Beating the income challenge

|

Written By: David Buckle |

The possibility of negative cash flows is becoming an increasingly pressing problem for local authority pension schemes. David Buckle of Fidelity International examines the options and looks at how effective a multi-asset income solution could be

The pressures on Local Authority (LA) pension schemes never really let up. The latest challenge facing approximately one in two LA schemes is dealing with negative cash-flows, a potentially serious issue for open schemes.¹ As money goes out to meet pensioner liabilities, funding ratios will get worse unless the scheme can deliver growth, or more tellingly, the right combination of growth and income. Starkly put, without asset growth, an open scheme which is 5% cash-flow negative will run out of money in only 20 years. So, what can committees do?

The only route left for many schemes is to diversify the scheme assets and target a higher overall risk-adjusted return. This is really about working the assets harder and making more effective use of the available risk budget. It has been reflected in a number of identifiable trends – in particular, a search for yield and greater targeting of income-producing assets beyond fixed income.

However, care is required with open LA schemes to ensure the growth portfolio is large enough to deliver the required level of growth for the long term; careful consideration is required to retain genuine flexibility.

Assessing the scheme income requirements

While no two schemes are the same, we can make some back-of-the-envelope assumptions. If contributions currently cover pension payments, the scheme is likely to become cash-flow negative in the next five years. If the scheme is turning cash-flow negative now, then it will typically need less than 5% of scheme assets as income. However, if cash-flow requirements are greater than 5% of scheme assets, it is likely that capital drawdowns will be required. As a general rule of thumb, if the cash-flow requirement exceeds the scheme discount rate, the scheme will need to drawdown capital.

Ultimately, for an open LA scheme income is a key factor to address but it cannot be considered in isolation; there is also a greater need to focus on asset growth in the here and now.

Meeting the scheme income requirements

There are a couple of ways in which commitees can look to address the scheme income problem, without giving up too much growth potential. Both are multi-asset income approaches that can provide a blended income yield that is higher than bond-only strategies, with the prospect of some capital growth. The first is to invest directly in a mix of income-producing assets by using a building blocks approach. This requires a continuous assessment of the relative value and risks of assets and their income streams. The second option is to use a multi-asset income fund approach, which enables schemes to outsource daily management responsibility while effectively ring-fencing their income generation needs.

A building blocks approach to multi-asset income

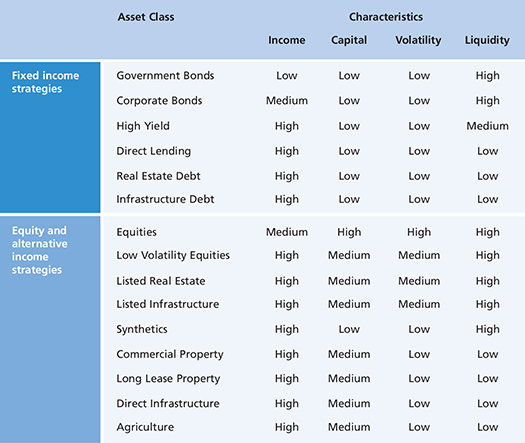

The right blend of asset class building blocks can help to meet liabilities and improve funding, but a traditional approach of growth and matching does not directly address the income problem. Instead, there is value in isolating the income requirement and targeting a part of scheme assets towards the specific tactical asset allocation required to deliver the bulk of an income target. By selecting income assets carefully, it is possible to maintain an exposure to the real economy and protect income from being eroded by inflation. This can be achieved in a multi-asset income strategy by including a balanced amount of equity, credit and alternative assets (see Figure 1).

Figure 1: Asset class characteristics

Source: Fidelity International, as at 2017. For illustrative purposes only

Historically, pension funds varied the asset mix between capital growth assets like equities and lower-risk, income-paying assets like government bonds. However, in a low-yield environment characterised by stretched asset values, this approach will now often fail to deliver the required scheme income target.

Local authority schemes are now looking towards other income-generating risk assets to meet their cash-flow needs, such as commercial real estate, infrastructure and dividend-paying equities. However, moving away from predictable fixed income streams to blended income complexity demands a new level of continuous asset management and governance. Indeed, the caveat to drawing an income from investments is that you inevitably give up some capital growth. This is a trade-off that needs regular appraisal to ensure that growth potential is not compromised.

A pooled approach to multi-asset income

An off-the-shelf, multi-asset income fund that outsources the job of continuous investment management can be a cost-effective and appropriate option for many funds. Committees and their advisers can work with the asset manager to agree and regularly review how much of the total asset mix to commit to such a scheme to cover future cash-flow needs, allowing an element of future-proofing.

By investing in a range of income-producing assets including equities, fixed income, real estate, infrastructure and loans (and tactically reallocating throughout the investment cycle), multi-asset income strategies can typically target a c.4-6%pa income stream, which could cover the scheme’s cash-flow needs while also offering the prospect of c.2-3%pa capital growth that helps to address the funding gap.

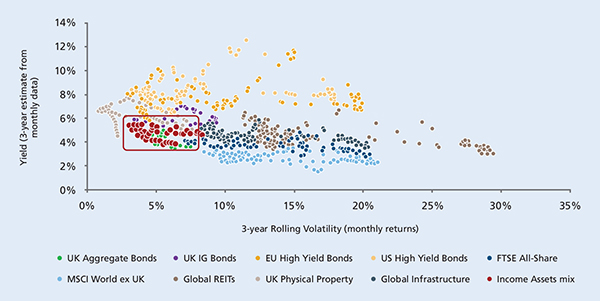

A multi-asset income strategy can deliver an attractive level of income with relatively low volatility. Critically, the yield/volatility profile of the blend is significantly more consistent over time than single asset classes (see Figure 2).

Figure 2: A multi-asset versus a single asset class approach

Source: Fidelity International, DataStream, Bloomberg, Fidelity Multi Asset calculations. November 2004 to March 2017. The chart shows the relationship between the yield and the historical volatility of monthly total returns of various asset classes and a static blend of income asset classes, a long-term neutral reference point that serves as a back-test for our analysis. The Income Assets mix is made up of 70.0% BofA ML Sterling Broad Mkt ;15.0% FTSE All Share;10.0% MSCI World ex UK; 5.0% SONIA. This is not a guarantee for the future.

How could a multi-asset income fund approach fit into an existing pension scheme?

The way in which a multi-asset approach is implemented will differ depending on the type and maturity of the pension scheme, the level of funding, liability profile and the appetite for risk.

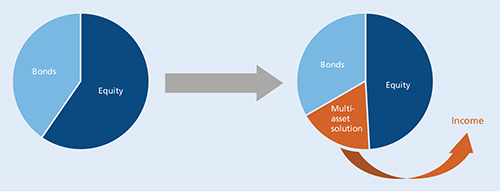

For open schemes such as the LGPS, where the risk of becoming cash-flow negative is a serious issue, a multi-asset income strategy can meet the pressing needs for income without compromising growth. It can be implemented into an existing asset allocation mix by dialling down equity and bond weightings in the same proportion, leaving the underlying equity and bond managers untouched if desired (see Figure 3). This enables a wedge of the overall asset mix to be explicitly set the job of targeting an income – effectively isolating the cash flow problem and making sure it is properly addressed.

Figure 3: Using a multi-asset solution to isolate the cash flow problem

Source: Fidelity International, as at 2017. For illustrative purposes only.

Conclusion

Local authority pension funds face a pressing need to get more from existing resources by making scheme assets work harder. With many funds in or close to negative cash-flow, the need to take full advantage of the available risk budget to deliver the right balance of growth and income is evident. This demands a continuous investment oversight that many committees are justifiably looking to outsource to professional managers. In this regard, a multi-asset income approach that isolates the cash-flow problem, without compromising growth, could be a highly effective solution.

1. 55% of UK Defined Benefit schemes are now cash flow negative according to Mercer.

More Related Content...

|

|

|