Do equities still have any part to play for pension funds?

|

Written By: Ian Lance |

Over recent times, UK pension funds have gradually been reducing their allocations to equities. In light of this shift in attitude, Ian Lance of RWC looks at the prospects for equity investors and examines the opportunities that can arise when taking a more long-term view of both investment strategy and performance measurement

As an asset class, equities were not favoured by pension schemes until the second half of the century. In 1952, US private sector pension funds held just 17% of their assets in equities compared to 67% in fixed interest. The early fifties marked the start of what has been dubbed “the cult of the equity” in which equity yields moved below that of bonds, and the asset class began to find favour with pension funds. Over the next 50 years, the weightings of US schemes reversed such that by 2006, the same funds held 69% in equities and 18% in fixed interest. UK pension funds were even more enthusiastic, as by the late nineties they had 76% in equities compared with 12% in bonds.¹ Although this conversion to the “cult of the equity” has been attributed to the end of the war, economic prosperity and Markowitz portfolio theory, it was undoubtedly helped by simple extrapolation of returns.

Equities to a large extent became a victim of their own success as valuations were bid up to levels in the late nineties where future returns were almost guaranteed to disappoint, and the volatility that followed in 2000 and 2008 saw many funds desert the asset class. In contrast, bonds gained favour in a world where many think low growth or deflation is more likely than inflation. In addition, the structural arguments for this new “cult of the bond” are that maturing populations favour bonds over equities and that defined contribution investors (who take the investment risk themselves) are much less likely to tolerate volatility of equities than defined benefit investors (where the firm takes the risk). Mark-to-market accountancy standards, and the move by pension funds and insurance companies to align assets more closely with liabilities (accelerated by LDI strategies for DB schemes, the new IAS 19 Employee Benefits standard, changes to the PPF levy and the impending application of Solvency II for insurance companies) has also led to lower acceptance of equity volatility. The large scale flight from equities has been forced on some institutional investors such as insurance companies and pension funds who have been regulated out of the asset class and become forced buyers of both government and corporate bonds, whilst for others there is undoubtedly an element of return-chasing behaviour. At the end of 2012, UK pension funds held only 35% in equities, with less than 10% in domestic equities.²

We suspect, however, that there is more to it than this. Companies themselves are also deserting the equity market in droves; according to The Economist, the number of companies on London’s main market has fallen by a half over the past decade. Equity market volumes have also collapsed. We believe that this is the cumulative impact of several forces that have caused a loss of trust by investors in markets which many now consider to be rigged.

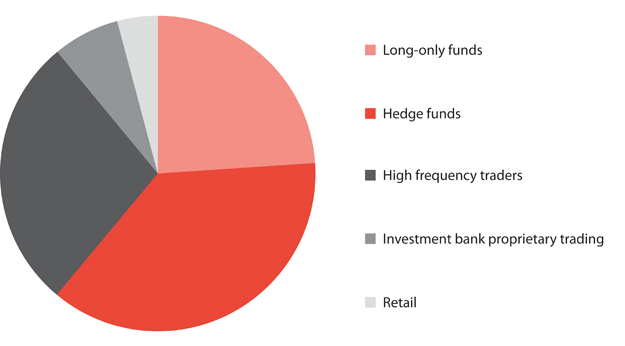

Figure 1: Percentage of UK average daily share turnover, by beneficial owner type

Source: TABB Group (from the Kay Review). Note: Population covered consists of all UK markets including LSE, Chi, Turquoise etc.

Markets are now dominated by investors who have no interest in a company’s fundamentals whatsoever, but are engaged in a game of guessing where share prices are going next. Figure 1 shows that hedge funds, high frequency traders and proprietary traders now account for 72% of market turnover even though they are a much smaller percentage of shareholding.

More than ever, it is relevant to think about the market being separated into “traders” and “speculators” who are merely trying to anticipate near-term price moves, and “investors” who engage in an assessment of corporate worth, buy assets for less than their intrinsic value and patiently wait for that value to be realised.

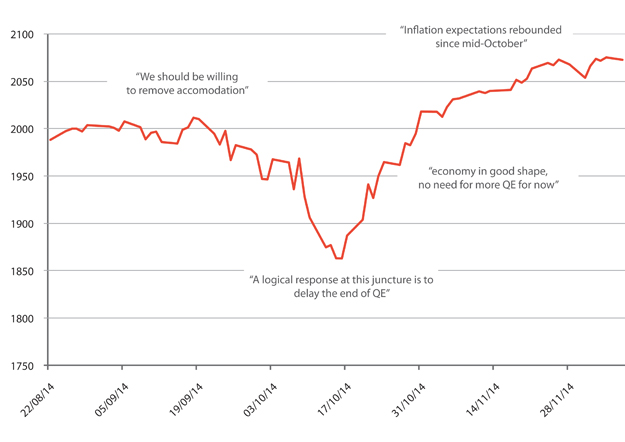

Figure 2: S&P 500 Index

Source: Zerohedge, Bloomberg, 22 August 2014 – 8 December 2014

In today’s markets, the Keynesian beauty contest is epitomised by high frequency traders and hedge funds who seem to believe that the central tenet of investing is not just to guess what Mario Draghi and Janet Yellen will do next, but also how other investors will react, and then to deal in advance. The week this note was written provided a perfect example of how markets now hang on every word of the central banks. On the 4th of December, the ECB hinted they would not engage in full blown quantitative easing (“QE”) leading to a sell-off in Eurozone equities largely led by periphery banks. The following day, post a variety of briefings “suggesting” that actually QE was indeed on the cards, the ECB QE trade was back on; cue a rally in Eurozone equities driven by periphery financials. Even on a short-term basis, central bankers and their close allies seem to have become unwilling to accept any volatility in asset markets as the bewildering behaviour of Federal Reserve member Jim Bullard in October demonstrates.

“It is not a case of choosing those which, to the best of one’s judgement are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practise the fourth, fifth and higher degree.”³

John Maynard Keynes

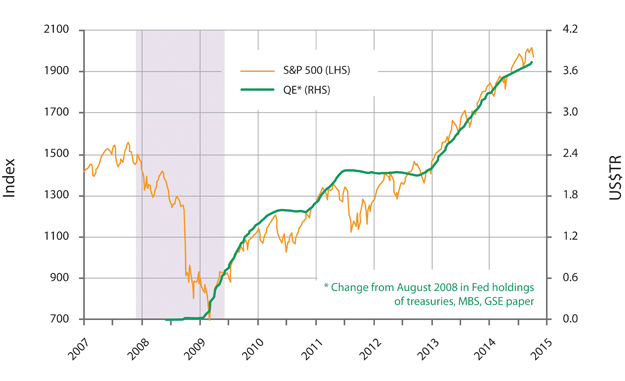

Whilst many of us regard these fast money participants as parasites, in many ways their behaviour was a rational response to the policy of central bankers who have decided to use financial markets as the transmission mechanism of monetary policy in the misguided belief that inflating asset bubbles creates economic prosperity (which they do, but only for about 1% of the population). Hence over the last few years, markets have moved in lockstep with monetary policy (Figure 3).

Figure 3: QE and US equities

Source: Minack Advisors, 1 January 2007 – 30 September 2014

Amidst all this noise, it would be easy to give up on equities altogether, and two years ago the government commissioned Professor John Kay to investigate the issues that many felt were interfering with the efficient working of the UK equity market. The Kay Review4⁴ started by reminding us that the equity market has two main functions; the first is to allow savers to participate in economic growth of the country by linking their savings to business profits. The second is to encourage efficient allocation of capital. These basic tenets appear to have been lost as equity markets became places for speculators and computers to exchange electronic ownership certificates back and forth millions of times a day. The core themes of the Kay Review are “erosion of trust” and the “misalignment of incentives” which have caused so many to abandon equities. In the long run, it recognises that this will be bad for companies if raising equity financing becomes prohibitively expensive, and it is also potentially bad for savers. The 17 Kay Review recommendations are all aimed at getting asset owners, asset managers and companies to think and act longer-term, and to improve active engagement between them.

Does this all mean that equities should play no part in an investor’s portfolio of assets? Of course not, and in actual fact, some of the trends mentioned above are helpful for the genuinely long-term active investor. To the extent that market prices are derived by speculators with no interest in the underlying company’s fundamental worth, then quoted prices should diverge from intrinsic value more frequently and by a wider margin. For investors who value investments based on their prospective streams of cash flows, that is good news.

Paul Woolley, who is one of the founders of GMO and now a Senior Fellow at the London School of Economics, has a special interest in this area having funded the Paul Woolley Centre for the Study of Capital Market Dysfunctionality. He stated in a 2012 Financial Times article; “The patient investor, by contrast, has the choice of holding on to stocks where the fundamentals have not changed but the market price disappoints. This makes cash flow investing best placed to win in the medium and long run.”⁵

Woolley goes on to recommend how investors must adapt in order to benefit from these new markets; firstly, turnover should be drastically lowered i.e. as other investors become very short-term, you must become very long-term. Secondly, you replace market cap weighted benchmarks with more stable ones. Thirdly, asset owners should lengthen performance evaluation timescales and pay performance fees based on them. He concludes: “A fund adopting these strategies will gain a private advantage in the form of higher medium- and long-run returns. As more funds follow suit, equity markets will become more stable, encouraging investment. If the market signals improve, there is a better chance of capital being allocated productively. This is a rare case of the private and public interests being in complete alignment.”

To this I would add my own recommendation: pension funds should start to push back hard against the use of mark-to-market regulation, as the distortions flowing through many markets mean that daily prices are rarely a good guide to fair value. By abandoning this short-term imperative, funds would be able to invest with a time frame more closely matched to that of their liabilities.

1. “Is the Equity Cult Dying (again)?” Robert Buckland, Citigroup, 27 May 2012

2. UBS Pension Fund Indicators 2012. Figures quoted based on funded private and public sector self-administered occupational pensions including LGPS

3. “The General Theory of Employment, Interest and Money”, John Maynard Keynes, 1936

4. http://www.bis.gov.uk/assets/biscore/businesslaw/docs/k/12-917-kay-review-of-equity-markets-final-report

5. “Investors must rediscover their patience”, Paul Woolley, Financial Times, 15 August 2012

More Related Content...

|

|

|