Finding resilience in mid-market infrastructure investments

|

Written By: Guillaume D’Engremont |

|

Jerome Sousselier |

Guillaume D’Engremont and Jerome Sousselier of ICG discuss the focus required when selecting infrastructure investments, structuring them sensitively and understanding the benefits of an ESG framework in order to achieve stable and sustainable returns

The economic consequences of the Covid-19 pandemic thus far have been significant and are set to negatively affect near-term GDP growth on a global scale. What is clear, however, is that while certain sectors have been disproportionately affected e.g. leisure, travel, there are constituents of other parts of the market that have found themselves either largely unscathed or indeed in a position to capitalise on unexpected new dynamics. The fiscal response has been substantial as governments have attempted to mitigate the collapse in private demand. European leaders have agreed an unprecedented EU Recovery Fund package of €750 billion and interest rates are expected to remain at near-record lows for an extended period.

The above measures will unquestionably impact state funding for infrastructure projects given the pressure on public budgets, and this will exacerbate an already significant investment gap which, pre-Covid, had been expected to reach €1.6 trillion by 2040¹.

Against this backdrop of economic fragility and volatility, in order to find investments that exhibit the necessary resilience to generate the stable, double-digit returns that the infrastructure sector is capable of delivering, it is instructive to focus on the following:

- The selection of an asset

- The financial structure of an investment

- The creation of value in an asset, with particular focus on ESG

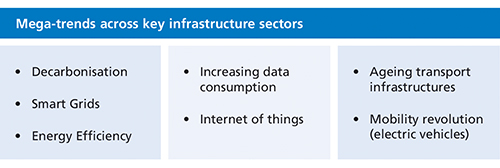

On the first point – the selection of an asset – there is a core set of mega-trends within the energy, digital and mobility sectors that merit scrutiny. The changes being wrought by these key new trends in certain parts of the market are such that infrastructure renewal is almost an imperative and this in turn yields some attractive opportunities.

For the second point – the financial structure of an investment – being able to utilise instruments beyond pure equity in a transaction can confer a significant advantage. By deploying either preferred equity or mezzanine instruments, investors can not only maximise downside protection by ensuring structural seniority in relation to other equity stakeholders but also have the ability to build in a cash yield component delivering liquidity in the form of contractual cash coupons. By incorporating a wider range of instruments, an investor has the ability to balance an investment so as to achieve the correct risk-return profile. Additionally, bespoke structuring like this can be deployed in such a way that it ensures minimal dilution for existing stakeholders in a business being acquired, putting a potential investor on a favourable footing.

When it comes to the final point – creating value in an asset – while the usual tenets still apply, i.e. seeking to ensure that an asset is not burdened with too much debt upon acquisition, leveraging expertise to achieve operational efficiencies and being in a position to undertake targeted, accretive capital expenditure, one of the factors most affecting value creation is, in our view, the incorporation of an ESG framework for investments.

Devising an ESG framework for investing in infrastructure assets

While the incorporation of ESG measures into an investment process is no recent phenomenon, nor is the assiduous marketing of an investment scheme’s “green” credentials, what has become apparent over the years is the need for a homogenised and universally-adopted set of definitions, standards and regulations governing sustainable investment. The publication of the EU’s Sustainable Finance Disclosure Regulation (SFDR), in force from March 2021, constitutes a significant step forward in this respect, giving asset managers a framework within which to define their approach and investors much-needed clarity based on reliable, quantifiable information.

There are myriad tools at an asset manager’s disposal that can be incorporated into a sustainable investing framework, the conclusions of which will then determine the category into which an investment or fund falls under the terms of the SFDR. Exposure to certain sectors e.g., fossil fuels can be limited or excluded entirely. Rigorous online tools will assess such issues as climate risk and corporate governance. Screening checklists can identify the ways in which the core activities of a particular business can contribute both positively and/or negatively to such universal targets as the UN Sustainable Development Goals (SDGs). Carbon footprint analysis can be undertaken at asset or portfolio-level and close engagement with management teams allows for the development of relevant key performance indicators, allowing progress to be monitored through the lifetime of an investment.

Increasing correlation between accounting for ESG and enhancing performance

Where an investment is concerned, a focus on sustainability as described above leads to value creation by way of improving working conditions and attracting talent, driving product and service innovation, enabling cost savings, ensuring preparedness for impending environmental legislation and regulation, enhancing brand reputation and reducing environmental and social risks in the supply chain.

The signing of the Paris Agreement in 2016 required significant investment into strategies that combat climate change. At the same time, global policymaking, certainly in developed countries, has been heavily focused on restructuring economies so as to both align with and drive the sustainability agenda. Keeping pace with these changes as an investor not only allows you to take advantage of opportunities being presented as a result of the major shifts being wrought in traditional industries but also allows for the mitigation of adverse environmental impact. By building an ESG framework into an investment process, the likely future impact of climate change or environmental degradation (to take but two examples) can be quantified and mitigated.

Highlighting the increasingly positive correlation between investing in accordance with ESG principles and bolstering the value of an asset, in the US equity market sell-off in the first quarter of 2020, ESG leaders in the index fell by just over half as much as the overall market and recovered strongly when the rebound came.²

The Covid-19 pandemic has demonstrated the vulnerability of our economies to the negative shock of an environmental event beyond our control and illustrates the value that some measure of preparedness might have brought. Investors and businesses that choose not to take ESG factors into account in a meaningful way inevitably invite higher risk and increased volatility.

Discipline engenders resilience

The infrastructure sector has a key role to play in adopting and fostering the rollout of new technologies that underpin the energy transition and increase the efficiency of communication, both physical and digital, and accordingly there are huge opportunities for investors not only to devote capital to businesses engaged in bringing about these changes, but also to benefit from the increasingly visible financial rewards that can materialise as a premium for having a sustainable focus. By finding companies exposed to the salient megatrends described above, by structuring investments sensitively and by understanding the benefits of investing within an ESG framework, an infrastructure portfolio exhibiting genuine resilience can be assembled. Stable, sustainable and protected returns are available if the necessary investment discipline is applied.

1. Global Infrastructure Hub, July 2018

2. Dot Investing, Dec 2020

More Related Content...

|

|

|