Building a portfolio with style

|

Written By: Paul Myles |

Paul Myles of BMO Global Asset Management outlines the benefits of incorporating style-based factors in an investment strategy

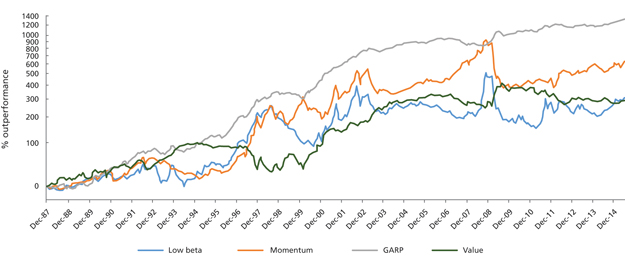

In traditional diversified investment portfolios, returns are typically thought to be determined by two principal drivers: market exposure (beta) and fund manager skill (alpha). If, however, you deconstruct the alpha element, you could identify a third set – “styles”.

Figure 1: Sources of Absolute Return

Source: BMO Global Asset Management

What is a style?

In technical terms, a style is a quantifiable characteristic of a group of stocks or bonds that determines the risk and return of that group. In practical terms, it is a potentially important source of diversification and added value for your portfolio.

The most recognised equity styles can either be valuation-based, calculated by using “book-to-price” and “price-to-earnings”, ratios or growth-based ratios, such as “earning growth”. Well-known investment styles include Value, Size, Momentum, Quality, Low Volatility and Growth at a Reasonable Price (GARP).

Having been identified in academic studies as long ago as the early ‘90s, styles are not new. While they have lain undiscovered by the majority of investors, they have been successfully employed by some well-known market participants. If you make an analysis of Warren Buffet’s portfolio, for example, you’ll see that most of it is style-based rather than alpha-based. Now, with markets suffering heightened levels of volatility, an increasing number of professional investors are also waking up to the benefits of styles: broader diversification with relatively low correlation.

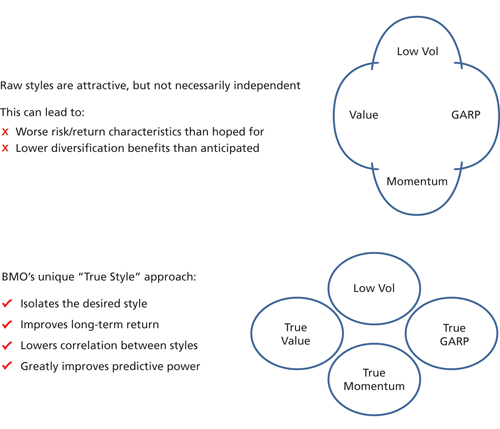

Another reason that style investing is becoming more popular is performance. Analysis has shown that many styles deliver consistently positive returns over multiple periods and at an acceptable level of risk. But as past performance can be no guarantee for the future, should investors reasonably expect these characteristics to persist?

Figure 2: Historic out-performance of individual equity styles

Source: BMO Global Asset Management, Factset, gross of fees. All data from January 1988 to June 2015. The returns represent the outcome of buying the top 20% of stocks with each particular attribute and selling the bottom 20%, rebalanced monthly, and do not include any transaction costs.

Do style characteristics persist over time?

The first step in answering this question is to examine what drives these returns. There are two separate schools of thought. First is the efficient market theory that says that these excess returns are a compensation for risk: because you take extra risk, you can reasonably expect over sufficiently long periods to be rewarded. There are others who say that it is not about risk, it’s more the effect of the hard-wired behavioural biases of investors. An example of this would be that “value” as a style works because investors have difficulty in mentally distinguishing between a good company and a good investment. So, if you are looking at a highly regarded company such as Apple, the question you should be asking is, how much of that quality is factored in to the share price? Logic says that if all that goodness is already discounted, your investment may disappoint. Another example of a behavioural bias is “momentum”, where people buy stocks that have gone up because they have missed the initial pick-up and want to join the party. You just have to look at the internet boom at the turn of the millennium to see how far the herd mentality can distort the market.

We believe that, in reality, both the efficient market and behavioural explanations make contributions to the persistence of styles. That said, it doesn’t really matter where the effect comes from as both can be expected to persist on their own merits. For the efficient market/risk compensation theory, risk does not go away. While you may lose on shorter periods, over longer-term horizons you can expect to be rewarded. For behaviour, people’s natural biases have been ingrained for thousands of years and you can’t expect that to change in just a couple of decades.

The counter argument to this expectation of persistence is that the markets are getting ever more efficient. But styles are not technical arbitrage opportunities; the very fact the majority of assets are still being managed in the traditional way means that there is less chance of these style effects disappearing.

So what part should styles be playing in a portfolio?

On one level, there is an argument to say that style-based investments should be core holdings. If you want a strategy that delivers higher levels of fund manager value in a convenient “single factor” format, then styles are a great way of achieving it. Blending disparate assets will often require the expertise of multiple managers, but with styles, that can be achieved with just one.

One way to implement styles into an effective strategy is to rank an index by each particular style, take the top securities for each and then blend them together in an allocation that corresponds to your market outlook. Therefore, instead of a traditional portfolio that is rigidly categorised by market capitalisation, you get a mix of securities that is much more reflective of your world view.

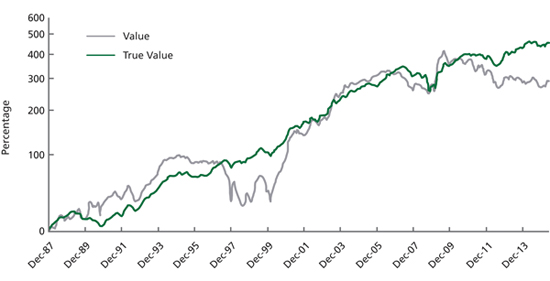

But an undisciplined repackaging of styles may not always give the desired results. One potential weakness is that, in practice, styles are not totally uncorrelated. When they are combined there is still too much overlap in their return characteristics, which reduces diversification and saps performance potential. For example, a small Italian retailer may look cheap from its book-to-price ratio, but if all Italian stocks are cheap, does it really represent value?

A solution is to take the styles in their raw state and apply a methodology that removes their common factors. At BMO Global Asset Management our methodology removes the shared components from the raw variables, simultaneously, to come to an improved metric of the desired style. It is therefore possible to create the desired style exposure within a diversifying portfolio. This unique “True Styles” methodology lowers correlation between styles and removes the overlap that causes stocks to appear in more than one style index.

Figure 3: Removing common factors to reduce correlation

Source: BMO Global Asset Management

Passive or active management?

Investors these days are faced with a very clear choice. Do they invest actively or passively? A passive approach is appealing for a number of reasons. The associated costs are low, you know what you are getting (index return) and you are not reliant on fund manager skill. However, you potentially miss out on superior returns.

Traditionally, all returns from an active portfolio in excess of its benchmark (active return) have been attributed to fund manager skill. However, it is now recognised that there are number of stock characteristics which seemingly attract excess returns. It is possible to construct a portfolio that tilts to one or more factors and which, as a result, can be expected to generate positive excess returns.

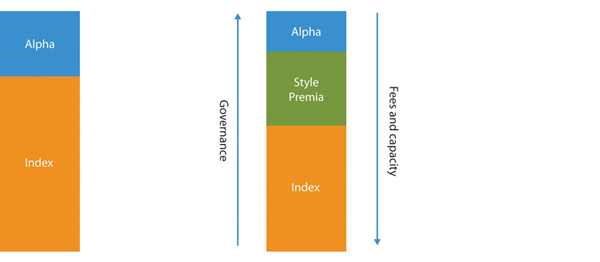

Such an approach is termed as being systematic but is still classed as an active approach. This is the essence of using systematic styles: a “smart beta” solution that gives you efficient, low cost exposure to the market but retains the potential for excess returns.

Figure 4: Cumulative value returns in global equities: Jan 1988 – Jun 2015

Source: BMO Global Asset Management, Factset

Why invest in a multi-style strategy?

Portfolio investors should no longer think merely in terms of alpha and beta. Style investing has shown itself capable of delivering distinct risk and return performance over time and should therefore be counted as a key component of asset allocation strategies. And by allocating weights of different styles dynamically, it is relatively simple to articulate both strategic and tactical views.

Aside from the portfolio construction advantages of a multi-style strategy, there are also cost benefits. The fact that the approach is so scalable means that fees can be lower than for products with comparable active return objectives.

The cost argument is reinforced by the fact that an actively-managed styles portfolio only really needs to be rebalanced when there are changes in your market view. This can occur typically at the time – perhaps half-yearly – when individual style pots are recalibrated to account for the natural changes in valuations, capitalisation and other variables within the index of stocks/bonds you are using. Overall, fewer fund managers performing less time-consuming research has to result in a lower cost base.

We argue that the enhanced efficiency of a multi-style strategy can be achieved without any compromise on the quality of the strategy. So with the potential for more reliable and less correlated at a lower cost, it seems that by investing in styles, you can have your cake and eat it.

Past performance is not an indication of future performance. The value of investments and income derived from them can go down as well as up as a result of market or currency movements and investors may not get back the original amount invested.

More Related Content...

|

|

|