Generic alpha: a robust approach to alternative style premia investing

|

Written By: Pascal Spielmann |

Pascal Spielmann of LGT Capital Partners looks at the advantages and disadvantages of different strategies for investing in alternatives and outlines an approach that improves the likelihood of investment success

Smart beta, risk factor and risk parity investing are well-known concepts in the long-only investing world and are now being applied to alternative investments. They allow investors to target certain return drivers in the market such as growth or value stocks, but there is a potential problem with all these investment approaches in that they are structurally taking on market risk at all times. In other words, these are passive “buy and hold” approaches that do not factor in whether risk-taking is actually rewarded in markets or not. This becomes a crucial point especially as global markets have become increasingly fragile in recent years.

Traditional market dynamics may not hold in future

Government bonds as a classic diversifier to a growth-oriented equity and/or income-seeking credit portfolio may no longer function properly in the post-QE world: at zero and negative interest rate levels, investors are no longer getting any significant rates of return from their fixed income portfolio. Bluntly speaking, the so-called “Greenspan put”, “Bernanke put” and “Draghi put” are unlikely to be that effective in the future. Valuations are high and risks are asymmetrically skewed to the downside; many investors learnt this lesson after the so-called “taper tantrum” period in May and June 2013.¹ We feel that in an environment where long-term dependable market dynamics are at the brink of failing, imprudent long directional risk-taking by ever moving out on the risk-return curve can lead to unacceptable losses.

Investors must ensure they understand their true beta exposures

Another point of consideration is that investors, especially those with fairly traditional 60/40 equity-bond portfolios, should be wary about doubling up on certain “smart” betas which may in fact not diversify but “di-worse-ify” and exaggerate portfolio risk, particularly in the best and worst months for the markets.

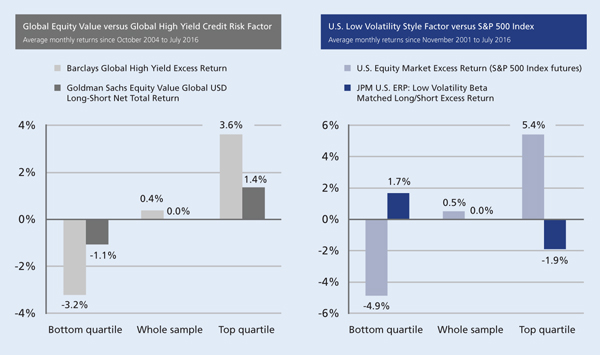

For example, equity value factor investing is akin to taking on high yield credit risk in disguise. As you can see from Figure 1, the value factor performs particularly well or poorly in line with the best and worst quartiles for high yield credit markets, i.e. when spreads are collapsing or exploding. This makes intuitive sense because many of these stocks, for example energy and mining companies, become cheap or richly priced for a reason. Yet, on average, the long-run compensation from the equity value factor is almost nil. In other words, equity value factor investors get mostly compensated for taking on exposure to distressed credit risk, where selection skills are key for investment success while a purely quantitative investment approach may disappoint.

Likewise, what is commonly known as the Low Volatility or Quality style in equities can hardly be extracted as a factor in a market neutral, long-short format. Investors holding high quality, low beta and low volatility stocks which are leveraged up to the same volatility as the index have historically outperformed the market because of better compounding. However, when leverage is applied to short the market in an attempt to beta-hedge a portfolio of low volatility stocks, then the compounding benefits break down: low volatility effectively becomes a short volatility style because of rising correlations and the subsequent beta-hedging mismatch in carrying a supposedly beta neutral position at times when volatilities spike. Figure 1 shows that investors in the low volatility style factor tend to outperform in the bottom quartile months but then underperform significantly in subsequent rebounds which often turn out to be the top quartile months, leading again on average to an almost zero factor return over the long run.

Figure 1: Equity factor returns in different market regimes

Source: LGT Investment Partners, Bloomberg, Goldman Sachs, J.P. Morgan, Barclays.

Note: The Global Equity Value Factor is defined as the Goldman Sachs Equity Value Global USD Long-Short Net Total Return index (Bloomberg: GSRPEVWF). The Global High Yield Credit Risk Factor is defined as Barclays Global High Yield Excess Return index (Bloomberg: LG30ER). The U.S. Low Volatility Style Factor is defined as J.P. Morgan US Equity Risk Premium Factor: Low Volatility Beta Matched Long/Short Excess Return index (Bloomberg: QTJPVBLS) and the U.S. Equity Market Excess Return is defined by the return of the Generic 1st E-Mini S&P 500 Futures contract (Bloomberg: ES1 Index).

In summary, there is nothing particularly “smart” or “alternative” about these factors and diversification benefits may be disappointing when portfolios need it the most. The rise in popularity of the smart beta investment concept and the corresponding inflows has surely been beneficial for the profits of investment banks and the ETF industry as a whole. Whether it will also be beneficial in the long run for investors who are systematically exposed to unwanted and often unknown underlying risk factors is another question. Instead of hunting for smart betas, we believe investors should rather focus on how to construct smarter portfolios.

A robust approach to alternative style premia investing: generic alpha

Our ongoing research has taken us beyond modern portfolio theory and post-modern portfolio construction approaches based on enhanced beta and smart beta strategies. These are all relatively rigid and have projected returns based on strategic asset allocation techniques which are highly dependent on how economic scenarios will transpire relative to expectations. However, there is no passive portfolio that would maximise the likelihood of performing well under any scenario, no matter how smart the underlying betas.

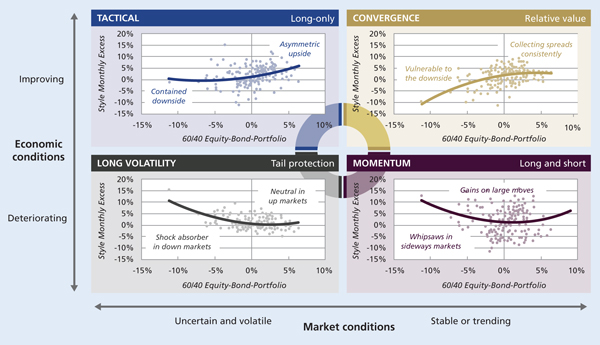

Figure 2: The generic alpha approach to alternative style premia investing

Source: LGT Investment Partners, Bloomberg

Monthly style returns from January 2000 to December 2015 reflect pro forma results, in USD gross of fees. Past performance is not a guarantee, nor an indication of current or future performance.

Figure 2 shows how our generic alpha approach is profoundly different. Each quadrant corresponds to one of four investment styles: Tactical, Convergence, Momentum and Long Volatility. They each have their own distinct risk/return profile.

Instead of passively allocating to a particular asset class or a strategy, one would allocate an equal maximum risk budget to each investment style and then leave it up to the underlying strategies to exploit their budgets in accordance with the prevailing conditions. Because each style has a positive long run expected return and its “sweet spot” under different environmental conditions, return contributions from the styles are not only alternating but also complementing each other over time. Hence, by balancing risk budgets equally across styles, investors can effectively maximise their chances of performing well in any given scenario, which we believe is the essence of a smart and robust portfolio construction.

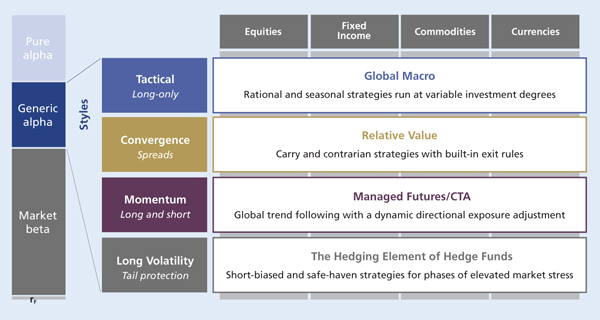

The styles themselves bundle a diversified set of underlying strategies with a coherent risk return profile and are also diversifying to one another. Each underlying strategy is based on a fundamentally sound investment thesis as well as long-term persuasive empirical evidence. They are developed in a rigorous research process and continuously monitored as regards to their model risk and the validity of their underlying investment theses. In particular, most strategies have built-in safety valves which allows them to de-risk and even hibernate in cash if and when warranted. Thereby, they become environmentally adaptive instead of structurally taking on risk at all times. Accordingly, they are implemented primarily using the most liquid, listed futures so that they can actively adapt to evolving conditions on a daily basis. As you can see from Figure 3, the four styles extract certain style premia – generic alpha, from all major asset classes across markets globally.

Figure 3: Extracting the common denominator of hedge fund returns

Source: LGT Investment Partners. rF = risk-free rate: interest rate on short-term government debt.

Why do we call it generic alpha?

The four investment styles provide “alpha” in the sense that their payoff profile resembles alternative return profiles known from the hedge fund world. For instance, Tactical resembles Global Macro, Convergence is similar to Relative Value and Momentum looks very much like Managed Futures/CTA. However, the alpha is not derived from skill but rather from the disciplined, rule-based application of proven investment and risk management techniques. Hence, it is “generic” in the sense that it can be accrued reliably and consistently over time since it is derived from economically well-founded risk premia (e.g. FX carry, volatility term premium), persistent behavioural biases (e.g. investor herding, risk aversion) as well as structural limitations in arbitraging.

The existence of myriad biases inherent in human decision-making and the structural limitations of markets and their participants are the very reasons that style premia exist and will likely continue to persist. We do not want to call these style premia “alternative beta” or “smart beta” because beta by definition represents the tendency of a factor’s or security’s returns to respond to swings in the market. Therefore, beta is structurally long and “risk-on” while alpha is not. For instance, the Momentum and Long Volatility styles can provide crisis alpha by going short and benefiting from a “risk-off” flight-to-quality, which is exactly the opposite of what is commonly implied by beta.

Lower cost, flat fee approach

We would also argue that “generic” does not mean less safe or less effective but simply less costly. By avoiding high fees to typical hedge fund managers, alternative style premia investors already start with a significantly lower hurdle to overcome, which translates to a compounding advantage over time.

Transparency is crucial

Investing in alternative style premia should be a highly transparent experience for investors, who should be able to gain comfort about the plausibility of the fundamental investment thesis of every single strategy, so that they know what they are buying into. This level of transparency allows allocators to build confidence and conviction into the process from the outset, something that is hardly possible with classic hedge fund type investments.

Conclusion

Smart beta investing can be applied to alternative investments if done so in a thoughtful manner. In our view, the outlined generic alpha approach can generate solid returns by combining the best of traditional and liquid alternative investments while diversifying equities and bonds over a full market cycle. It combines the economic rationale, cost efficiency, persistency, liquidity and scalability appreciated from traditional investments with the diversification and stringent risk controls expected from hedge funds. The disciplined, rule-based implementation combined with full transparency eliminates much of the usual uncertainty that arises from managers’ discretionary asset selection and market timing decisions.

We believe that results will only be satisfying over the long run when a sensible combination of robust and environmentally adaptive style premia strategies is paired with prudent risk budgeting and strict risk control.

1. The taper tantrum of 2013 refers to the unexpected announcement of a potential QE reduction by the US Federal Reserve which caused a violent sell-off in equities and bonds

More Related Content...

|

|

|