Cashflow driven investing: does it make sense for UK LGPS?

Published: August 1, 2019

Written By:

|

Soraya Kazziha |

|

Michael Burns |

As UK local government pension schemes (LGPS) mature and approach full funding, Soraya Kazziha and Michael Burns of PIMCO discuss why trustees may want to consider cashflow driven investment (CDI) solutions as part of their future strategy

Cashflow Driven Investment (CDI) has recently become one of the most discussed topics in the UK pension industry. A popular and well established form of fixed income investing in the insurance sector, could CDI also be appropriate for local government pension schemes (LGPS) in the UK, which do not have the same regulatory capital constraints? We think that there are three main factors to consider:

First, the sector is still generally underfunded, gradually maturing and turning increasingly cashflow negative (i.e. pension payments exceed contributions and income). This trend will only accelerate over the next 10-15 years, which will likely create a drag on asset portfolio returns and an implicit liquidity need.

Secondly, and because of their underfunded position, many schemes have been invested on a growth plus liability-driven investment (LDI) basis, which increases the scheme’s vulnerability to market downturns and forced-selling if they are cashflow negative.

Finally, in the event of a rising rate environment, the impact on levered LDI portfolios could potentially increase liquidity needs due to higher collateral requirements.

The conditions listed above are clear risks to underfunded and cashflow negative schemes – but are they sufficiently significant to justify a switch to CDI?

The effect of cashflow negativity

A reduction of the asset base diminishes the overall compounding effect of a pension plan. This lengthens the time that the scheme needs to achieve full funding.

Let’s use an example: imagine two hypothetical pension schemes, both 90% funded, and both with identical expected excess returns of 1.1%. The differences are:

Scheme 1: is cashflow neutral over the next 10 years.

Scheme 2: is cashflow negative to the tune of 4-5% per annum over the same period. This means that net outflows are approximately 4-5% of the asset value.

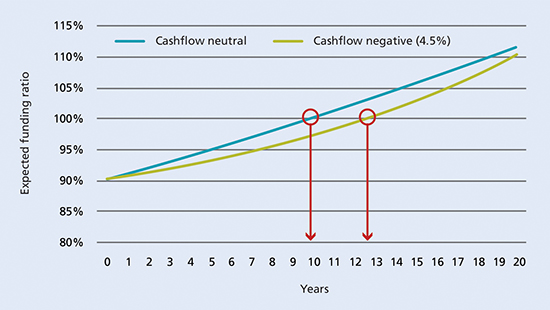

Once we run the numbers, and as we see in Figure 1, we find that the cashflow neutral fund is expected to reach full funding by year 10, a timeframe that extends to 13 years for the cashflow negative scheme. This happens because the cashflow negative scheme loses compounding power as the asset base is reduced in order to pay for liabilities. From this we infer that even without other impediments to achieving full funding, the cashflow need alone is significant to impair that timeframe.

Figure 1: Cashflow negative schemes need more years to reach full funding

Source: PIMCO

Vulnerability to a market downturn

Applied to our example, let’s assume that each of our two schemes allocates a typical 40% to Equities and 60% to Liability Driven Investments (LDI). Imagine that equity markets drawdown by 25% in the first year, but they recover over the remaining nine years, so that the total return of the portfolio over the 10 years equals the expected return at the outset.

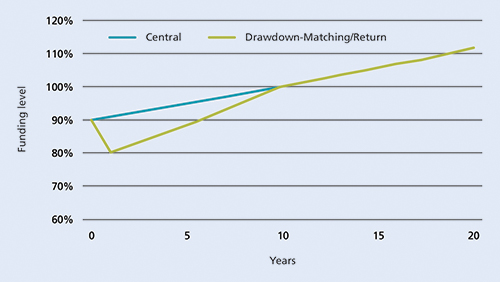

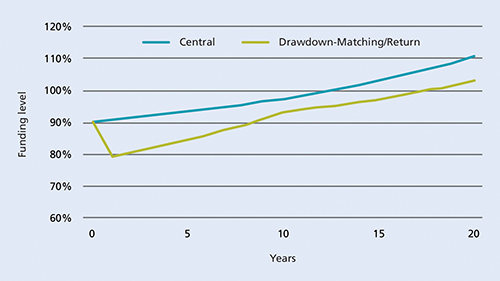

As seen on Figure 2, we find that the cashflow neutral scheme recovers full funding in year 10, as it happened in our previous baseline scenario. However, the cashflow negative fund, see Figure 3, reaches full funding by year 18, five years later than under the neutral market, and eight years later than the cashflow neutral scheme. This extra time needed to reach full funding comes as the market drop depletes the fund’s asset base even more, further reducing the compounding effect. For a cashflow neutral scheme only the cumulative returns matter. However, for a cashflow negative scheme, the sequence of returns over time matters. This illustrates the risk for cashflow negative schemes to fund liability cashflows from asset disinvestment, i.e., path dependency.

Figure 2: Funding level projection on a cashflow neutral scheme

Source: PIMCO

Figure 3: Funding level projection on a cashflow negative scheme

Source: PIMCO

What can be done?

1. Capital efficient solutions

Combining existing beta exposures such as equity futures collateralised by a core bond portfolio could help free up liquidity. However, this may not be appropriate for those schemes with an already levered LDI portfolio as it would add further leverage.

2. Equity-defensive strategies

These strategies typically cover trend-following, tail-risk hedging via explicit option buying and alternative risk premia diversifiers, which when combined can help mitigate equity risk while delivering higher positive expected returns.

3. Cashflow driven investing

Anchor the portfolio around income generating/self-liquidating assets that can meet a certain portion of liability payouts with a high degree of certainty. While the mix of assets that could meet that approach includes equity dividends, infrastructure, long-term lease property and other illiquid fixed income assets, we believe the core of most CDI portfolios will be allocated to high quality investment grade credit. However, CDI is only a means to an end, and should not be employed at the expense of achieving required growth to close a funding gap.

Important Information

For professional investor use only.

PIMCO Europe Ltd (Company No. 2604517) and PIMCO Europe Ltd – Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (12 Endeavour Square, London E20 1JN) in the UK.

This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2019, PIMCO.

More Related Content...

|

|

|