and that both objectives are continually aligned.

An efficient way to overcome the diseconomies of scale which exist: Many of the most attractive opportunities within this space come in smaller deal sizes which are accessible by boutique, and importantly, specialist managers, but often sit below the investable universe for larger mainstream managers. Conducting robust due diligence on these types of managers, let alone multiple managers, can be challenging for institutional investors.

As the responsible investing landscape continues to evolve, it is essential for firms to ensure these considerations are part of a wider due diligence process across all asset classes, enabling sound awareness of these factors to seek investment opportunities with both the greatest return and impact.

Important information

For professional use only.

Unless otherwise specified, Russell Investments is the source of all data. All information contained in this material is current at the time of issue and, to the best of our knowledge, accurate. Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.

The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

Issued by Russell Investments Limited. Company No. 02086230. Registered in England and Wales with registered office at: Rex House, 10 Regent Street, London SW1Y 4PE. Telephone +44 (0)20 7024 6000. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London E20 1JN. Russell Investments Limited is a Dubai International Financial Centre company which is regulated by the Dubai Financial Services Authority at: Office 4, Level 1, Gate Village Building 3, DIFC, PO Box 506591, Dubai UAE. Telephone +971 4 578 7097.This material should only be marketed towards Professional Clients as defined by the DFSA. Russell Investments Ireland Limited. Company No. 213659. Registered in Ireland with registered office at: 78 Sir John Rogerson’s Quay, Dublin 2, Ireland. Authorised and regulated by the Central Bank of Ireland.

KvK number 67296386.

© 1995-2020 Russell Investments Group, LLC. All rights reserved.

MCI-02096/03-07-2021 EMEA 2055

More Related Content...

|

|

|