Alternative beta

|

Written By: Chris Stevens |

Chris Stevens of bfinance outlines an approach that can systematically capture risk premia using alternative investment techniques

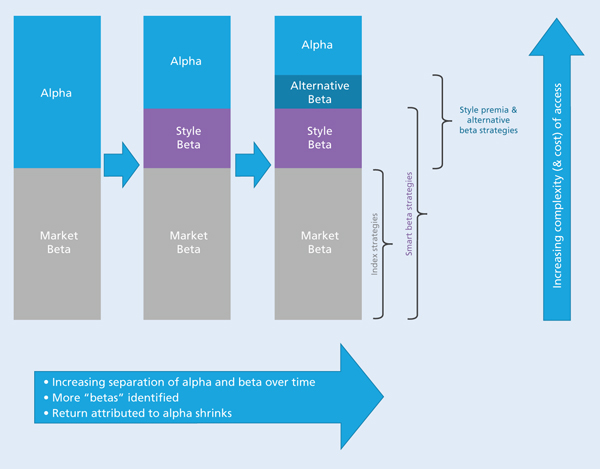

The history of investment theory shows the ongoing decomposition of what was previously considered alpha, into beta(s); an increasing proportion of a portfolio’s returns are considered explainable by exposure to identifiable risk factors (or risk premia) rather than manager skill. It is in equity investing that this trend has been most notable, from straightforward equity market beta available in market-cap weighted index funds, to the small-cap and value risk premia identified by Fama and French¹, to the momentum risk premium identified by Carhart.

Most recently “smart beta” has been popular as a way of moving away from traditional market cap indices (pure market beta) to include more exposure to the “style premia” identified by Fama, French and Carhart, and potentially other factors. Essentially the approach tilts equity portfolios away from pure equity market beta to exploit the range of available risk premia in addition to the broad market – although importantly the overall market beta exposure still dominates the risk-return characteristics of such strategies.

This article examines “alternative beta”, a further extension of beta investing into the realm of alternatives. No widely-accepted definition exists, but the essential approach as we characterise it is to systematically and “passively” capture certain risk premia beyond traditional equity, bond and credit market exposure using alternative investment techniques. The link with “style premia” strategies is also examined.

Defining alternative beta

Alternative beta is sometimes termed “hedge fund beta”. This provides one way to define what we mean by alternative beta, by directly considering the common investment and trading styles used by different hedge fund strategies to drive returns, and creating a systematic, rules-based process to mimic these strategies. The example below demonstrates the approach.

Merger Arbitrage: When a merger or takeover deal is announced, the share price of the acquirer typically falls and the share price of the target increases to closer to the offer price. A typical merger arbitrage play is to buy the stock of the target and short the stock of the acquirer, with the aim of profiting from the convergence of the spread between the target’s current market price and the deal price which results from the uncertainty of the deal completing. This is essentially selling insurance on the deal completion – bringing in profits if everything proceeds to plan (receiving the insurance premium/merger spread) and taking losses if the deal fails (insurance payout as target reverts to pre-announcement market price). Shorting the acquirer (or an index) aims to reduce the overall equity market exposure of the strategy. Shorting the acquirer is also a small profit source as the acquirer’s share price will usually decline on deal completion.

Merger arbitrage hedge funds typically aim to add “alpha” by selecting the deals to invest in by analysing factors such as the probability of deal completion, the potential for counteroffers, legal or regulatory issues. An alternative beta strategy by contrast would apply the long target/short acquirer strategy to all announced deals, aiming to capture the “merger arbitrage risk premium”. In the same way that an equity beta can be defined by creating a universe of stocks, the alternative beta in merger arbitrage can be defined by the universe of all merger deals. It is not strictly an arbitrage (riskless profits from the mispricing of identical/similar instruments), but over time has positive expected returns from bearing the particular risk involved (underwriting insurance on deal completion). Backtests of such a strategy by alternative beta managers do seem to demonstrate that a large proportion of the returns of merger arbitrage managers can be captured this way.

In addition to the merger arbitrage strategy, the alternative beta concept has the potential to be extended to a number of hedge fund investment styles, including trend following (CTA), convertible arbitrage, long/short equity, fixed income relative value, global macro and others. It should be stressed that alternative beta strategies are not necessarily a replacement for hedge funds in the traditional sense, in that they do not attempt to capture any alpha that the best managers may produce, rather alternative beta strategies look to capture the trading styles/strategies that are common to various hedge fund strategies that should properly be considered beta.

The use of alternative investment techniques (in particular the ability to be short an asset as well as long) can be seen as a defining characteristic of alternative beta strategies. Systematising the application of the alternative techniques used by hedge funds enables the key drivers of the return streams of those strategies to be captured passively. Importantly, for many of these hedge fund strategies, an economic or behavioural rationale can be provided for why the strategy can be expected to provide positive returns over time, by taking exposure to certain risks not available in long-only, traditional investment styles. This provides diversification to traditional market risks in an investor’s portfolio.

The link with style premia strategies

With the ability to go short, the more traditional style premia previously mentioned can be isolated and packaged as an alternative beta. Whereas in a smart beta strategy the aim may be to overweight value stocks relative to the market cap index (exposure to market beta + value beta exposure), in an alternative beta strategy the aim can be to capture the “value spread” by being long value stocks and short growth stocks such that no overall market beta exposure is taken (pure, market neutral exposure to the value premia). Similarly, the small cap premia might be isolated (long small caps, short large caps), as might equity momentum (long positive momentum stocks, short negative momentum stocks). The “smart beta” version of this would be to merely overweight small caps/underweight large caps and overweight positive momentum stocks/underweight negative momentum stocks respectively, with returns still dominated by the market beta. As such, alternative beta strategies can be used in portfolios to add a risk premia without taking additional traditional market exposure. Such “style premia” strategies are more common than strategies that attempt to mimic convertible arbitrage or merger arbitrage strategies but both fall under the term alternative beta as we define it.

Ultimately the range of approaches that might be termed alternative beta is wide. As a useful heuristic, we can say that the defining characteristics alternative beta involves the use of non-traditional investment techniques (including shorting, derivative use and leverage). These techniques to be defined such that they can be applied systematically in order to provide exposure to a particular risk premium beyond those available in traditional, long only investing (or to isolate a particular risk premia from overall market exposure). And for which a rationale can be provided for why exposure to the risk is expected to have a positive return over time.

Figure 1: Using alternative beta strategies to capture alpha

Source: bfinance

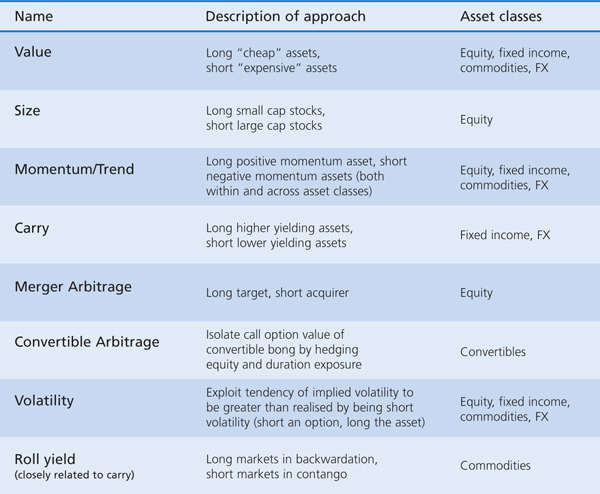

Whilst the discussion and examples so far have focused on alternative beta in equity markets, the techniques and ideas can also be applied to other asset classes. A non-exhaustive list of potential alternative beta strategies is shown in Figure 2.

Figure 2: Potential alternative beta strategies

Source: bfinance

What alternative beta is not

Thus far alternative beta has been characterised as the attempt to systematically capture certain sources of return that are common to hedge fund investing. However it should not be confused with “hedge fund replication” which, as generally understood, involves attempting to mimic the returns of a hedge fund or hedge fund index.

It is an important point to make that a hedge fund replication approach does not represent an attempt to provide systematic exposure to identifiable risk factors and thus should not be termed alternative beta. Hedge fund replication can be seen as top-down attempts to capture the return stream of hedge fund strategies, with the alternative beta approach more of a bottom-up approach, looking at the actual strategies used by hedge funds to drive returns.

Implementation

Interest in alternative beta appears to be increasing and a number of investment managers have strategies in the space. Due to the variety of risk premia that might be included in the term alternative beta, these strategies vary widely in their investment universe, process and risk/return characteristics.

Many alternative beta strategies have risk-return characteristics that may be somewhat undesirable on a standalone basis, e.g. FX carry trades typically make persistent small gains but face “crash risk” and can experience large drawdowns in a short period of time. However alternative betas are almost by definition likely to be lowly correlated to each other, so there are benefits to combining different strategies in one portfolio as well as implementing strategies across multiple asset classes where possible. On a standalone basis, individual risk premia may not provide positive returns over extended periods of time (e.g. when growth stocks outperform value stocks or markets fail to trend in any particular direction for value and momentum premia respectively) or face sharp drawdowns as discussed in carry trades. Combining alternative betas has the same benefit of combining traditional market betas in a portfolio, i.e. diversification improves the risk/return profile.

Trading costs can also be reduced by combining approaches. For example a value strategy may call for being long a particular stock which looks inexpensive but a momentum strategy may call for a short position if the stock has negative momentum. Combining and netting signals across the various approaches allows for more efficient portfolio construction.

Why invest in alternative beta?

Investing in alternative beta strategies provides access to liquid, transparent and cost-effective alternative return streams. Alpha and beta separation has occurred in traditional portfolios in recent decades, and can now be done in alternatives.

A number of alternative betas have low expected correlation to traditional betas and to each other. As such, and in common with the typical rationale for investing in alternatives, they can be used to diversify an existing portfolio consisting of traditional betas, improving the risk-return profile.

The universe of potential alternative beta strategies is heterogeneous, meaning that for larger mandates a modular approach can be taken, providing tailored diversification to an existing portfolio.

Alternative beta strategies are potentially more cost effective. Access to beta, albeit alternative beta, can be isolated and priced appropriately at “non-alpha” levels. Anecdotally, we have also seen fee compression in more quantitatively driven hedge fund strategies as the alternative beta concept has gained popularity – most notably in the trend-following space.

Alternative beta strategies may also be an efficient way of accessing the diversifying characteristics of hedge funds for those investors that, for legal or regulatory reasons, are not currently able to access these return streams, or for investors that simply do not wish to take the illiquidity, high fees and lack of transparency that can be part of hedge fund investing.

In the current market environment, with low yields on most fixed income asset classes and relatively richly-valued equity markets according to many metrics, strategies that do not rely on traditional beta exposures to drive returns are particularly attractive. Alternative beta can be used to source return streams not otherwise attainable and can be implemented without adding to traditional beta risk.

Issues for consideration

Capturing traditional market betas has over time become very straightforward (and cheap) for investors, and the rise of smart beta strategies has similarly enabled investors to easily supplement broad market betas with higher exposures to the style premia (value, small cap, momentum), captured systematically whilst paying lower fees than to an active manager that provides similar exposures. By contrast, in order to capture alternative betas the use of complex alternative investment techniques is necessary. Manager skill is required on both the definition and implementation of these strategies, which may involve frequent trading, leverage, shorting and derivative use. As such, whilst the return streams from the defined strategies may be correctly termed beta, the efficient implementation and capture of an alternative beta’s risk/return characteristics still requires manager skill.

Manager selection therefore remains as important as it is in selecting a hedge fund, with a particular focus on the background of the manager in the research and implementation of quantitative investment strategies alongside robust operational infrastructure.

It is important to remember that this is an active area of research and product development. Managers may therefore present back-tests of their proposed strategy which need to be more carefully scrutinised than live track records (for example, to make sure that transaction costs and market impact have been accounted for). Also as a result of this being a developing space, there is some price discovery ongoing and a relatively wide dispersion of fees, from a flat 0.75% to 1.50% and potentially a performance fee structure too. As the alternative beta manager universe develops we expect that fees will generally trend downwards and also away from the performance-related fee structures common to the hedge fund world.

A notable point of issue for constructing portfolios involving alternative betas is how to size and weight positions. Returning to the merger arbitrage example, the particular rules-based strategy might call for being long the target and short the acquirer such that the overall position is market neutral, but there is no obvious methodology to weight different merger opportunities within a portfolio, nor how to weight the merger arbitrage beta relative to other alternative betas within a portfolio. For any strategy that has offsetting long and short positions, there is no clear rationale for the sizing of positions. A number of managers are constructing portfolios based on some measure of risk-weighting, taking into account correlations to ensure that the portfolio is diversified and targeting a consistent volatility for the strategy. This is a complicated issue with sophisticated portfolio construction techniques, so again manager skill is key.

Some hedge fund strategies are not amenable to the approach, for example, activist investing, discretionary global macro, or the less liquid strategies such as distressed credit. By definition, the alpha component of any hedge fund return is also not captured, such as the ability of event-driven managers to invest pre-event, for example, before a merger deal is announced. An alternative beta strategy could however be used to gain core exposure to those risk premia that can be captured passively, with satellite positions in high conviction hedge fund managers, or strategies that are not passively investible.

The market capacity of certain alternative betas is clearly limited, particularly in less liquid strategies such as convertible arbitrage and strategies that require instruments to be available for shorting. The equity style premia are much more scalable. Investors may already have exposure to some alternative betas in their portfolios (particularly the style premia), so care should be taken that an alternative beta allocation does not provide an unwanted increase to those exposures.

Conclusion

Over time, more and more of a portfolio’s return has been decomposed into various betas, or equivalently, explained by reference to the exposure taken to risk premia. At the same time, the use of systematic and rules-based investment approaches have been increasingly used to capture these sources of return.

The concept of passively capturing a risk premium is now extending into the alternative investment strategies commonly used by hedge funds, and offers the potential benefits of hedge fund investing (principally, the diversification of traditional risk premia that are dominant in most investor’s portfolios) in a more liquid, transparent and cost-effective manner. However alternative beta is a developing space in terms of products offered and is complex both in terms of the definition and implementation of the approach, so careful manager selection remains a priority.

1. Fama-French three-factor model

More Related Content...

|

|

|