High-yield bonds and loans – the best of both worlds

|

Written By: Bernard Abrahamsen |

Bernard abrahamsen discusses the advantages of managing both bonds and loans in the same fund

Unless you’re talking about the yields on Greek, Portuguese or Spanish government bonds, we are well and truly living in a “low interest rate” world. Central banks in the US, UK and Europe have cut official rates most of the way to 0% and Gilts yield just 2% pa. for 10 years.

Naturally, institutional investors tend to require better returns than this, particularly pension funds looking to close deficits. But earning higher returns usually means investing in riskier assets.

Equity markets have reminded us over the past five years – if we needed reminding – that higher risks can lead to pain. More than ever, investors need to ensure their investment returns adequately reward them for the risks they have to take along the way. In this feature, we’ll focus on two asset classes which can offer returns that we feel more than adequately compensate investors for the risks taken, and explain why it makes sense to manage the two asset classes in the same fund.

The assets in question are traditionally accessible through either the European leveraged loan or the European high-yield bond markets.

High-yield bonds and loans – a quick recap

Although both high-yield bonds and loans increasingly offer exposure to the same sort of company – the leveraged corporate borrower, each market contains characteristics that are distinctly its own.

Loans are senior, secured assets paying a floating rate of interest and benefiting from maintenance covenants. In Europe, the terms of loans are fairly unstandardised, individually negotiated and complex contractual relationships with borrowers in a private market, and are typically not rated by the ratings agencies. As a result, investing in European loans requires both credit and legal analysis, and resources – with respect to sheer numbers and market presence. Major lenders in Europe have more involvement in the construction of deals and are involved in an issuer throughout the life of the loan as the company’s strategy evolves. Scale, resources and relationships are paramount.

Meanwhile, high-yield bonds, as with their investment-grade siblings, are public securities. They benefit from call protection but don’t typically offer the same level of seniority, covenants or security as loans, and most bonds pay fixed-rate rather than floating-rate cash flows.

Loans and bonds – why manage them together?

There are several good reasons why it makes sense to manage them in the same fund.

The first is the changing nature of the sub-investment grade debt market in Europe. It may come as a surprise that the loan market has been larger than the high-yield bond market for much of the past decade. But, the high-yield bond market has evolved to become a realistic alternative to bank finance for corporate finance directors, so the two markets are now broadly equivalent in size.

The high-yield market, which used to be notorious for being small, undiversified and volatile, is becoming more mainstream. With far fewer corporations able to borrow from the banks, more have turned to issuing bonds. And investors, all the more wary about the safety of their assets following the financial crisis, are demanding greater seniority and security from these high-yield bond issues. Also, more issuers and investors are considering both markets as financing options, fostering an evergreater convergence between the two markets. So, managing a fund investing in both markets reflects this changing dynamic.

Despite the fact that the issuing companies in both markets are increasingly similar, relatively few companies issue both bonds and loans (as of 31 July, there were only 47 out of 614 companies according to Merrill Lynch and Credit Suisse).

So from the off, investing across both markets opens up a bigger investment universe, better opportunities to diversify and potential opportunities specific to each market.

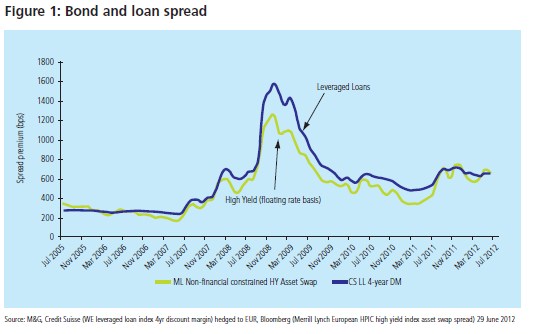

And what about the relative value between the two markets? Figure 1 illustrates the credit spreads of both markets since 2005. Until the calm before the storm that was 2008, European loans were a very stable asset class, and generally offered lower returns, reflecting their seniority and security. This encouraged some investors to lever up their returns, but, in late 2008, a number of these leveraged investors became forced sellers in the face of pretty modest pricing volatility, causing a dramatic decline in prices and sending potential returns skywards. The market has now normalised, with unlevered long-term investors replacing these leveraged funds, but the potential returns are still higher than they used to be, even on an unlevered basis. This means that, despite generally being more senior and more secure, loans paid higher returns than equivalent highyield bonds during this period and still pay similar returns now.

That said, while these asset classes’ returns are currently looking similarly attractive, this won’t always be the case. Under certain conditions one market may look relatively more attractive than the other and vice versa. Anticipating and taking advantage of these changing conditions can be an important driver of value.

For example, imagine we finally leave the “low interest rate” world and central banks across the globe begin to hike interest rates again. This would undoubtedly favour the loan market – with its floating-rate interest payments – over the bond market, typically offering fixed-rate coupons. Again – it’s only when a manager is able to invest in both that they are able to take advantage of each market’s relative strengths at the right time.

And there can be circumstances where a company issues both bonds and loans, and inefficiencies in pricing mean that the secured loan pays more than the unsecured bond or vice versa.

The future of leveraged finance?

We believe that investors will be wise to stay with managers who have genuine experience and expertise specific to both asset classes, and to avoid those who could well be a jackof- all-trades. The analytical, legal and restructuring expertise required, as well as the highest level access to the rather exclusive loans market, through the right relationships and the ability to make use of private loan information, are all essential to the success of such funds.

Given the nature of bond and loan markets, some may ask the question “why aren’t there more loan and bond funds already out there across Europe”? It’s a good question, given that funds like this are a natural response to the evolving market and the “next-generation” of leveraged debt investing. But very few managers have the experience, ability and resource to ensure that such a product – making full use of the private information available on loans in Europe – is brought to market in a fully compliant way. Only these firms are really able to access the best of both markets in today’s “low interest rate” world.

The distribution of this article does not constitute an offer or solicitation. The value of investments can fall as well as rise. The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Services Authority’s Handbook. They are not available to individual investors, who should not rely on this communication. M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Services Authority. 3229/FI/1012

More Related Content...

|

|

|