Building infrastructure

|

Written By: John Finch |

John Finch of JLT Group discusses the infrastructure investment potential of the newly-established wealth funds, and looks at the prospects for the LGPS in the sector

Life is full of surprises, and this was especially the case for Local Government Pension Funds 2015:

- Surprise announcement in the summer budget that LGPS should “pool” assets

- Surprise that there wouldn’t be a consultation on the criteria

- Surprise that there would be consultation on new investment regulations

But the biggest surprise of all was when chancellor Osborne announced, at the Conservative Party conference, the establishment of six British Wealth Funds to invest billions in infrastructure in the regions. No-one was expecting that!

Is it a silly idea? Should the LGPS be encouraged to invest in UK infrastructure? And importantly, can they, through the creation of Collective Asset Pools, invest [particularly in infrastructure] more effectively?

This article attempts to answer these questions and provide some detail on how it might all be acheived.

A first question though is how much does the LGPS already invest in infrastructure?

In its 2013 Annual Report, the Scheme Advisory Board stated that 0.3% (c£550 million) of LGPS assets were invested in infrastructure. More has been invested since then, but an estimate by JLT Investment Consulting suggests that this has only grown to c£1 billion as at March 2015.

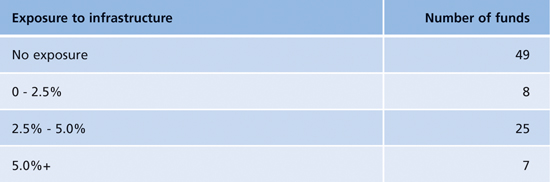

Why is this? Well, certainly it seems that LGPS funds do not have high strategic allocations to this asset class. Based on the March 2014 Report and Accounts of the 89 English and Welsh funds, Figure 1 highlights the position.

Figure 1: Positions of the 89 English and Welsh funds based on the March 2014 Report and Accounts

Source: LGPS Annual Report and Accounts 2014

The next question is why such low allocations? Strategic allocations are nearly always the result of asset liability studies carried out by investment consultants, and the results will be driven by the return and risk assumptions made within the models. Put the wrong numbers in and the model will not produce the “right” result. So, a key driver of allocations may be problems with the assumptions in the models, although to be fair, infrastructure is a difficult area. Those with clear views and understanding of the market are those that will be positive on it.

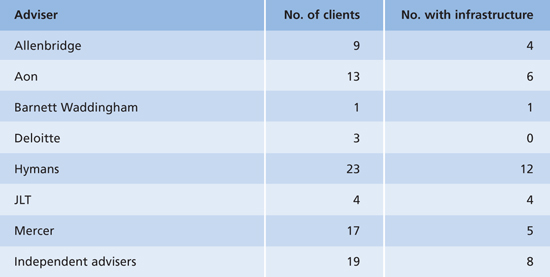

The results in Figures 2 were taken from the 2014 Report and Accounts of the eight groups of advisers involved in advising the LGPS.

Figure 2: Groups of advisers involved in advising the LGPS

Source: LGPS Annual Report and Accounts 2014

Is investing a silly idea?

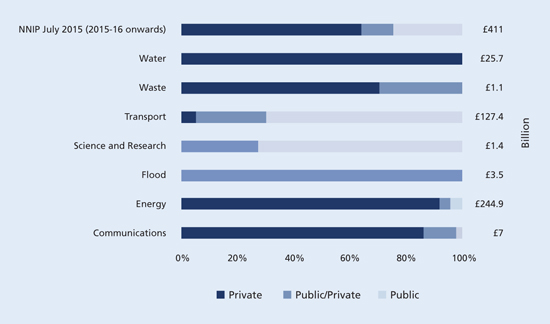

Definitely not! And what’s more, the UK economy needs it. Figure 3 below shows the national infrastructure pipeline as at July 2015.

Figure 3: National infrastructure pipeline at July 2015

Source: HM Treasury

The annual spending figures outlined in the pipeline are expected to average around £48 billion pa. over the next five years, with £264 billion (64%) of the overall pipeline expected to be funded solely by the private sector. The private sector is expected to deploy the majority of capital in energy (renewable and conventional energy generation as well as transmission and distribution) and water and wastewater projects.

A House of Lords report published in February 2015 states: “Around a fifth of the generation capacity which was available in 2011 is expected to close by 2020. The Government estimates that £110 billion of investment in new power stations and grid infrastructure is needed to replace this lost capacity.”

What is clear is that an enormous amount of investment is required in UK infrastructure in the years to come.

Should the LGPS be investing in infrastructure?

Definitely yes! Infrastructure assets are a strong match to liabilities. They offer:

- Relatively predictable long-term returns with stable cashflows

- Low [price] volatility compared to equities and listed property

- Access to an illiquidity premium

- An inflation linkage (where underlying revenues are inflation linked)

- Diversification from traditional asset classes and market risks

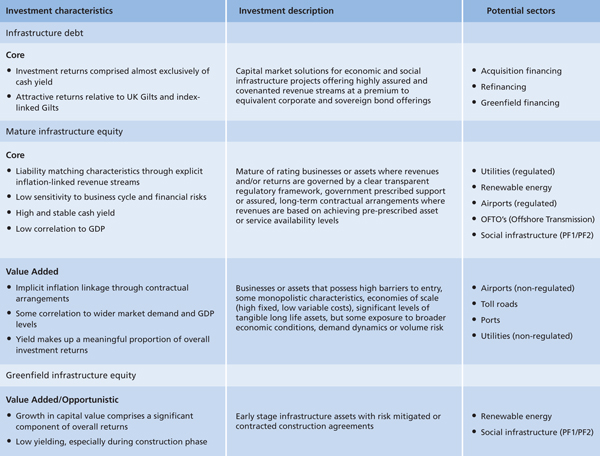

But, it does need to be the type of infrastructure that provides the above benefits, and not all infrastructure does. Figure 4 highlights the characteristics of different types of infrastructure investment.

Figure 4: Characteristics of the different types of infrastructure investment

Source: Hermes Investment Management

What should be the strategic allocation?

Overseas, there are many schemes that have exposures of 10% to 20% because they feel the attributes of infrastructure meet well with their long term goals. Whilst the level of exposure will vary from local fund to local fund because of individual considerations around which existing assets to sell and their specific liability profile, from the modelling we have carried out based on our return and risk forecasts, a 10% exposure is certainly viable. If this exposure was implemented across the entire 89 English and Welsh funds, a further £20 billion could be available to the UK infrastructure market.

What investment structure best suits the LGPS?

There are three main ways in which to access infrastructure investment.

The first of these is to access specialist infrastructure managers and to build diversified infrastructure portfolios in a manager-pooled vehicle. It is no surprise that this remains the most popular approach for UK investors.

The second pathway some large investors in the UK have opted for is to run segregated accounts with fund managers, often alongside fund allocations, which can offer the investor some discretion over the opportunities in the portfolio in terms of both strategy and liquidity. At the same time there can be some cost advantages when using segregated accounts rather than pooled funds, from which large investors can benefit.

The third main way that other large investors in the UK have adopted is by committing capital to selective co-investment opportunities, although most UK investors lack the scale and specialist knowledge required to invest directly in infrastructure projects – however attractive they may be. Uncovering the best opportunities requires trust, networks and experience. It is also the case that managing the due diligence requirements for large infrastructure projects is particularly challenging without specialist knowledge. Also, there are significant fixed costs associated with setting up internal teams with the skills in both investment and asset management and the comprehensive governance structures required to compete effectively in the global infrastructure market.

Therefore our conclusion is that it will be most advantageous for LGPS infrastructure to be invested alongside the major infrastructure managers with pooled investment funds as this will bring expertise in project evaluation and diversification across a wide range of different infrastructure projects and revenue streams, which the LGPS currently could not achieve on its own. It has already been seen that asset managers understand the cost pressures of the LGPS and many have already reduced fees for LGPS clients by up to 15%. We believe that further fee reductions can be achieved.

What else needs to be done?

In all of the above comments, we have focused on mature (already developed) infrastructure projects. The net could be widened to more development projects if there were some type of revenue guarantee or stop-loss for construction risks. This would provide two advantages. Firstly it would take away some of the fears of investing in greenfield opportunities, and secondly it would allow greater involvement in higher returning areas without significantly increasing risk.

A second important development is in the creation of an internal LGPS secondaries market (perhaps a “Clearing House” type approach). This would not only help liquidity a little more and reduce costs, but would also enable new opportunities to be assessed jointly.

Summary

Investment by LGPS funds into infrastructure makes sense, and the 49 funds who currently do not have an allocation to this area should make it a priority when they review their investment strategy following the March 2016 valuation.

Allocations should be targeting 10% of assets, and funds should look to work with colleagues across the UK to find and assess opportunities. In developing their plans in response to the Guidance and Criteria published in November 2015, funds must think long and hard about how they are going to invest in this area.

If all this can be achieved correctly, then both funds and UK infrastructure (and the country we live and work in) will benefit.

More Related Content...

|

|

|