Asset allocation audit: how to see the wood for the trees

|

Written By: John Roe |

|

James Sparshott |

John Roe and James Sparshott at Legal & General Investment Management provide a framework for pension funds preparing an audit of their asset allocation

Our conversations with committee members from Local Government Pension Scheme (LGPS) funds have revealed some striking overlaps with our own multi-asset team. Both have responsibility for large asset bases and need to determine the level of risk to take, what to invest in, and where to use active management.

We want to share an approach we use to help us step back from our day-to-day priorities and see the bigger picture, helping us see the wood for the trees. A recent session we led for the LGPS on the topic gained a lot of traction. In that case we had just 45 minutes, but we can also work with individual funds to perform a more complete exercise.

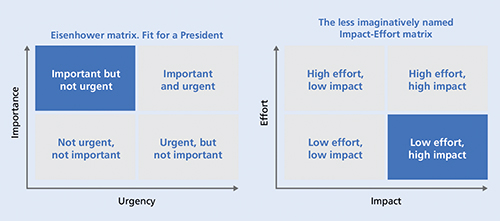

When we’re all so busy, there’s a risk time isn’t used in the best way; the audit helps combat that and is designed to target the main objectives identified in two popular prioritisation matrices, as Figure 1 explains.

Figure 1: Objectives identified in two popular prioritisation matrices

Source: LGIM

The point both matrices make is that the most impactful decisions aren’t always the most urgent, meaning they often don’t get the attention they deserve. The audit offers a low-effort way to set aside time to review those important decisions.

Identifying the big decisions

The first step is to identify the most important, impactful decisions to focus on. These will vary, but generally we’d say they are:

- What assets to own given the acceptable level of investment risk

- Their regional exposure

- What overseas currency exposure to have

- Where to use active management

- How to allow for bigger structural risks such as climate change

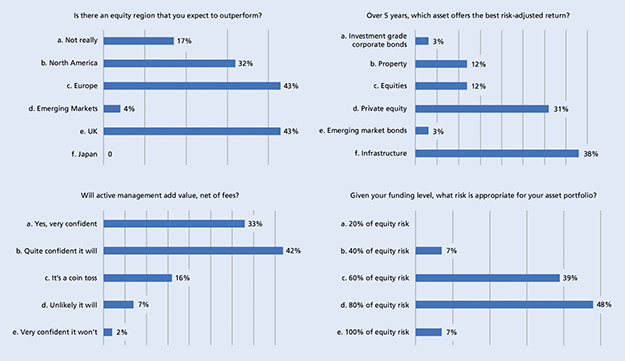

Unfortunately, there’s no universal answer to those questions. To illustrate that, at a recent seminar1 focused on the LGPS, we asked the audience for their views on four topics, as shown in Figure 2. The wide variety of opinions illustrated highlights that different decision-makers will have different investment preferences.

Figure 2: Responses of seminar attendees to queries on four topics

Source: LGIM

Once a fund is clear on its investment beliefs and has written them up as a set of principles, it can move on to the next stage of the audit. This involves questioning how well the current allocation matches those beliefs, focusing on those decisions that could have the biggest impact on end outcomes.

Let’s get auditing – common themes in LGPS

When an investor completes an asset allocation audit, they will generally find a small number of important areas to revisit. The aim isn’t to go into the minutiae, but rather to focus on high-impact decisions, like what mix of asset classes and regional exposures to own.

Although each fund is different, there are some common themes we see when reviewing LGPS asset allocations:

1. Home bias in equities. UK equities can potentially offer significant diversification benefits, which could justify a weight within equities above that implied. For example, in the first quarter of 2022, they outperformed European equities by about 10% and US equities by over 5%, having been a laggard in recent years.2 However, UK weights are often very high, to the degree that LGPS often reconsider if this is consistent with their equity regional views.

2. Low allocations to alternative credit. LGPS have long been pioneers in embracing alternatives for diversification and additional return potential. Generally, they have higher weights than corporate schemes to assets such as infrastructure, property, private equity, hedge funds and commodities. However, allocations to alternative credit assets such emerging market and high yield debt typically remain very limited, meaning this area could be worth closer scrutiny.

3. Active management risk concentration. As our survey showed, many LGPS decision-makers are advocates of active fund management. It is therefore interesting to review where they use it, to check it’s consistent with their investment beliefs. To start with, most investors would accept that all else being equal, more diversification is better; so in the case of active management, spreading the risk budget across different asset classes seems intuitively appealing. What we see in practice is that active manager risk is concentrated in equities and alternatives; it could be that LGPS funds believe that’s where it is most applicable, but when we speak to them that’s not the case. Generally, they say it’s a concentration that they’d like to reduce by transferring risk into areas like fixed income and asset allocation.

4. Lack of short-term asset allocation. Beyond the longer-term decisions taken by funds, such as the proportion of equities to own and what new asset classes to introduce, we often find shorter-term active asset allocation is very limited. LGPS funds often say that’s not a decision that’s consistent with their investment beliefs. Active asset allocation can be accessed via unconstrained multi-asset funds. Generally, solutions with a very high active risk budget may be most appropriate, so that even a small allocation has a material impact at an overall fund level.

A helping hand with your audit

The framework we’ve outlined is deliberately transparent and straightforward to apply, as we believe this helps target the important, but not urgent, decisions efficiently. You could either go it alone, or you could speak to an investment consultancy about going through the process with the fund or pool.

However, given the similarities between large-scale asset allocators at fund managers and the LGPS, it may also be worth going through the process with a suitable manager who you’d trust to input ideas and remain objective rather than focusing on proposals their own firm could provide.

Key risks: For illustrative purposes only. Reference to a particular security is on a historical basis and does not mean that the security is currently held or will be held within an LGIM portfolio. The above information does not constitute a recommendation to buy or sell any security.

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. It should be noted that diversification is no guarantee against a loss in a declining market. Views expressed are of LGIM as at 11 May 2022. The Information in this article (a) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice. Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119272

1. Seminar date Feb 2022, 55 respondents

2. Source: Bloomberg FTSE All-share Index for UK, FTSE Europe ex UK (in Euros) for Europe, FTSE USA Index for USA

More Related Content...

|

|

|