Cashflow-driven investing: a new approach for reliable, predictable income

Published: December 1, 2016

Written By:

|

John Dewey |

In the current environment for liability hedging, maturing defined benefit pension schemes should look at alternative strategies, including cashflow-driven investing, says Aviva Investors’ John Dewey

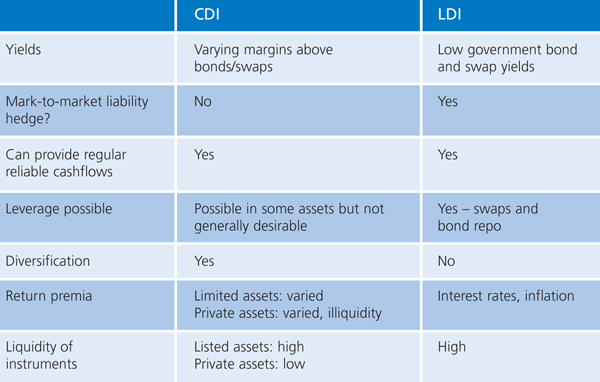

While liability-driven investment (LDI) and growth approaches will remain a key part of the toolkit for defined benefit pension schemes, there is a strong case to be made for incorporating cashflow driven investing (CDI) into their strategies. CDI can deliver the predictable returns of LDI strategies but at higher yields, while diversifying portfolios and drawing on a wide range of return premia.

Traditionally, market returns from assets such as equities, property or diversified multi-asset portfolios have been called on to do the heavy lifting of generating the long-term returns to overcome deficits. But the challenging outlook for these asset classes raises questions over their ability to continue to fulfil this role. Furthermore, experience has demonstrated that a simplistic diversification approach of investing across listed markets can fail to deliver protection when it is most needed – when volatility is high, asset prices are falling and correlations rise.

Even if growth assets might conceivably deliver the returns targeted in the long term, mature pension schemes are juggling the challenging combination of rising cashflow needs and persistent underfunding. This has placed greater emphasis on the risk of path dependency: the possibility that several years of poor returns may deplete a scheme’s assets to the extent that meeting long-term funding targets is unviable; putting pressure on corporate sponsors.

For cashflow negative schemes, successful investing in growth assets also relies on the order in which returns arise. Good returns followed by bad returns allows a scheme to build its funding level, pay benefits and weather difficult subsequent market conditions. Conversely, poor returns in the near term could put the scheme in a more vulnerable position later on.

Kicking the usual bucket approach

The conventional investment approach sees pension assets split broadly into two categories: growth assets, invested to generate strong returns in a diversified pool, and matching assets, used to hedge a scheme’s liabilities in line with movements in interest rates and inflation. But the return outlook for both matching assets and growth assets has been in long-term decline, while deficits remain stubbornly persistent.

Pension schemes should therefore consider a change in investment strategy to exploit assets that may not fit naturally into either growth or matching buckets but will provide reliable income at an attractive premium above bonds and swaps.

Income-producing diversified growth

A multi-asset investment portfolio of listed assets carefully tailored to pay out a regular income is one way of meeting the cashflow demands faced by maturing pension schemes. This can be achieved by investing in a wide range of listed asset markets, with a robust strategy to deliver regular, reliable cashflows and protect capital. The success of this approach depends on the skill of the investment manager.

Customised credit

A credit portfolio can be constructed to meet the cashflow needs of an investor’s liabilities and held to maturity. This provides investors with optimal credit exposure and interest rate, inflation and cashflow exposure tailored to a pension scheme’s liability profile.

Private assets

Private assets with clearly defined and transparent cashflow characteristics are particularly relevant in this environment, providing higher yields through illiquidity premia and diversified return premia. They include infrastructure debt, real estate debt, private corporate credit and some types of financing transactions that banks are keen to offload from their balance sheets.

The optimal assets have bond-like characteristics, but offer better yields and a more reliable means of meeting cashflow requirements with less risk. Infrastructure is particularly attractive, since it can offer highly regulated and secure returns that can reliably deliver annual income of over 7%.

The middle ground

An investment strategy focused on such assets, generally termed CDI, doesn’t mean replacing growth assets altogether, particularly because it doesn’t provide a perfect match for liabilities when interest rates and inflation change. But it offers an attractive middle ground that can be balanced against traditional approaches, depending on the situation and requirements of each pension scheme.

Pension schemes should clearly understand their time horizon, objectives and cashflow requirements over the coming years to determine the appropriate balance between growth, LDI and CDI. Unlike LDI assets, which offer an effective mark-to-market hedge of a scheme’s liabilities, CDI assets are driven by a wide range of factors, including supply and demand for individual private assets. This offers opportunities to provide cashflows, diversify portfolios to make them more resilient and enhance returns.

If a scheme has a medium- to long-term time horizon, and a tolerance for less liquid assets, private assets merit exploration. Conversely, if a scheme is well funded and targeting a buy-in or buyout in the short to medium term, it will typically need a robust mark-to-market hedge and the balance should remain towards LDI.

The next natural step

Cashflow negativity is becoming more prevalent in pension schemes. According to Mercer¹, 42% of plans surveyed are currently cashflow negative and, of those that are not, nearly 80% are expected to become so over the next decade.

This dynamic highlights why pension schemes should put cashflow requirements at the heart of their asset and liability management strategy. Once a scheme truly understands how its cashflow commitments will change and has determined what allocation it can make to less liquid private assets, it can test those holdings in multiple scenarios and stresses to fully understand how the portfolio will perform in any conceivable environment.

An evolution to CDI represents a natural step for a large number of maturing pension schemes and should lead to a more effective investment strategy in the challenging years ahead.

Important Information

This document is for professional clients and advisers only. Not to be viewed by or used with retail clients. Except where stated as otherwise, the source of all information is Aviva Investors Global Services Limited (“Aviva Investors”) as at 20 December 2016. Unless stated otherwise any views, opinions expressed are those of Aviva Investors. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature. The value of an investment and any income from it may go down as well as up and the investor may not get back the original amount invested. Issued By Aviva Investors Global Services Limited, registered in England No. 1151805. Registered Office: St Helen’s, 1 Undershaft, London EC3P 3DQ. Authorised and regulated by the Financial Conduct Authority.

1. European Asset Allocation Survey 2016, a survey of nearly 1,100 institutional investors across 14 countries, reflecting total assets of around €930 billion.

More Related Content...

|

|

|