Focusing on active engagement

Published: August 1, 2017

Written By:

|

James Sparshott |

From an investor point of view, active engagement can be about more than just voting. James Sparshott of Legal & General examines the concept of good stewardship and the increased influence that can be wielded by the new LGPS asset pools

It’s crucial for investors that stewardship is effective. We believe companies that demonstrate good corporate governance and have sustainable business policies will generate long-term superior financial benefits for their shareholders. Effective stewardship means working with companies to ensure that they have a diverse and skilled board, and a robust approach towards topics such as management recruitment and succession, remuneration, sustainability, risk management and shareholder and employee rights. The ultimate goal is to ensure that company management align their business objectives with the long-term interests of shareholders such as the LGPS.

As the LGPS undertakes the significant exercise of creating asset pools, the issue of stewardship has increasingly started to take centre stage. Pooling has created unprecedented opportunity for the LGPS to improve corporate governance across the market, but questions nonetheless remain around who is best placed to leverage this scale most effectively, and in what ways.

All parties in the investment chain have a role to play in changing and impacting company and regulatory policies to ensure that the market is supporting long-term and sustainable economic growth. To have the most effective influence and impact, these parties will need to work in partnership to speak with a consistent voice. Choosing managers with the scale and expertise to engage effectively with companies on your behalf, and holding those managers to account for their stewardship, is one way in which LGPS pools can fulfil their own stewardship duties to their members.

Leveraging the benefits of scale

An important benefit of choosing an asset manager to undertake effective stewardship and engagement activities on your behalf is that these are often complex, resource-intensive exercises which are best performed by dedicated and experienced teams. Entrusting an experienced manager with these responsibilities would allow the newly-formed pools to focus time and energy on their day-to-day fiduciary responsibilities.

In addition to preserving resources, another advantage for pools is that asset managers can leverage their entire scale to deliver significant impact with these stewardship activities. Fund managers can use their position as significant long-term shareholders to influence the companies they invest in, and change their behaviour for the benefit of clients. Companies value shareholders they can trust to provide advice and feedback on a wide range of investment topics. The strength of relationships, alongside scale and breadth of knowledge, is fundamental to being able to influence and change behaviours rather than just create “noise”.

Clients have an important role to play

When asset managers undertake stewardship duties on behalf of their clients, the clients they represent have an important voice in the dialogue. The pools should challenge their existing asset managers to integrate their views and concerns into existing policies, and hold managers to account for delivering on the pools’ stewardship objectives.

The largest shareholdings are often owned by the biggest index fund managers, who are important in changing market dynamics. As such, healthy pressure from clients on all asset managers to use their shareholding and access to engage and vote on ESG issues is crucial for meaningful change to occur. The pooling of LGPS assets to achieve scale, and to push for a unified agenda across the market, is a positive move. However, it should not mean that the pools no longer hold their asset managers to account for their actions.

Voting: one tool among many

Debates around stewardship will often tend to centre on the issue of voting, with asset owners commonly under the impression that voting is the single most impactful way of expressing their views. It is true that stewardship cannot be separated from voting and should be central for all clients. However, asset owners should be aware that voting is just one part of the asset manager’s stewardship toolkit. The aim of informed voting is to exercise shareholder rights in order to change a company’s current approach or policy and impact the market as a whole. To help achieve these goals, and to speak to companies with one consistent voice, voting has to be fully integrated with other engagement activities.

As Professor Kay noted in his 2012 review of UK equity markets and long-term decision making, good governance and stewardship relates to “the oversight of capital allocation within companies” overall, not just to ESG issues. In pushing companies to develop long-term, sustainable business strategies, asset managers should engage with companies on a wide variety of issues that will extend beyond the usual shareholder resolutions (while at the same time not abstaining from voting). The FRC Stewardship Code recognises that these issues sometimes require different forms of company engagement, stating that “stewardship is more than just voting”.

The LGPS pools should assess their existing managers on the full range of stewardship capabilities, not just the ability to process votes, in order to ensure that their voices will be heard.

Passive investors, active owners

When active investors take issue with the management or behaviours of a particular company, and fear that they may negatively affect future investment returns, their usual response is to sell it from their portfolio. Index investors, who cannot “vote with their feet” by selling a stock purely on the grounds of poor corporate governance, may seem somewhat powerless by comparison.

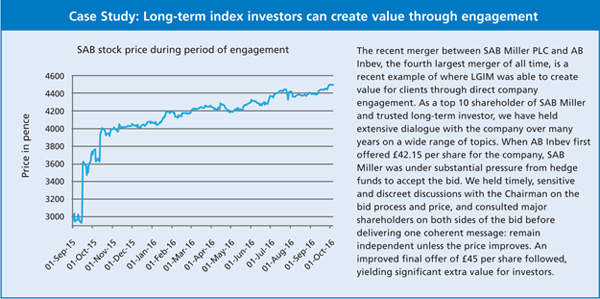

However, index investors have the considerable advantage of being long-term trusted advisers to the management and the boards of the companies in which they invest. Consistent long-term engagement leads to a robust process for actively escalating concerns around company behaviour and ensuring maximum impact.

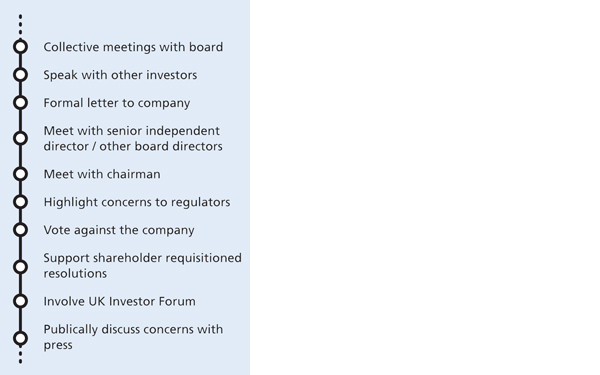

Figure 1: Escalating concerns around company behaviour

Source: LGIM

Source: LGIM and Macrobond

Tackling the biggest issues affecting long-term returns

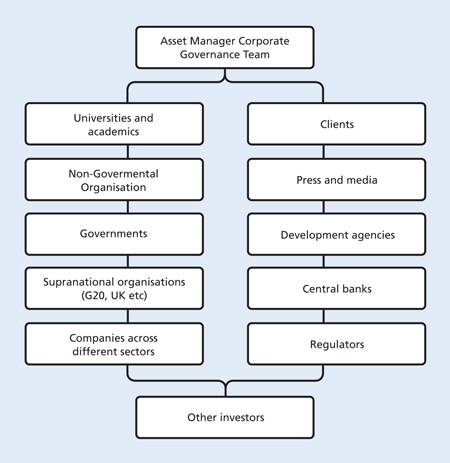

There are other crucial areas whereby voting is inadequate on its own as a means of driving industry-wide, long-term change on a global scale. Climate change, in particular, requires a policy that extends far beyond simply voting. Impacting the way in which companies prepare for the transition to a low-carbon future requires ongoing dialogue with a broad range of stakeholders. Asset managers can only fulfil their stewardship duties in this area by coordinating their engagement efforts with other asset managers, industry bodies, regulators, governments at home and abroad in order to drive change. Where asset managers have stewardship capabilities that are limited simply to processing votes, the capacity for those managers to affect long-term change in important areas such as these, on behalf of their clients, is heavily compromised.

Figure 2: Stakeholder map for effective engagement on climate change

Source: LGIM

Split voting is complex and introduces additional risk

The issue of split voting is most often raised by pension providers who are concerned with adequately and fairly representing the views of their members. However, while split voting may seem at first glance like an effective way of ensuring their investors’ voices are heard, it can often have the opposite effect.

There are three key issues with split voting which investors need to keep in mind. Firstly, it dilutes the impact of engagement as it removes the asset manager’s ability to speak with one voice across all of their holdings, compromising the benefits of scale for investors. Secondly, it reduces the weight, in terms of share ownership, behind each competing position. Finally, the complex and highly manual nature of split voting introduces operational and reputational risks due to the structure of the entire investment chain. We therefore need to use it sparingly, to avoid constraining the resources of the asset manager which could be better allocated to more effective forms of engagement, and to reduce risk for clients.

We recommend that LGPS pools challenge their managers to ensure that their views and votes are incorporated, proceeding with one strong voice that leverages the scale of the manager and represents the best interests of all shareholders. Additionally, the LGPS could use their voice to call for improved efficiencies throughout the investment chain. A number of industry and investor-led projects are already underway.

Making stewardship count

The stewardship benefits of pooling should be significant for the LGPS and its members, and will have the positive effects of driving better company behaviour and creating sustainable long-term returns for all shareholders. Stewardship should be an embedded, complimentary service undertaken on behalf of all clients, which can more broadly satisfy the cost-saving requirement of the pooling exercise.

Important Information

This document is designed for the use of professional investors and their advisers. No responsibility can be accepted by Legal & General Investment Management Limited or contributors as a result of information contained in this publication. Specific advice should be taken when dealing with specific situations. The views expressed in Index Intelligence by any contributor are not necessarily those of Legal & General Investment Management Limited and Legal & General Investment Management Limited may or may not have acted upon them. Past performance is not a guide to future performance.

This document may not be used for the purposes of an offer or solicitation to anyone in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it is unlawful to make such offer or solicitation.

© 2016 Legal & General Investment Management Limited. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, without the written permission of the publishers.

Legal & General Investment Management Ltd, One Coleman Street, London, EC2R 5AA.

www.lgim.com

Authorised and regulated by the Financial Conduct Authority.

The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested.

Legal & General Investment Management Ltd, One Coleman Street, London, EC2R 5AA www.lgim.com

Authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|