First steps to impact investing

|

Written By: Elena Tedesco |

Elena Tedesco of Vontobel Asset Management outlines the steps investors should consider as they formulate their approach to impact investments

Asset managers’ briefcases are bursting with so-called sustainable products, and rightly so. Judging by this equity segment’s dizzying growth rates, investors are currently lapping up all things “green”. Their enthusiasm is understandable. Who wouldn’t want to make an investment that promises not only returns, but also a clear conscience?

The growing popularity of this sub-segment has spawned a multitude of products proudly wearing the “sustainability” badge. Despite efforts to help investors understand what’s green and what’s not, notably in Europe¹, it’s sometimes hard to penetrate the jungle of sustainable concepts and terms. What exactly, for example, is the difference between microfinance and impactful investments in public markets given their ultimate common goal of achieving a beneficial effect? While the answer in this case is relatively simple – the former category is characterised by specific, often privately-funded projects, the latter aims to achieve impact via listed equities – few people have the time and resources to drill into the nitty-gritty of investment prospectuses, fund holdings and voting track records to understand all differences in detail. Asset managers need to increase transparency and improve how they communicate what they do.

Impact investing as a fine art

As a rule, impact investors look for a double dividend of financial returns alongside social and environmental benefits. Most asset managers are happy to offer a gateway to this market. Not all of them live up to the better-planet-plus-returns claim though. Critics have pointed out that some asset managers overpromise without delivering². Therefore, the fine art of impact investing is to walk the green talk, thus deflecting criticism of “greenwashing”.³

What’s the mechanism behind impact investing?

The first steps on the impact path typically take investors towards some of the United Nations’ 17 Sustainable Development Goals (SDGs). Vague as they may sound (“Sustainable cities and communities”, “Climate action”), they describe the most pressing global challenges. Contributing to accomplish some of these SDGs, hundreds of companies develop the necessary products and services, and their shares sit particularly well in an impact portfolio.

What comes next? There are guidelines designed to provide a solid foundation for impact-eager investors. Both the Global Impact Investing Network (GIIN)⁴ and the International Finance Corporation (IFC)⁵ – the World Bank’s investment arm – have established the following, largely overlapping principles:

1. Intentionality of the impact investment

The investment process starts by defining the impact objective(s) at the core of the intended positive social and environmental impacts aligned with some of the 17 UN SDGs or other widely accepted goals.

2. Aiming at financial returns

Apart from achieving the desired effect, impact investors aim for a financial return on capital that ranges from at least a market rate to a risk-adjusted market rate. This is to distinguish impact investment from philanthropy, which solely focuses on social or environmental change and not on financial returns.

3. Investments across asset classes

There are numerous opportunities across multiple types of asset classes, from private equity and private debt, to listed equities and green bonds.

4. Managing and measuring impact

Defining indicators according to the intentions, then measuring each investment’s achievement and report results.

The indirect effect of impact investing

Investing in publicly traded stocks with the ultimate goal of bringing about environmental and/or social change is an indirect approach – it lacks the immediate effect, or “additionality”, that investments in specific projects or microfinance offer. This is also the problem some investor advocacy groups have with this broader concept of impact investing. Whilst there is no simple conveyor belt between the investment and the effect, we think the results can be convincing, nonetheless.

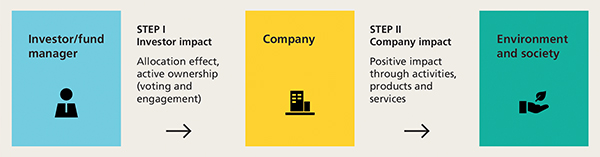

This has to do with what we call a two-step model. In a first step, an impact investor influences a listed company through engagement and the allocation of capital, which should ultimately result in lower financing costs for these companies. In a second step, companies can grow the businesses with superior impact credentials faster, scaling up the beneficial effects of their products and services on the environment and society (Figure 1).

Figure 1: Two steps between impact investors’ capital allocation and a beneficial effect

Source: Vontobel; University of Zurich, Dep. of Banking and Finance, Center for Sustainable Finance and Private Wealth (CSP), “Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact,” July 2019

Sharpen your impact objectives

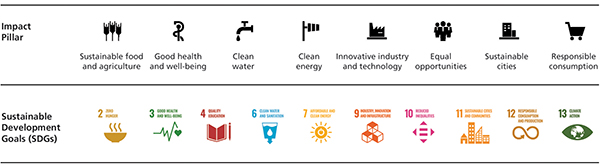

Once you are propelled onwards by a sustainable wind in your sails, you will at some stage want to set your own course. You can do this by creating your individual set of objectives, focusing on the global challenges you find most important. In our case, we decided to focus on eight “impact pillars” that address what we see as the most pressing issues humanity faces, where our investments can make a real difference. These eight pillars are resource scarcity, rising pollution, climate change, global water problems, aging population, health problems, food distribution issues, and growing inequality. These pillars then support some of the much broader UN SDGs (Figure 2).

Figure 2: Our impact objectives and their link to the UN SDGs

Source: Vontobel

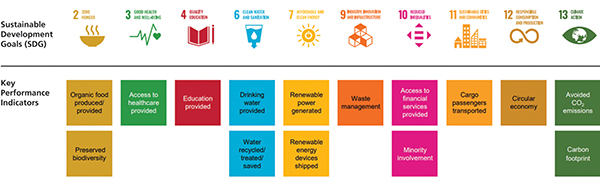

What gets measured gets done

The last step in the investment process may be the crucial one. There is no convincing anybody of the uniqueness of your approach if you have nothing to show for it. Therefore, it is important to define key performance indicators (KPIs) and track their development over time. The better your results and the more rigorous your tracking, the more credible your offering will be. The measurement should, in our view, be coherent with global criteria as defined by IRIS+, a globally recognised system with standardised impact indicators. IRIS+ is the generally accepted impact accounting system of the GIIN that leading impact investors use to measure and manage their impact. The IRIS+ framework ensures a reasonable level of consistency in impact claims and reporting. Figure 3 gives an overview of some of the KPIs we use.

Figure 3: Examples of key performance indicators

Source: Vontobel

In a world facing many sustainability challenges, we think that investors should expect strategies to deliver both measurable “green” performance as well as investment performance and that the long-term power of investing in such a strategy is superior to investing in any single “green” stock.

1. The recent EU Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants and financial advisors to be much more transparent when promoting financial products based on sustainability criteria or their pursuit of sustainable objectives. Impact-focused asset managers too, will have to provide details of policies and objectives in their investment processes, and how their products actually match their marketing claims.

2. Questions about the effectiveness of the impact approach are being raised regularly. Switzerland’s leading newspaper Neue Zürcher Zeitung, for instance, recently doubted there is any additional positive effect of a “sustainable” stock being held by asset managers with an impact focus relative to a direct holding by a retail investor. See “Greenwashing wird für Anleger zunehmen zum Ärgernis”, Neue Zürcher Zeitung, July 19, 2021.

3. Germany’s financial regulator BaFin recently addressed the problem of greenwashing. In its publication 13/2021, it specified the maximum limits on the share of sales derived from coal mining companies, for example, that are part of asset managers’ “green” portfolios.

4. The Global Impact Investing Network, a forum for impact investors, aims to facilitate the exchange of best practices among its members and highlight innovative investment approaches. GIIN also produces tools and impact investment statistics.

5. IFC, “Investing for Impact: Operating Principles for Impact Management,” 2019

More Related Content...

|

|

|