An alternative approach to investing in emerging markets

|

Written By: Paul Cooper |

Paul Cooper of Sarasin & Partners outlines the potential benefits of an equally-weighted approach to emerging market investing

Investing in emerging markets brings particular challenges to investors. The variety of cultures, languages, demographics, corporate governance and the different ways of doing and monitoring business makes investment in this part of the world extremely complex.

Historically, emerging markets have experienced much greater volatility than developed markets – Turkey, for example, fell by 13% in USD in January 2014 but it then rose 3% in February, and 17% in March. And because of the nature of their economic structure they typically exhibit low correlation to each other – while Turkey and Brazil rose 17% and 11% respectively in March, China and Russia fell by 2% and 3% respectively.

At Sarasin, we responded to the challenges of this asset class with the launch of our first systematic emerging markets fund in 1996. In brief, we take advantage of the high volatility and low correlation by investing equally across the emerging world, rebalancing regularly to take profits from the outperformers to reinvest in the underperformers. Today, we manage more than $1.5 billion for institutions looking for a differentiated, complementary, way of investing in the emerging world.

Our method exploits the academic results published by William Sharpe at the end of the 1980s in his influential paper “Dynamic Strategies for Asset Allocation”. Sharpe demonstrated that when a portfolio is invested in asset classes characterised by high volatility and low correlation, it is possible to extract a “bonus” by rebalancing the portfolio back to its original weights at a given frequency.

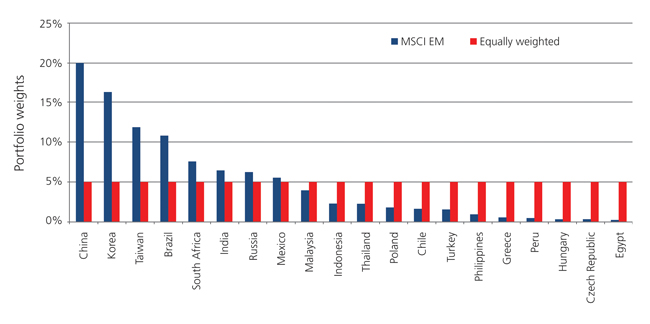

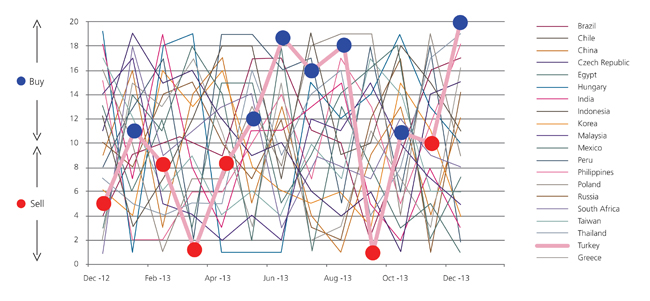

At Sarasin we apply this process across 20 single country indices in the MSCI Emerging Market index, and rebalance to equal weights on a monthly basis (Figure 1). The presence of low correlation derives from the relative mean-reverting which can be appreciated more easily in Figure 2. The presence of volatility acts as an amplifier to the size of the rebalancing bonus; in other words, the higher the volatility and the lower the correlation, the higher the bonus or “alpha” that can be extracted from rebalancing (buy low, sell high).

Figure 1: Portfolio diversification – portfolio weightings

Source: Bloomberg, Sarasin & Partners LLP, Jan 2014

Figure 2: Relative mean reversion with Turkey demonstrating the “rebalancing bonus”: the ranks of the monthly returns

Source: Bloomberg, Sarasin & Partners LLP, Jan 2014

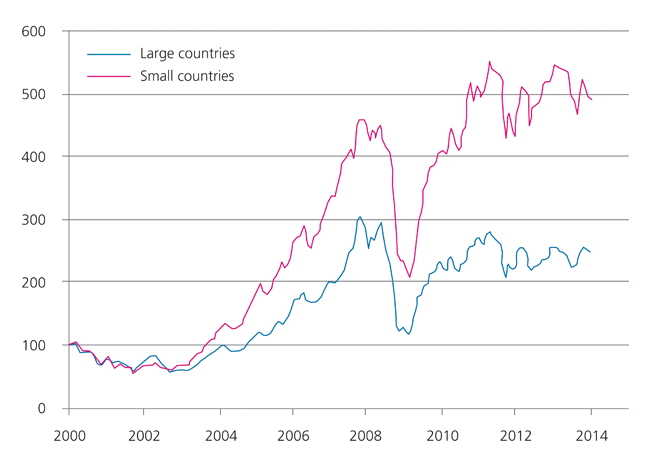

The decision to target an equally-weighted approach relies on our conviction that the potential for outperformance does not depend on the market capitalisation of a country. On the contrary, our studies indicate that in the medium to long term, an investor can achieve superior returns from the smaller rather than the larger countries. Figure 3 shows the cumulative returns of two portfolios invested respectively in the five largest markets (chosen on a monthly basis and equally weighted) and in the remaining smaller markets (also equally weighted on a monthly basis). The outperformance of the smaller countries over this period is significant.

Figure 3: The small country effect (equally weighted) – Index rebased to 100

Source: Bloomberg, Sarasin & Partners LLP, Jan 2014

The majority of indices used as benchmarks by emerging market investors take a market capitalisation approach. This means that – on a country by country basis – economies with the greatest market values are given the largest weightings in the index. For this reason, most emerging market funds invest primarily in the larger economies like China, Russia and South Africa – not because these are necessarily more attractive, but because they represent larger constituents of the underlying index. Indeed, the market cap approach has become the default way of investing in the emerging world.

Unfortunately, though easy to understand, the market cap approach is not efficient. Firstly, the approach gives a false illusion of diversification as, in reality, the five largest constituents make up almost two thirds of the index. Secondly, it is backward looking, as indices do nothing more than reflect what has happened in the past; the better the past performance or the more expensive the stock or country the larger the weighting in the index. It is therefore unlikely that one can construct a genuinely forward looking portfolio by a reference to a backward looking index. Finally, a market cap approach significantly under-represents the smaller countries. Put simply, then, while this is a well-known style for portfolio managers to follow, there are compelling alternatives, some of which benefit from many of the aspects that would normally be seen as the drivers of risk.

Equally-weighted styles are defined in the way the name suggests: every country in the index is assigned the same weight. This removes the inefficient bias toward the larger markets, therefore more effectively reflecting the opportunity for the wider asset class. As well as providing greater diversification, the low correlation and the historically better returns of the smaller countries can lead to improved risk-adjusted returns at the portfolio level. Of course there are periods in which the small countries underperform the large countries (such as 2009 and 2013) but, historically, these periods have tended to be good opportunities to increase exposure to an equally-weighted approach.

In summary, our emerging market process relies on two principal strategies to deliver alpha:

- The “small country” effect

- The “rebalancing bonus”

Rather than seeing high volatility and low correlation as challenges to overcome we see them as opportunities to exploit. By systematically rebalancing on a monthly basis we remove emotion and market timing from the decision-making process and offer superior diversification compared to the highly concentrated indices. Unlike other approaches, we provide complete transparency over country allocation, tracking error and stock selection (we deliver index performance in each country) and the fund is less exposed than usual to Manager or stock risk.

More Related Content...

|

|

|