Bypassing the middle man – opportunities in direct lending

|

Written By: Tom Sargeant |

Tom Sargeant of Sankaty Advisors outlines the attractions of private debt for pension funds and the illiquidity premium that can be captured through direct lending to middle market companies

Large corporates across developed markets have steadily regained their access to public markets for equity or debt financing since the depths of the financial crisis. Current relatively low yields on investment-grade fixed income are indicative of the ease with which so many large businesses and also governments are securing financing. For smaller firms such as those that constitute the “core” middle market and at the lowest end, the SME sector, capital is not as readily available because traditional lenders either never returned to the market after the crisis or have retreated once again. Alternative lenders attracted by the higher yields and greater control have stepped in to fill this void. While the access to capital and the cost of capital for medium-sized companies varies to some extent across regions, the generalisation between the different sized corporate groups does hold. This discrepancy in capital availability is a consequence of the health of the local banks and the fact that medium-sized companies across the UK and Europe remain heavily reliant on the banking channel for financing. Historically, alternative asset managers have lent to these businesses alongside traditional bank lending, but as bank lending has receded, the alternative lending channel is growing in size and importance. Increasingly, institutional investors such as pension funds have been attracted to the features offered by loans to middle market companies relative to large corporates. Pension funds access this asset class via alternative lenders who typically build a diversified portfolio of loans across an array of different corporate sectors.

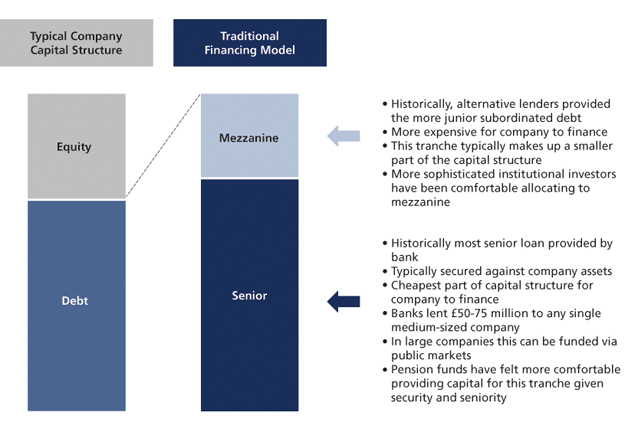

Alternative lenders to the middle market sector are able to negotiate specific loan terms that reflect the relative illiquidity of the loan and safeguard the lender against default or increase the chances of recouping a larger part of the outstanding loan amount, i.e. recovery value. Loans are typically floating rate in nature, and compensate the lender by offering a spread or a margin over the comparable larger liquid tradable loan. The contractual and binding loan agreement provides some certainty of income relative to potentially volatile public markets. Alternative lenders continue to replace banks with loans that can be structured with collateral in the form of the borrower company’s assets. This makes these loans senior in the borrowing company’s capital structure (hence reducing the probability of default occurring). Secondly, the security achieved through the use of collateral increases the recovery value should the loan default, in which case, the possibility of loss is vastly reduced.

Figure 1: Financing options for companies

Source: Sankaty

The nature of these loans as contractually-binding agreements implies that the assumption of strong positive economic growth is not necessary to generate a good return on investment. Successful investments are predicated on identifying good companies across different geographies and sectors and then structuring robust loan documentation. Loan documents focus on capital preservation, and maximising income through loan repayments that should be suitable to the borrowing company’s ability to repay. Unlike private equity where the performance of a 10-12 year fund is very much dependent on a successful “exit”, a direct lending fund has a shorter life and offers a more predictable outcome. Pension funds looking into this asset class should consider alternative asset managers who have proven their ability to find good businesses and structure solid documentation across different market cycles.

Defining the middle market

The middle market can be viewed as having three distinct segments, defined by a company’s ownership type, prospects, and access to capital. Companies with EBITDA¹ below about £7-10 million (lower middle market) are typically family or entrepreneur owned, and individual customer wins and losses greatly impact performance and they can be volatile as a result. At the other extreme, upper middle market companies and larger, usually have at least £75 million of EBITDA and can be publicly held. These companies, given their size, usually ebb and flow with their respective industries and have numerous options for accessing the capital markets.

Typically the core middle market includes companies between this range of £7-75 million EBITDA. These include well-established businesses and also high-street names. Importantly these are professionally-run businesses that may have been around for a few generations and are stable.

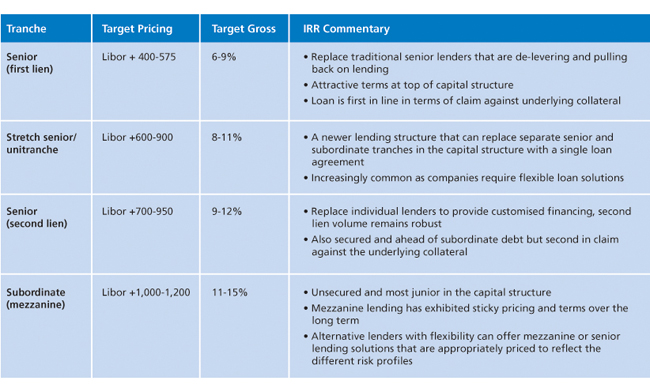

Figure 2: Loan terms and pricing

Source: Sankaty

Replacing bank lending

In Europe, 85% of debt finance for medium-sized companies has come from banks, compared to 25% of corporate lending in the US.² These traditional lenders are increasingly constrained by the regulatory environment on both sides of the Atlantic. Basel III capital requirements make middle market lending uneconomical for UK and European banks, which is resulting in banks writing smaller cheques to fewer companies. Even in the US, rhetoric from the Federal Reserve has largely driven banks out of middle market direct lending thus far in 2014. This has meant alternative lenders that have historically provided a smaller part of the financing for companies via the mezzanine part of the capital structure, are now providing loans for the much larger segment that is senior loans along with the mezzanine, or via a combination of two known as a unitranche.

Why are pension funds getting involved?

The attractiveness of lending for pension funds begins with the returns this asset class can generate and their key characteristics. Loans are typically floating rate and derive their returns from a combination of spread over LIBOR/EURIBOR and original issue discount. Their floating rate nature is desirable with the expected rise in interest rates, and today the most senior, safe loan can offer a premium of over 400 basis points above LIBOR. For more subordinate loans this premium can be closer to 10%.

More control…

As a small group, alternative lenders can control the tranche, force action, and make decisions to control the outcome of the investment. With more investors, as is the case in investment-grade and traded securities, because no one party can control the group, decisions often take longer and erode value.

Second, in our experience, lenders typically have a more active role in monitoring investments than high yield or investment grade investors. They have greater information rights than investors in large deals. Further, tighter covenants imply lenders can control decisions early in a downside scenario. By taking action early, they are able to preserve value and improve recovery rates.

…means better protection…

The result of strict covenants is that the agreement can be breached even if there is no default and the loan is repaid on schedule. This means that recovery rates are the critical statistic for investors to consider when evaluating alternative asset managers. Taking this one step further the annual default rate multiplied by 100 minus the recovery rate provides the credit loss ratio that indicates the annual loss in value that could not be recouped in recovery after default.

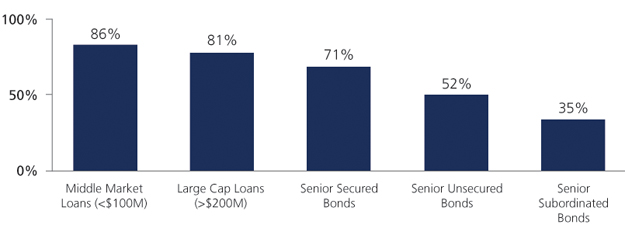

Below is a comparison of recovery rates across loan classes from the S&P LSTA (Figure 3), which demonstrates variation across capital structure and across market capitalisation. Of note, we find it compelling that the average recovery rate for senior direct lending is significantly higher than the 35% recovery rate for broadly-syndicated, liquid high yield bonds.

Figure 3: Recovery rate by loan class

Source: Source: S&P/LSTA. Ultimate recovery rates for the period 1989 – 2009

…that can deliver attractive risk-adjusted returns

Altogether, accounting for potential credit loss on a portfolio of middle market loans, a pension fund can seek to generate 6-8% net returns using a relatively safer risk profile. Investors who are comfortable with accepting more subordinate loans in their portfolio can expect to get compensated for the higher risk with higher yields, and a riskier portfolio of this profile could potentially deliver 11-12% net. Given the structure of the loans that include ongoing repayments, investors can typically expect 6-7% annually as cash yield. This is an appealing feature that provides liquidity in an otherwise illiquid asset class.

Importance of manager selection

Alternative asset managers involved in lending to the middle market have a broad range of skills. It begins with evaluating sectors and businesses to identify suitable borrowers. The sourcing for this includes a number of different channels such as industry-specific conferences, advisers to the company, private equity managers who may be acting as sponsors for the business, and various other intermediaries including banks. Documentation of the loan requires a very different skill set that must acknowledge the different scenarios that could emerge over the lifetime of the loan (typically six or seven years). The lender and borrower should agree in advance on how to deal with different situations, and the lender should have appropriate provisions to monitor the borrower and recoup value of the loan in case of default. Lastly, driving high recoveries is a critical driver of outperformance and so successful alternative managers are often able to achieve a higher recovery rate because of the turnaround work of in-house portfolio groups with deep operational expertise. These teams can quickly enter a situation to drive operational changes that improve business performance and returns. Borrowed from the private equity model, the inclusion of operation professionals in the deal process also allows alternative lenders to invest more wisely and improve the outcome of investments.

Conclusion

The advantages of direct lending to middle market companies are evidenced by the volume of assets from pension funds allocated towards this asset class. While sophisticated institutional investors have historically allocated to direct lending, this has been taken up more broadly given the increasing involvement of alternative lenders in the senior lending channel to replace banks. The relative safety of senior lending has been more palatable for investors, along with the relative attractiveness of the risk-adjusted returns. Typically an alternative lender packages 20-30 loans in a portfolio that could be a pooled fund offering, or separate account for pension funds. This offers broad diversification across a number of different sectors and, while the fund will typically have a closed-end structure, the annual cash yield offers healthy liquidity and repayment of capital. The stability of the market is proven through decades of alternative lending. We might be now witnessing a transition towards less involvement from banks but even without this trend accelerating, direct lending to middle-market corporates would be an attractive option for pension funds to consider as part of an income generation or equity replacement strategy.

1. A company’s earnings before interest, taxes, depreciation, and amortisation is an accounting measure calculated using a company’s net earnings, before interest expenses, taxes, depreciation and amortisation are subtracted, as a proxy for a company’s current operating profitability, i.e., how much profit it makes with its present assets and its operations on the products it produces and sells, as well as providing a proxy for cash flow.

2. Credit Suisse, ECB, Federal Reserve, data as of November 30, 2011.

More Related Content...

|

|

|