Illiquid credit: an opportunity for local authority pension schemes

|

Written By: Alex Veroude |

Over the past decade, local authority pension schemes have seen benefits from being “early adopters” of more esoteric asset classes. However, a number of factors including diminishing cash flows and volatile investment returns have continued to put pressure on funding levels. Illiquid credit is an under-utilised asset class that should be considered as part of the solution, suggests Alex Veroude of Insight.

All pension schemes face challenges. At Insight we recognise that local authority pension schemes confront particular issues that are shaping their portfolios and the investment characteristics of the assets that they buy. A premium is rightly placed on assets that can:

- Provide stable returns across economic cycles to reduce funding level volatility.

- Offer an inflation hedge: assets need to outperform inflation as liabilities are linked to the CPI inflation rate.

- Generate income: regular distributions can help avoid the need to liquidate long-term investments to meet pension payments as schemes become cash flow negative.

- Diversify portfolios: assets that have low correlations with other asset classes can improve the risk/return profile of scheme assets at the level of the overall portfolio.

Given today’s uncertain investment outlook and the low yields on most traditional fixed income assets, local authority pension schemes are finding it increasingly difficult to achieve their objectives using traditional asset classes alone. As a result, there is renewed appetite for alternative investments such as illiquid credit that have characteristics which may be an ideal match for the investment needs of local authority pension schemes.

Economic uncertainty

Though there are few certainties in economics or markets, it is abundantly clear that even when Europe’s economy recovers it is unlikely to be a V-shaped rebound. This is because the combination of household, government and financial deleveraging is likely to lead to shallower and more frequent business cycles, increasing the importance of assets that have a more stable return profile. Medium- term prospects for economic growth in the UK and mainland Europe in particular remain challenged.

The weak growth outlook should continue to ensure that domestically- generated inflation remains subdued. This, combined with the inevitably slow process of deleveraging, should result in a benign inflation outlook. However, the extent and unprecedented nature of current monetary experimentation means that there is potential for inflation to become a more significant longer-term risk, meaning that local authority pension schemes may be well advised to look to hedge some of this risk while inflation and inflation expectations are relatively low.

While the threat of inflation might normally be associated with much higher long-term bond yields, we believe that financial repression in the western world (where yields are kept below the rate of inflation to enable governments to ease debt burdens) will cap the duration risk of rising yields in bond markets. If yields rose, more quantitative easing or some other intervention seems likely. In addition, central banks have made it clear that short-term interest rates are likely to remain anchored near zero for some time, meaning that schemes may need to look beyond traditional fixed income investments to generate the income they need.

The right risk/reward trade-off

In this low-growth, income-starved world, the grab for yield across investment markets is likely to remain a significant driver of investor behaviour. Investors need to generate returns regardless of the economic backdrop. While nominal yields are relatively low, the additional pick-up offered by the spread on credit will continue to be attractive. Credit markets could therefore remain a primary beneficiary of the hunt for yield, especially given the greater certainty of return that they offer relative to volatile equity markets in an uncertain economic environment.

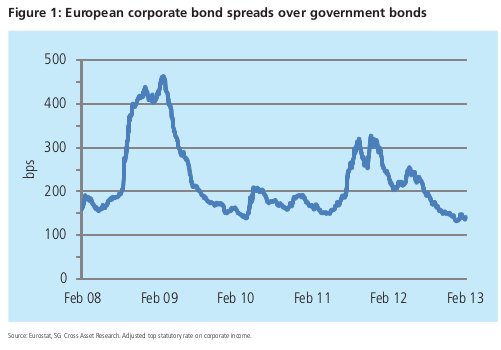

As the search for yield continues, however, there is potential for increasingly bubble-like conditions in credit markets. Both in the developed and the emerging world investors could bid up prices beyond levels that are justified by fundamentals. But even if there is as yet no bubble to burst, total returns in 2013 are unlikely to be as high as those seen in 2012, as credit yields were significantly higher at the end of 2011 than they are today. The starting point for credit is not nearly so promising, as Figure 1 shows.

Investors looking to maintain relatively high returns are faced with a choice. They can reduce credit quality and increase the risk of default, or explore more niche areas of credit markets where they can expect to be paid for accepting lower levels of liquidity. In our view, going down the route of accepting lower liquidity currently offers a better balance of risk and reward.

Loans meet needs of LAPF sector

Two areas of illiquid credit we currently believe are worth considering are secured corporate loans and commercial real estate loans. The first area is a well- established part of the credit market and a good example of an asset where investors are well rewarded for giving up some liquidity.

The absolute yields of secured corporate loans are now more attractive than those from high yield corporate bonds. Loans are also senior in the capital structure, which means investors are given a higher priority claim on a borrower’s assets than a bondholder. Because of the secured nature of the asset class, recoveries are generally higher in the event of a default. Another interesting characteristic of loans is that they typically pay a floating rate coupon that is reset in line with market interest rates. This provides a natural interest rate hedge.

A new opportunity is investment in European commercial real estate loans. Against a backdrop of economic uncertainty, regulatory change, demands for higher capital buffers and deleveraging, many European banks have shrunk their balance sheets. This new financial landscape has created what appears to be a once-in-a-cycle opportunity for new lenders to enter the institutional loan market.

With real estate debt spreads at their highest level for over a decade, valuations in the commercial real estate loan market would appear to be compelling. Indeed, loans of this nature are currently trading on average around 3% over Libor (sterling), which compares very favourably to pre- financial crisis levels of less than 1%. The investment case improves further when you consider that the average loan-to-value of pre-crisis loans was around 75%, compared to the current average of 50-65%.

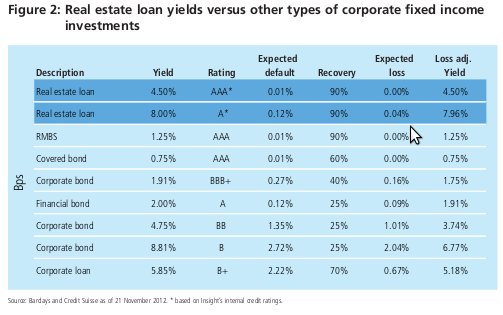

All else being equal, local authority investors in this market have the potential to be paid considerably more income to take significantly less risk than before the financial crisis, at a time when they are also benefiting from generally lower property prices. This risk/reward profile also compares well with other parts of the European fixed income universe including residential mortgage backed securities (RMBS), as can be seen in Figure 2.

In addition to attractive valuations, fundamentals for the commercial real estate sector are improving. Rent levels and occupancy rates are beginning to recover from recent lows, while the average yield available on prime assets is at its highest level for over five years. The loans are also structured on a floating interest rate basis. This offers lenders a significant degree of insulation from interest rate risk, potentially offering attractive diversification from more traditional fixed income instruments.

Within the commercial real estate universe, investors seeking to make their first foray into this market may be well advised to target prime assets. These buildings generally have long leases and are rented to high-quality tenants. The rent received from these tenants is currently around 50% higher than the interest payments on the debt. In addition, the investor can potentially benefit from a number of additional characteristics of loans, such as direct rent pass through, amortisation covenants, cross default clauses and other security pledges.

Accessing illiquid credit opportunities requires specialist asset management skills. Often these instruments do not have public ratings. Managers have to make an in- depth credit assessment themselves and understand their structure and documentation. Those asset managers that have a strong credit research capability should be well placed to generate returns for clients as they can offer investments in more esoteric parts of the market and different instruments such corporate loans, commercial real estate loans, and other securities.

At Insight, we believe that these more illiquid areas of the credit market have the potential of offer a return profile that closely aligned with the needs of local authority pension schemes in today’s challenging economic environment. They offer diversification from more traditional fixed income investments, whilst providing an attractive level of income, a more stable return profile than high yield bonds and a natural inflation hedge.

More Related Content...

|

|

|