Artificial intelligence offers versatile opportunities in the financial industry

Published: February 1, 2022

Written By:

|

Daniel Seiler |

|

Sheridan Bowers |

Daniel Seiler and Sheridan Bowers of identify the several ways in which the use of AI to analyse vast amounts of data can help improve decision making in the financial sector

Artificial intelligence (AI) has become a buzzword over the last few years and is a source of great fascination. Generally speaking, AI refers to the technology and science behind algorithms that can make intelligent decisions. In this context, AI is an umbrella term that is associated with great expectations and deep fascination but also fears in the financial industry in particular.

Fears of novel technologies, also known as technophobia, arise from the fact that people tend to have greater trust in their feelings than in the facts. People have always been sceptical toward new technologies, as demonstrated impressively by the Luddites in the 19th century during the Industrial Revolution. Looking back, this resistance seems abstruse and absurd in part, considering that, so far, it has always turned out that technology offered more advantages to humans than risks.

Systematic and unemotional processing of market data

AI can also offer a wide range of opportunities in the financial industry that are accompanied by positive effects. It can be used for a wide range of applications, as there is no ONE artificial intelligence. Instead, this heterogeneous technology covers various processes, methods, and technologies that can be used in different areas. The focus is always on smart data networking that enables a more precise evaluation. This refers in particular to the systematic and unemotional processing of the considerable amount of market data from which experts in the complex financial market expect an enormous added value.

When it comes to the speed and efficiency of data processing in particular, AI is superior to humans. This superiority is supported by the impressive increase in the available processing power of computers needed to handle the data. What is more, the amount of data available continues to increase rapidly. The use of technical tools helps to make ever better and faster use of the wealth of information that the financial market holds and generates, allowing users to gain an advantage.

Machine learning (ML) in particular, which is a sub-area of AI, can quantify connections between data elements in an efficient and systematic way by combing through large amounts of data in order to extract, cluster, and classify relevant aspects. In combination with economic knowledge, these results can be used to derive forecasts that provide crucial strategic support to decision-making in the investment process.

Cognitive biases influence people’s decision-making

In the investment area in particular, where a wide range of decisions must be made, AI is proving to be more competent than human experts when it comes to making statistical judgments. In contrast to the assumption in economics that people act rationally to maximise benefits, we are not always able to make the best decisions. Given this, we have to ask ourselves what happens when people do not act rationally?

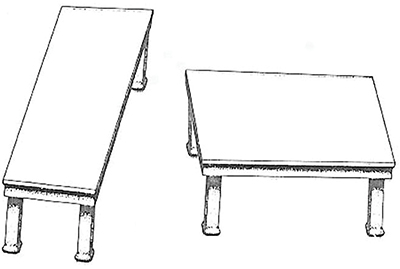

A good example of this can be found in the book Nudge: Improving Decisions About Health, Wealth, and Happiness by economist and Nobel Prize winner Richard Thaler and Harvard professor Cass Robert Sunstein (Figure 1, over)¹. Take a look at the two tables and eyeball which one you think is bigger. If you then take a ruler and measure them both, you’ll find that the two tabletops are the same size – yes, the same shape and area!

Figure 1: The Müller-Lyer illusion

Source: Thaler & Sunstein 2009, p. 17.

This “Müller-Lyer illusion”² uses a geometric optical illusion to expose our everyday errors in reasoning. It shows that our senses often play tricks on us without us even noticing. Decisions can therefore be the product of unconscious subjective processes by means of which we deceive ourselves systematically.

Feelings and experiences are suppressed

These cognitive biases, where feelings and experiences influence people’s judgments, can be suppressed by the use of artificial intelligence. AI is not distracted by details, sees the actual situation accurately, and makes a systematic decision.

Artificial intelligence is defined by Power, Burstein & Sharda (2011) as “a class of computerised information systems that support decision-making activities […] which enhance users’ effectiveness in making complex decisions.”³ It is characterised by uninterrupted learning on the basis of examples. The neural networks formed in this way are comparable to the structure of the human brain and help the system to make the right decision. This allows it to unemotionally and quickly convert considerable quantities of data into information and patterns that can be interpreted. It arrives at unbiased results within the decision-making process and detects data patterns or links that would otherwise go unnoticed.

Quick and efficient analysis of large data quantities

In view of these advantages, AI has the potential to change and improve the existing processes in the financial industry. The benefits of the technology are noticeable in regulated markets in particular, as they have a high level of data availability. The high computing power of AI pays off in this environment, as it can analyse large amounts of data efficiently in a short period of time. In addition, the limited rationality and various cognitive biases of humans are eliminated.

AI systems typically look for linear and non-linear connections between data points. They use historical data in which the programmes search for patterns that they compare with current data in order to make predictions for decisions. Especially in combination with new data sources, AI is introducing completely new methods and possibilities into asset management, in particular in the field of systematic investing. Here, the use of artificial intelligence can contribute to improving the understanding of probabilities and the use of evidence-based models.

Potential of artificial intelligence

The opportunities that AI offers in the financial industry depend largely on the application of the AI systems and the acquisition of the corresponding technical skills. The type of AI as well as the instruments used for decision-making, but also the time frame, the financial functions to be fulfilled, and the involvement of humans in the process must be taken into account here.⁴ When used correctly, AI can prove to be a useful instrument for investments. A study published recently by Chen and Ren (2021) provides an indication of this: it revealed that AI-assisted funds can perform better than their competitors managed by humans. This outperformance can be traced back to sources such as the smaller amount of behavioural biases.⁵

1. Thaler, R.H. & Sunstein, C.R. (2009). Nudge: Improving Decisions About Health, Wealth, and Happiness. London: Penguin Books.

2. Müller-Lyer, F.C. (1889). Optische Urteilstäuschungen. Archiv für Anatomie und Physiologie, Physiologische Abteilung, 2, pp. 263–270.

3. Power, D.J., Burstein, F. & Sharda, R. (2011). Reflections on the past and future of decision support systems: perspective of eleven pioneers. In Schuff, D., Paradice, D., Burstein, F., Power, D.J. & Sharda, R. (Eds.), Decision support: an examination of the DSS discipline, annals of information systems (pp. 25–48). New York: Springer.

4. Karppi, T. & Crawford, K. (2015). Social Media, Financial Algorithms and the Hack Crash. Theory, Culture & Society, 33 (1), pp. 73–92.

5. Chen, R. & Ren, J. (2021). Do AI-Powered Mutual Funds Perform Better? Finance Research Letters, Forthcoming, Available at SSRN: https://ssrn.com/abstract=3979672.

More Related Content...

|

|

|