Asset pooling and the LGPS: spotlight on investment vehicle options

Published: April 1, 2014

Written By:

|

Robert Frazer |

|

Aaron Overy |

In the light of London Council’s proposal to create a common investment vehicle for London Borough pensions, Robert Frazer and Aaron Overy look at some investment vehicle options for UK asset pooling solutions and consider the tax, risk and governance implications of each

Local government pension schemes (LGPS) have long found themselves under pressure to become more efficient, reduce their operational costs and obtain maximum value from their investment programmes. A potential solution to this end is to invest alongside each other in a single collective investment vehicle to achieve scale efficiencies and access to best-in-class managers.

Multinational corporations were among the first institutional investors to implement asset pooling in this way, gaining greater levels of cost-efficiency, purchasing power, control and oversight of pension scheme investments. While the benefits of such arrangements are significant, implementation is however not necessarily straightforward, and several options exist in the way funds may be structured and operated.

Now, London Councils have signalled their intent to develop a common investment vehicle for London borough pensions using the Authorised Contractual Scheme (ACS), a new kind of vehicle set-up by HM Treasury as part of its strategy to improve the UK’s competitiveness as an investment management centre. As discussed in a recent seminar organised by LAPF Investments, by doing so London Councils aims to reduce administration costs and increase return on investment while maintaining local accountability and control.

Against this backdrop, this article examines which investment vehicle may best be used for asset pooling in the UK – and the potential implications for taxation, governance and risk management of the fund. In particular, we will examine how investing pension fund assets through life funds compares to using a tax-transparent contractual vehicle, particularly the ACS and the Common Investment Fund (CIF), another popular structure that may be used for asset pooling.

Taxation and the importance of tax-transparency

Tax efficiency has become an important factor impacting fund performance in recent years, particularly in terms of withholding tax (WHT) applied on equity investments. In order for UK pension funds and their stakeholders to benefit most effectively from the use of asset pooling, a tax-transparent fund structure is generally recommended wherever possible.

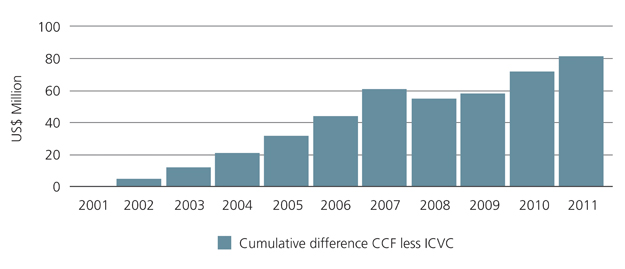

Significant research¹ has been undertaken into the positive effects of using a tax-transparent fund structure to reduce unnecessary tax “drag” on investment performance (see Figure 1 below), as without such a structure in place WHT may be applied at the fund level without regard to investor type or domicile. This potentially results in investors incurring higher effective tax rates than if they had invested directly in the market.

Historically, the European tax-transparent vehicles used for this purpose have been domiciled primarily in Dublin and Luxembourg. Recently, two options have come to the fore for UK-based pension funds, insurance companies and investment managers: the CIF and ACS, both of which structures can allow UK pension schemes to effectively pool and manage their assets.

Figure 1: Additional cumulative returns in Irish common contractual fund over 10-year period (US equities)

Source: Northern Trust research (January 2012)

Access to double taxation agreements

In the UK, pension schemes can often access favourable withholding tax rates on equity income through application of a double taxation agreement or through recourse to domestic or EU law. However, with tax legislation varying from country to country on which structures qualify for relief, life funds tend to obtain varying results – positive WHT outcomes are often obtained in some markets, such as the US but not in others, such as in France.

By contrast, the tax-transparent nature of the ACS means that when the correct fund constituting documentation and tax ruling from HM Revenue & Customs is obtained, it is generally possible to “look-through” the fund to the underlying beneficial investors and reclaim at their tax rate rather than at the fund rate.

Where a number of registered pension schemes have pooled their investments in a CIF, the managers of the fund can submit centralised repayment claims on behalf of all the participating pension schemes. However, restrictions apply: the share of each registered pension scheme in the pooled fund must always be identifiable, and the assets of the participating schemes cannot be subjected to any other trusts. It should also be noted that the CIF is only an investment agency for the assets of the participating schemes of the same employer or associated employers, and therefore cannot be a registered pension scheme in its own right.

This means the CIF can present obstacles in some European markets in obtaining tax reclamations at the correct rate. For example, the Netherlands tax inspector will not accept reclaims in the name of the CIF. In such cases, the custodian or administrator would be required to proportionately distribute all income to each underlying pension fund investor and issue claims in their names.

Although some investment markets do not explicitly view the ACS as being fiscally transparent, the outcome achieved in these markets through the use of an ACS is likely to be closer to the direct investment outcome than would be the case via a CIF and certainly when investment is made through a life company.

Insolvency risk and asset protection

Post-crisis, asset protection of course remains a foremost consideration. When investing through a life company, the LPGS member is buying a policy (or contract) rather than the assets in which they are investing. As a consequence, the insurance company is the counterparty in such instances – and in the event of an insolvency situation occurring, there is the possibility that the policy may not be honoured.

Whilst such scenarios may appear unlikely, the 2009 near-collapse of institutions such as AIG and the absolute collapse of Lehman Brothers show the extent to which counterparty risk has become a more significant issue for pension funds.

By contrast, in the case of the ACS, the pension fund owns the asset in which it invests, and in the event of an insolvency event occurring, strict ring-fencing exists in the ACS structure between sub-funds. Compared to the ACS, the legal language of the CIF framework is less clear in this regard.

Investing through either of these structures, rather than through a life fund provided on a reinsurance basis, also removes the need for a re-insurance contract, overcoming the issue of credit risk, and negating the possibility of confusion exactly as to where responsibility lies in the event of asset manager insolvency.

Scheme governance and transparency

Slight differences exist between the governance arrangements of the CIF and ACS: the former is overseen by a board of trustees, the latter by an operator. In addition, the ACS is an authorised fund and so regulated by the Financial Conduct Authority (FCA), whereas a CIF requires a corporate fund manager and trustee to be in place, and for each to be authorised and regulated by the FCA.

As a more substantive legal entity with a regular and audited net asset value, the ACS is likely to be more expensive to manage than the more lightly regulated, monthly CIF, or by investing through life companies. However, it may be considered that, over time, the accumulated benefits obtained elsewhere may offset the disadvantage of potentially higher operating costs.

Investing through a collective investment scheme such as an ACS or CIF will often also offer the user greater levels of transparency over their operations and charges. The operator or board of trustees play a more hands-on role in “paying the bills” and are able to obtain higher levels of oversight over areas such as fees paid to professional advisers, commissions or bid-offer spreads paid to brokers, than is generally possible when investing through a life company.

Even quite small variations in expenses can, of course, make a significant difference to investment return, so higher levels of ownership and visibility over these areas must certainly help meet targets for greater transparency over investments and efficiencies in their business.

Conclusion

At Northern Trust, our experience in servicing pension funds as their custodian and asset servicer has enabled us to see the benefits that may be obtained through successful pooling of investment assets. As vehicles for administering and managing pension fund assets, asset consolidation through an ACS or CIF can allow pension funds to obtain economies of scale and access more investment opportunities than investing through single mandates.

Of course, every scheme is different and asset pooling is unlikely to be a viable solution in all cases for LGPS, but the use of an ACS in the right circumstances potentially offers a number of advantages. In the area of taxation, more certainty can generally be obtained through the use of an ACS when investing cross-border and when engaging with overseas tax authorities.

More secure ring-fenced bankruptcy protection is available between sub-funds within the ACS, as well as greater protection against credit risk when compared to using other investment vehicles or investing pension funds through a life company.

And finally, the ACS operator benefits from clearer and more stringent UK governance guidelines and higher levels of transparency over charges and operations in the management of their funds. For these reasons, we feel the ACS can currently be seen as the optimal collective investment scheme option for UK schemes considering an asset pooling solution.

1. Cross-Border Investing: Why Fund Structures Matter: Examining Excess Returns Derived from Tax Efficient Investment Structures, Lipper, June 5th, 2013

More Related Content...

|

|

|