Broaden your real estate horizons

Dugal Hunt, Senior Director, CBRE Global Investors.

Over the past 20 years, real estate has become a global asset class in much the same way as equities and bonds. We believe there is a strong case for a UK pension fund to include an allocation to global real estate as part of its portfolio. There are three principal reasons why we say this:

1. Greater opportunity set

CBRE Global Investors estimates that the global institutionally-investable real estate market has a value of $28.1 trillion, predominantly made up of assets in Developed Markets (73% of the universe). The UK has a relatively large real estate investment market, yet represents only about 5.5% of the global investable universe.

By broadening allocations to include markets outside the UK, investors can substantially increase their opportunity set. The diverse range provides a large depth of investments across the three principal regions of continental Europe, the Americas and Asia Pacific.

We believe that a key attraction of the global market is that it offers significantly greater opportunities for skilled managers to earn “alpha” than are available in the UK market alone. Alpha can be generated by allocating capital top down to markets which will out-perform, as well as by good stock selection and asset management within markets.

2. Diversification benefits

While income returns from property are fairly stable, total returns display higher volatility. Real estate is a cyclical asset class with cycles lasting approximately seven years. These cycles differ significantly from country to country because of their specific demand and supply drivers. Therefore having exposure to more countries will create a more stable total return profile than investing solely in one country.

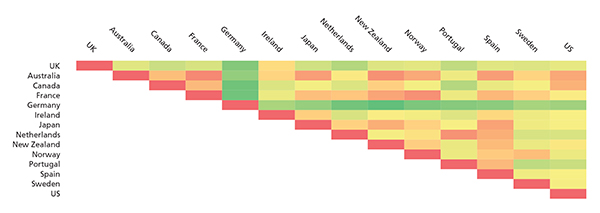

This is reflected in the heat map (Figure 1) that represents the correlations in local currency total returns for the major developed real estate markets over the period 1991-2015. The data suggests that there is high potential to diversify a UK domestic portfolio by investing abroad.

Figure 1: UK asset class vs global direct real estate market total return correlations (1991-2015)

The colours represent diversification potential (green – high, cream – medium, pink – low; the stronger the pink colour less diversification benefits, the stronger the green colour more diversification benefits).

Source: CBRE-Ikoma, IPD, NCREIF, PMA, CBRE Global Investors, UK Equities: FTSE All Share Total Returns index, UK Gilts: Bank Of America Merrill Lynch United Kingdom Gilt, all underlying returns are local currency.

Within Europe the weakest correlation is to France and Germany followed by The Netherlands and Portugal, indicating that the greatest diversification benefits can be achieved by combining the UK properties with properties in these markets. Outside Europe the weakest correlation is to Canada and Japan.

3. Enhanced returns

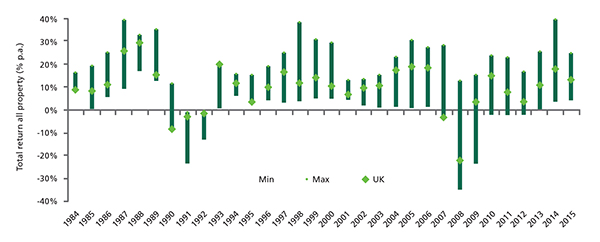

The correlation between real estate rental growth and economic growth tends to be strong, which means that there is obvious merit in gaining exposure to markets that are expected to grow at faster rates than the UK. The cyclicality of the real estate markets are reflected in the wide variations in returns across markets (Figure 2).

Figure 2: Dispersion in total returns between strongest & weakest performing market

Source: IPD Multinational Index

Dispersion between the strongest and weakest performing real estate markets globally peaked in 2008 at 47.3%. The UK recorded a total return of -21.9% in that year. Being exposed solely to the domestic market in that year would have been extremely damaging to investment performance. Another year where large extremes were recorded was 2014, when the Italian real estate market delivered the weakest return (3.5%) and Ireland recorded the highest return (39.5%).

Capturing the return generated by the Irish market in that year would have been extremely beneficial for a portfolio. In short, the wide dispersion creates an opportunity to earn higher overall returns through top down market selection and achieve higher performance relative to global averages/indices by tactically tilting allocations towards markets that offer better return potential.

“Alpha” is generated by selecting the markets with higher returns at each point in time. Our in-house relative return framework includes an evaluation of each market’s risk so that we assess expected risk-adjusted returns when making allocation decisions.

Accessing the global real estate market

The challenge is how to access global real estate, and manage the associated risks. Individual properties have high specific risk relative to their market, and it is necessary to own a large number of buildings to diversify these away. Only the largest investors have sufficient capital to buy a sufficient number of properties to create a properly diversified global portfolio. An investor can however gain exposure to a diversified portfolio with very limited capital by investing indirectly via local operating partners.

Both top down market allocations and investment selection offer considerable opportunities to generate “alpha” from a global real estate strategy.

This requires a detailed understanding of various risks and issues including property specific risk, leverage, tax, currency risk, management fees and other operating costs.

Based on thorough research of market fundamentals, allocations should be made top down to markets which are expected to outperform while ensuring a well-diversified mix of market exposures.

Individual investment – and operating partner – selection is then critical.

Property is a local business, and skilled managers create significant opportunities to add excess return at the property level. An on-the-ground network and rigorous due diligence process are required to source proven local operating partners, execute investments in a structured way and actively manage the investments and risk on an on-going basis. We believe that there are benefits to UK pension funds expanding their real estate allocations beyond the domestic market.

More Related Content...

|

|

|