Acting as owners: constructive activism in Europe

|

Written By: Mike Bishop |

Constructive activism drives change in order to deliver shareholder value. Mike Bishop of RWC explains how activism can be a powerful weapon in the investment arsenal

Shareholder activism has become a mainstream part of the allocations of in particular US-based investors who predominantly invest in US-based activist strategies. There is a case for the coming of age of activist investing in Europe and for European-based activism to become a more common investment strategy for investors.

What is constructive activism?

Most definitions of activism suggest that the strategy centres on public action, campaigning and/or confrontation. This is, however, misleading as today’s reality is that the majority of activist investors in the UK and continental Europe seek to work collaboratively with their portfolio companies to generate excess returns. To distinguish these investors from their more confrontational peers, the term “constructive activism” has been coined by some and this has become interchangeable and synonymous with the term “active ownership”. Constructive activists, as company owners, drive change, for example, by addressing corporate governance or operational issues, with the ultimate aim being to deliver long-term shareholder value that would otherwise not have been achievable. The constructive activist is in the business of selling change and creating alpha.

Why activism is a compelling investment strategy

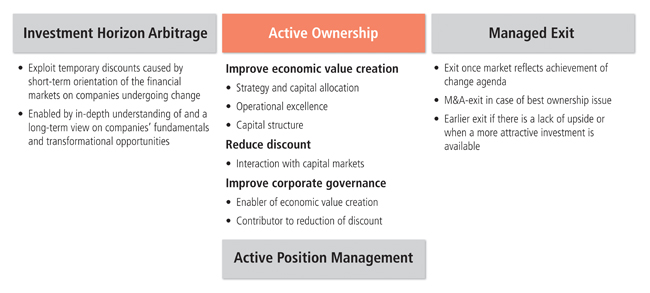

The constructive activist can create value at two different levels: firstly, at the company level, by identifying fundamentally sound but undervalued companies and acting as a catalyst for the change required to unlock value (in Figure 1 this is referred to as “Active Ownership”); and secondly, at the fund level, through dynamic stock selection and active position management to exploit market inefficiencies (in Figure 1 called “Investment Horizon Arbitrage”, “Active Position Management” and “Managed Exit”).

The typical activist investor will run a concentrated portfolio because the strategy is tremendously research intensive. Concentrating on fewer companies, and truly understanding their fundamentals and internal dynamics, means that proactive engagement can be used to clearly target change opportunities. Active ownership funds that run such portfolios are therefore an obvious answer to address some of the structural issues related to the governance of listed companies, as highlighted in the Kay Review1.

Figure 1: Activism as an investment strategy

Why Europe provides an attractive opportunity for activism

There are several reasons why activism in Europe represents a notable and attractive opportunity.

By international standards, shareholders in the UK have very powerful rights. There is growing frustration that too many boards are “gaming” the system. Gaming undeniably reduces total shareholder returns. The Kay Review highlighted short-termism amongst equity market participants and encouraged investors to act as long-term stewards of more concentrated portfolios. This has very publicly put the boards of public companies “on notice” to expect investors to use their voice, either individually or in an investor forum, to engage and support long-term value creation.

In the UK the sweet spot is the small- and mid-cap universe of around 500 companies. The common denominators within this universe are poor sell-side research coverage (giving an information advantage to those undertaking deeper research), concentrated share registers with a small number of institutions typically owning 30% of the company (facilitating collective action), good access to management, and market capitalisations of a size which enable meaningful holdings in each company (such holdings increasing both access and influence).

In continental Europe, activist investing does represent specific challenges due to the prevalence of controlling shareholdings and the more complex regulatory environment. However, European companies provide constructive activists with a broad range of attractive investment targets. Whilst many of these companies have fundamentally sound core businesses and hold competitive positions, many of them also have inefficient group structures, and on average their profitability lags behind that in the US. European companies also tend to trade at slightly lower multiples than their US counterparts. Activists can help address both of the above.

Following the financial crisis, many European companies appear more open to considering shareholders’ input regarding strategic choices and are willing to act as opportunities arise. An eventual pickup in M&A activity, which has been subdued following the financial crisis, should further support activism in Europe. Finally, there has been a gradual increase in the participation rates at shareholder meetings, which is an extremely positive platform on which activists can build momentum and drive change.

An effective approach to active ownership investing in Europe

RWC’s activist approach has evolved over the years in response to the particular characteristics of the various capital markets of Europe. This approach can be characterised as:

1. Intensive research-driven approach

An in-depth understanding of a company’s fundamentals forms the basis of the investment process and due diligence is carried out to validate investment case assumptions. This extends beyond what you will find typically in the asset management industry and is reflected in RWC’s intensive interactions with a company, its shareholders and competitors, as well as analysts and other industry experts. A full assessment of the investment case highlights a company’s key value drivers and this enables effective portfolio management and provides direction to the engagement process.

2. Constructive, behind-the-scenes dialogue with companies, yet with the ability to escalate as needed

Acting in a confrontational and public way has proved less effective in Europe and seeking to publicly shame management and the board is also not a style that typically wins support among European investors. In RWC’s experience, working together with other stakeholders is most likely to drive corporate change given that European companies often have formal tools to defend themselves against activist approaches. Also, investors in Europe are accustomed to a more consensual stakeholder culture and are often concerned about the headline risk of being seen as aggressive and short-term orientated. Therefore, the aim from the outset is to build relationships based on mutual respect and to discuss company priorities through sound analysis and business logic.

“Prove us wrong”

We adopt a constructive approach to dialogue which allow us to effectively challenge management and the board on the company’s strategic direction and approach to maximising shareholder value. Through open-minded dialogue, the company has the opportunity to counter our analysis and we are always open to changing our views. Similarly, we expect the same of the companies we engage with.

Building trust to “sell” change

We seek to build trust-based relationships with the CEO and relevant top managers; the chairperson; and, as appropriate, other members of the board. In doing so, we have to be considerate of the governance practices in various European countries. For example in The Netherlands, a shareholder approaching the chairperson outside of a shareholders meeting is typically considered as an escalation and a signal of distrust towards the management, whereas quite the opposite is true in the UK (and other European Countries) where shareholders are actively encouraged to speak directly to the chairperson and the senior independent director. In recognising how integral relationships are to the overall success of an activist strategy, we provide transparency on our shareholding to each company throughout an investment and indeed seek to maintain contact after exiting.

3. Specialist teams

A successful active ownership investment team needs to be independent, experienced and sufficiently resourced with a variety of competencies that are not typically found in traditional fund management teams.

Independence

This is a prerequisite as any other interests may interfere with the active ownership of a company. Boards need to be comfortable that active owners have no agenda other than increasing sustainable shareholder value.

Experience

“Time served” activists will have incorporated the lessons of previous activist investments in their processes and therefore will be better able to avoid the pitfalls in executing a strategy successfully.

Multi-disciplinary

RWC has brought together a multi-disciplinary team that incorporates investment research capabilities; bottom-up investment and portfolio management expertise; strategy consulting skills; and experience on the boards of public companies. The team’s capabilities go beyond what would be needed for a typical fund management team by including strategic and operational due diligence; corporate governance expertise; and the ability to manage the transformational process. Furthermore, we leverage external expertise and relationships, including with legal advisors; specialist research firms; executive search firms; consultants; and investment and industry expert networks, as required.

Multi-lingual and multi-cultural

In addition to technical and social competencies and experience, active ownership investing in Europe requires understanding of the rules, regulations and business cultures across various countries.

Most Western European companies are listed on one of 16 stock exchanges and operate across 12 different languages. Understanding the local context affords us an appropriate and effective approach to dialogue with companies and, whilst English can be used in company interactions, it is clearly beneficial to be able to speak the local languages. Firstly, this allows us to leverage local language data sources and, secondly, communication with companies is significantly more profound, which helps to build lasting relationships.

RWC’s investment team includes professionals who have lived and/or worked in The Netherlands, Finland, Italy, the UK, Switzerland, Germany, Belgium, France, and Austria, and the team’s language skills cover the major Western European countries. The team’s multi-lingual and multi-cultural composition is a great advantage and enabler for operating as an active owner across the continent.

Summary

Activism requires a markedly different mindset and skillset from the vast majority of fund managers; activists focus on intrinsic value and company fundamentals which means that share price weaknesses are viewed as long-term opportunities, rather than short-term threats. Moreover, as owners, they have deeper insights and a greater understanding of business dynamics in order to be able to influence companies for the better. Ultimately, what sets activist investors apart from passive funds and “voters” is the character and the quality of their engagement.

There are currently only a few truly Pan-European activist funds compared to the number of US activists. Given the attractive opportunity that Europe represents, it appears only a matter of time before both allocations to European activism as well the number of pan-European activist fund managers increases and that European activism will become a mature investment strategy.

1. Kay Review of UK equity markets and long-term decision making, July 2012

More Related Content...

|

|

|