Fixed income: dissecting the absolute return space

|

Written By: Roubesh Adaya |

As we move away from an economic environment where monetary policies were the prime driver of performance, investors have found themselves in front of an array of products claiming to deliver positive performance irrespective of the investment cycle. Roubesh Adaya of bfinance examines the market for those “all weather” funds, and looks at what investors are actually getting under the wrapper

Fixed income strategies had an unusual year in 2013, as investors came to terms with the fact that bonds could no longer offer the guarantee of low volatility coupled with positive returns. In a year marked by the US Federal Reserve’s shifting rhetoric about quantitative easing, both government bonds and emerging markets (the risk asset of choice for a number of investors) came under pressure. Corporate bonds posted positive returns, although spread levels have now tightened below the average of the last 10 years, with much less room left for further spread compression. Equities though, rallied significantly, posting double digit growth in most developed economies, as investors scaled back their bond exposure in favour of stocks.

Investment managers were quick out of the blocks to promote a range of absolute return strategies, that seek to deliver positive returns irrespective of the market cycle. Whereas those were predominantly fixed income strategies in the past, we witnessed a flurry of multi-asset strategies being marketed as targeting absolute positive performance. Part of the appeal was certainly the expanded toolkit that such strategies could make use of by allocating to stocks.

Given the low volatility (we analyse here strategies with less than 8% volatility) characteristics of such products, and their reliance on managers’ skills to deliver positive performance, we compared strategies aiming to use multiple sources of “alpha” and having no historical biases to traditional asset classes. We discuss our findings in more detail within this article.

Investors should however be aware that while those products offer low volatility, and often use low volatility asset classes as their investment universe, they make use of sophisticated investment techniques, more usually associated with hedge funds than asset managers.

As we move into an environment where directional market movements become less certain, investors seeking positive returns may be inclined to increase allocations to such products. One must however note that such products rely on the skills of the manager, and careful analysis of the quality and quantity of those “alpha sources” is thus required.

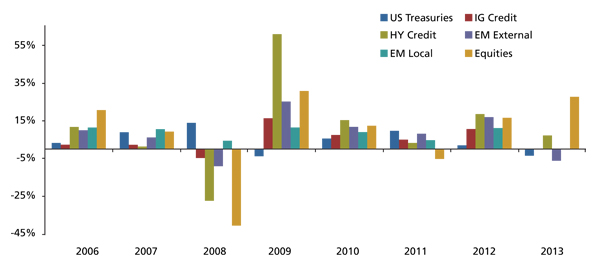

Figure 1: Asset class return dispersion 2006-2013

Source: Barclays Capital, in USD, December 2012

Mapping the absolute return universe

We used data gathered during a recent search to obtain the track record of 45 managers offering strategies that aimed to deliver positive performance, while maintaining volatility at a level below 8%. A natural bias exists within the sample to analyse funds that have performed well over the last few years. However, we believe they provide sufficient variety to be able to plot a landscape of offers for such strategies. For the purpose of this analysis, we segregated strategies that had approximately 4% volatility and below (low volatility), from those strategies that took higher risk over the course of three years (high volatility, typically between 4-8%).

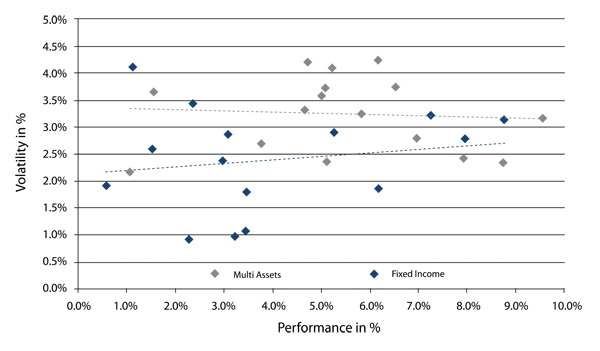

The two buckets give a good mapping of the strategies available on the market. The low volatility segment encompasses all the fixed income strategies, although a significant percentage of that universe includes multi-asset low volatility strategies. The high volatility peer group counts mostly multi-asset strategies, marketed as “all weather” solutions.

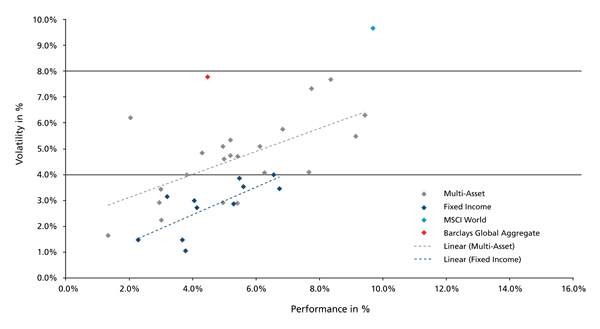

Figure 2: Mapping the absolute return universe: 3 years’ returns and volatility

Source: bfinance, September 2013. Data based on 33 managers, gross of fees in Euros.

The high volatility strategies within that search were predominantly made of asset allocation strategies that aimed to rotate across asset classes depending on market conditions. All of the strategies analysed illustrated high (>0.5) correlation to global equities over three years.

While performance was often generated via a mix of bottom-up and top-down strategies, the skill sets of those managers were predominantly in macro economic analysis and tactical positioning. Market dispersion over the last three years has offered opportunities for such managers, and it comes as no surprise that they have outperformed strategies confined to one asset class.

As opportunities become less obvious due to a lesser reliance on central banks’ accommodative monetary policies, we see renewed interest for tactical asset allocation strategies as clients look to delegate those decisions to managers able to be more incisive in re-allocating from one asset class to another.

The better managers in that space have also widened their investment universe over time; commodities, property (REITs), currencies and alternatives are now relatively common sources of added value for such strategies. Significantly, the more sophisticated managers also use derivatives for efficient implementation. Exchange traded futures are more commonly used, although some managers can make use of OTC instruments such as single-name CDS.

As investors continue their search for low volatility assets that could deliver bond-like returns, several product offerings have come to the market in the recent years. The key appeal of such low volatility strategies is that they aim to make use of managers’ skills to deliver a steady stream of “alpha” within a risk-controlled framework.

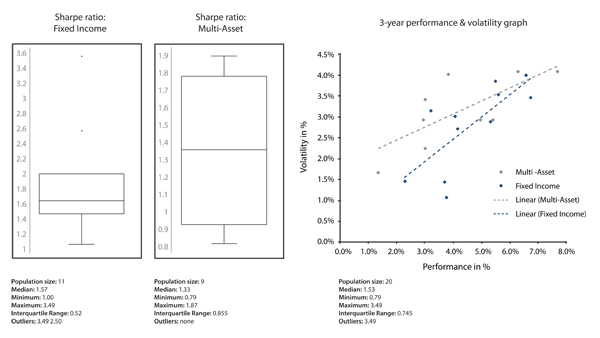

We compared managers over one and three years to establish their ability to generate alpha. In both instances, fixed income managers delivered a higher Sharpe ratio; 1.93 v 1.44 over one year and 1.57 v 1.33 over a three-year period.

This comparison takes into account the Sharpe ratio of such strategies. While multi-asset funds tend to have higher volatility due to their equity exposure, our view is that in strategies where “alpha” accounts for a greater proportion of total return, risk management becomes critical. The Sharpe ratio is thus a good metric to analyse the risk-adjusted returns of those strategies.

We believe that fixed income managers were able to provide higher risk-adjusted performance due to the following main reasons: lower volatility asset classes, a higher understanding of risk budgeting and the reliance on multiple “sources of alpha”.

The volatility of the underlying instruments within strategies affects to a large extent the volatility of the overall portfolio. Fixed income managers were historically more likely to have exposure to low volatility asset classes compared to their peers in the multi-asset space. We analyse in the following section how this changed in 2013, given the higher volatility in fixed income instruments.

Risk budgeting has historically been an important aspect of fixed income strategies. A good understanding of risk budgets, especially when allocated over a number of different strategies, has been an important facet on deciding where and when to take risk. Multi-asset managers operating in the low volatility space have placed a higher emphasis on risk budgeting than their peers operating in the higher volatility space (above 4%). Contrary to fixed income managers, multi-asset strategies tend to allocate risk budgets to fewer sources; typically across asset allocation and bottom-up selection, although some strategies are more diversified than others. Compare this to a typical fixed income manager who is likely to allocate across interest rates, currencies, corporate bonds, emerging markets and so on, and the reality is that fixed income managers benefit from more diverse sources of alpha.

Figure 3: The Sharpe ratio in low volatility absolute return strategies: comparing multi-asset to fixed income

Source: bfinance, September 2013. Data based on 20 managers, gross of fees in Euros.

Low volatility absolute return in 2013

The past year was interesting for fixed income investors as the Federal Reserve indicated the start of tapering – which markets interpreted to a large extent as the “start-of-the-end” of accommodative monetary policies. Fixed income assets performed badly across the board in May and June, and this boded particularly badly for emerging markets.

As a result, a number of fixed income strategies and trades, which exhibited low volatility in the past, fared badly. US Treasuries returned -3.4% while investment grade credit returned a mere 0.1%. Emerging market debt, the risk asset of choice for a number of fixed income managers, fared even worse. Equity markets on the other hand, performed well, with returns around the 20% mark.

On average though, fixed income managers still tended to outperform their multi-asset peers in terms of the Sharpe ratio, with a median of 1.93 for fixed income strategies versus 1.44 for multi-asset strategies.

Fixed income managers with a heavy emerging market bias fared less well in this environment, and typically delivered little return in spite of being at the higher end of the volatility spectrum. In fact, most fixed income managers who had been running a structural overweight to emerging market debt over the last few years, suffered from their exposure.

Interestingly though, some fixed income absolute return managers thrived in those economic conditions, achieving high Sharpe ratios. Upon closer analysis, they were often managers focusing on long/short and relative value strategies. We performed regression analysis across those managers, and interestingly, three of the best performers in terms of the Sharpe ratio had high statistical significance to the Hedge Fund Long/Short Corporate Bond Index.

While the median multi-asset manager delivered higher absolute returns than the median fixed income manager (5.2% versus 3.2%), the correlation of multi-asset funds was relatively high, possibly resulting from similar asset allocation decisions, and/or a reliance on equity beta to generate performance. In a year where equity markets rallied, we do not find this unusual, and the correlation of those funds is less pronounced over a three-year time period.

Low volatility fixed income products on the other hand, illustrated more dispersion both over one and three years, and ultimately provide more diversification benefits given their lesser correlation to traditional asset classes. We also found the interquartile range for absolute performance to be wider than within their multi-assets counterparts.

The complexity of those products is such that it is difficult to pin them down as an asset class. While we can broadly classify the type of strategies available to investors, each particular strategy has variations which make them unique. Over 2013, and over the last three years, fixed income strategies seem to offer higher diversification potential than their multi-asset peers.

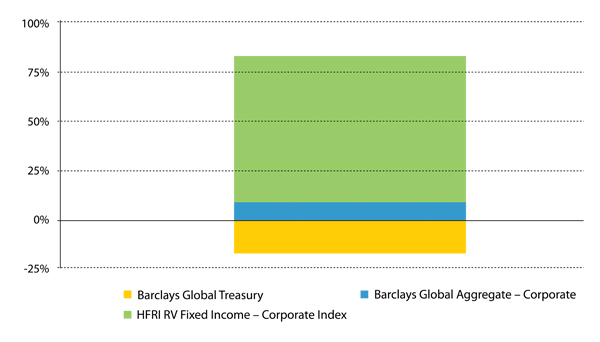

Figure 4: Regression analysis

Source: bfinance, 2013. Demonstration of the importance of the Hedge Fund Long/Short Credit Index to a fixed income absolute return fund

Figure 5: 1-year performance and volatility graph

Source: bfinance, September 2013. Data based on 31 managers, gross of fees in Euros.

Conclusion

As we move into a market environment where low beta is likely to be present across asset classes, alpha is likely to become a more substantial part of the total return of portfolios.

We note two main trends.

First, tactical asset allocation strategies are getting more traction as clients who can do so, look at outsourcing such decisions in an attempt to generate returns in a market environment unlikely to provide double-digit returns within traditional asset classes.

On the other hand, within fixed income, there is a clear inclination to reduce the reliance on benchmark-driven strategies, and increasing allocation to absolute return, non-bond correlated strategies. With the promise of providing low volatility bond-like returns, those strategies are being marketed as possible substitutes for corporate bond portfolios.

We remain cautious, and advise on careful manager selection. The skills and mindset required to produce absolute returns are very different from those required to beat a benchmark. While some managers have had a long track record of providing alpha mindset, this is an area where hedge fund managers had long plied their trade before the unavoidable influx of traditional asset managers. The differences across those strategies are also becoming more blurred.

As we move towards those more sophisticated strategies, it is also critical to ensure that the managers benefit from a robust process, with a strong risk-management framework. In our opinion, active risk has moved from how much tracking error should be afforded to a manager, to how much flexibility should be afforded to a manager. With more flexibility also comes the need for more in-depth due diligence.

Given those considerations, identifying managers with sufficient skills and an investment framework that allows them to thrive is critical.

More Related Content...

|

|

|