Infrastructure debt – opportunities in the post-Covid recovery

|

Written By: Phelim Bolger |

Phelim Bolger of IFM Investors outlines the benefits of investing in infrastructure debt, its ability to provide resilient income, and the important role it plays in building a more sustainable future

As the global economy recovers from the Covid pandemic, every sector is being forced to assess how the events of 2020 have impacted their operating environment and what the future may look like for their businesses and society as a whole. Companies and governments are also using the pandemic as an opportunity to re-think how economies operate and focus on rebuilding in a more sustainable way. These trends can be clearly seen in new approaches to remote working and learning, workplace collaboration, and commitments to net-zero emissions by 2050.

Recovery efforts are being supported by ambitious government spending plans that focus strongly on infrastructure. For example, the UK government recently announced £100 billion in infrastructure spending for 2021-22 to help build roads, rail and fibre, amongst other investments, to make the British economy more resilient as part of the “Build Back Better” plan. Similarly, in the US, the Biden administration is formulating ambitious spending plans to upgrade ageing infrastructure, including water, electric and transportation networks. And this is all taking place alongside the transition towards less carbon-intensive infrastructure which we expect to accelerate in the years ahead.

Increasing government infrastructure spending can bolster the whole infrastructure investment ecosystem and create an opportunity for long-term debt investors that have been impacted by low global interest rates and the hunt for yield in risker credits. This is because infrastructure financing is often more heavily weighted towards debt than equity, so as government policy and priorities are enacted and we see an evolution in preferences for a sustainable economy, the supply of infrastructure debt opportunities could increase.

For investors, the attractiveness of infrastructure debt investments lies primarily in the resilient income they generate and their relatively low risk profile compared to other similarly yielding fixed income alternatives. The resilient profile reflects the essential role infrastructure assets play in the economies they serve.

In this piece we outline the case for investing in infrastructure debt, the factors that enable it to provide resilient income, and the relative value opportunities that currently exist in the market.

Infrastructure debt’s resilient income characteristics

Infrastructure assets can provide services that are an essential part of daily life. The nature of those services means the pattern of usage is stable and well understood, which helps support the long-term case for investing in their debt. Infrastructure assets, such as renewable energy and low-carbon heating, are increasingly playing a role in supporting the transition to a lower carbon economy. This “essential” nature contributes to the resilient credit characteristics of the asset class.

Infrastructure assets tend to exhibit monopolistic features, either through regulatory‐based controls and/or high barriers to entry, but the relative strength of these features varies. For example, a regulated water utility can be protected from new competitors by law; a fibre network may, however, be open to competition from other networks and exposed to risks associated with starting a new service. The effects of competition are often mitigated by the high barriers to entry in constructing and duplicating existing infrastructure assets.

Protective covenants are also an important part of infrastructure debt investing and can provide a range of features to preserve the credit profile of the debt investment. Covenants place limitations on the nature of activity that can be pursued by the borrower, and can require minimum levels of cash flow coverage to be maintained and place constraints on leverage to help keep risk in check. Breaches of covenants can trigger a “lock-up” of equity distributions and can eventually lead to creditors taking control of the asset.

Given the capital intensive nature of infrastructure, significant equity commitments are required from asset owners. This acts as a loss-absorbing layer of capital, with debt formally ranking ahead of equity in the capital structure, making debt the natural first port of call for infrastructure investors looking for resilient income from infrastructure investments.

The underlying infrastructure assets generally benefit from a stable cash generation profile due to the essential nature of the services provided. Revenue stability is also often supported by regulatory regimes and/or medium- to long‐term contracts. This, coupled with the liquidity premium associated with private infrastructure debt, can offer an attractive, reliable cash yield.

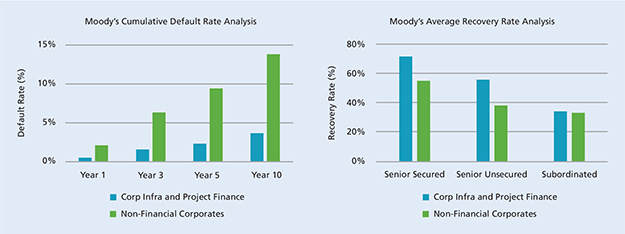

These features have resulted in superior default and recovery rates associated with infrastructure debt investments when compared to similarly rated non-financial corporate bonds.

Figure 1: Comparing default and recovery rates – infrastructure debt vs corporate debt

Source: Moody’s Infrastructure Default and Recovery Rates, 1983-2019 (published 9 October 2020)

Taking advantage of relative value opportunities

The pricing of private infrastructure debt has been influenced by low interest rates and a global search for yield like the rest of the fixed income markets in recent years. However, the global infrastructure debt market remains very diverse, which helps enable active selection among the opportunity set.

Sub-investment grade infrastructure debt is a specific sub-set of the market that encompasses debt assets considered to sit in the BB+ to CCC range, as denoted under various rating agency frameworks. We believe there is a particularly attractive, risk-adjusted opportunity at the upper end of the sub-investment grade range where assets still display certain resilient credit characteristics and yet tend to be of less interest to regulated investors (banks and insurance companies) who have a relatively low appetite for the incremental increase in risk. This segment is also often overlooked by higher return-seeking private credit investors who are more comfortable pursuing higher equity-like risks to maximise potential returns.

While the opportunity is there, identifying the right mix of deals outside the public domain and understanding appropriate risks is essential. It requires close relationships with sponsors and advisers in order to find suitable deals, and sector expertise and experience structuring private market transactions to fully harness the opportunity.

Well-researched incremental risk to drive incremental return

By investing in private market infrastructure debt, long-term investors are seeking to benefit from an illiquidity premium. But what are the other incremental risks associated with moving down the credit spectrum into BB territory, and how is this consistent with a resilient credit profile? We find incremental risks are worth taking if they are well understood and transactions are structured in a way that sufficiently manages downside risk.

One of the typical advantages of debt investing is its senior position in the capital structure of an infrastructure business, meaning that any income losses experienced will first be borne by the equity holders before they affect contractual debt obligations. However within the debt portion of a business’s capital structure there can be further subordination, meaning that some debt obligations will rank junior to other debt obligations and absorb the first losses that could occur to debt holders.

For example, it is possible to seek opportunities to lend at the holding company level (HoldCo) of a business, which is structurally more junior to operating company (OpCo) debt in the capital structure. This approach may be appropriate if the incremental yield is attractive and the underlying credit fundamentals of the revenue-generating asset are strong and considered consistent with an investment grade credit profile. An example of such an opportunity is providing HoldCo debt to a waste-to-energy facility that benefits from a long-term concession in the form of waste supply contracts or a regulated utility that benefits from the protections afforded by the relevant regulatory framework.

Investors may also consider sub-investment grade rated opportunities that are senior debt obligations of riskier businesses if they are benefiting from macro and/or regional trends that potentially compensate investors for taking on the extra credit risk. Examples include opportunities in battery storage which is a relatively new technology but is expected to play an integral role as countries seek to meet challenging renewable energy targets and provide more reliability to the energy grid.

Integrating Environmental, Social, and Governance (ESG) considerations in infrastructure debt investments

The other notable impact of the pandemic is the increased sense of urgency that is driving governments and companies globally to speed up the response to the world’s biggest sustainability challenges. This potentially creates opportunities for long-term pension capital and the workers and pensioners this capital represents.

Infrastructure assets have an important role to play in addressing these issues as they are estimated to consume about half of the world’s consumed materials each year¹. Significant investment will be needed to transition the world’s infrastructure to be less resource intensive. According to the Global Infrastructure Hub, infrastructure investment needs between 2016 and 2040 are forecast to be around US$94 trillion globally but current projections for global infrastructure spending by 2040 only amount to US$79 trillion, leaving a US$15 trillion investment gap.² Private capital will likely have a significant role to play in filling this gap, and a keen focus on ESG will help ensure it is done in a sustainable way.

The challenge for debt investors however, is that they lend money to companies but do not have ownership rights, hence they typically have less ability than equity investors to influence company management. This suggests ESG analysis for debt investing needs to be concentrated in the investment screening and due diligence phases, prior to entering an investment. This enables the avoidance of investments that might pose ESG concerns in the future.

Decarbonising power, heating and transport

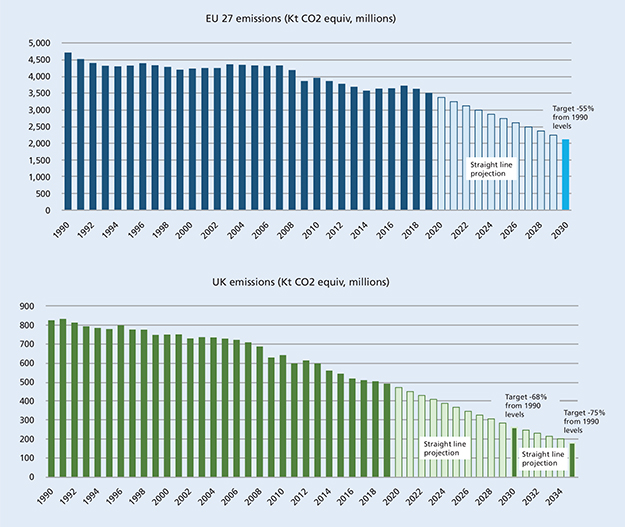

In recent years, we have observed a significant rise in the number of investments within the infrastructure debt market that deliver positive ESG impacts such as the decarbonisation of power, heating and transport. This is consistent with actions taken by governments and other organisations to achieve interim country emissions targets for 2030, on the ultimate path to be carbon neutral by 2050. The UK has gone a step further and set an additional ambitious target to achieve a 78% reduction in emissions by 2035. Looking forward, we expect this trend to continue, as countries seek to achieve these goals, and investor scrutiny over ESG factors increases.

Figure 2: EU 27 and UK emissions reduction targets

Source: European Environmental Agency, gov.co.uk (press release 20/04/2021), European Council (press release 17/12/2020)

Strong investor demand for renewable energy infrastructure debt deals has resulted in the emergence of a “green premium”, making some renewable energy investments relatively expensive. However renewable energy isn’t the only infrastructure sector contributing to lower emissions. There are an increasing number of deals associated with the decarbonisation of heating and transportation sectors, such as heating networks based on low carbon fuel sources, and electrification of rail networks.

Understanding ESG-related risks and opportunities, and assessing relative value in highly sought after renewables are certainly challenges for investors in the current market. However, infrastructure investments do have an important role to play in a more sustainable future, and strong relationships between investors, managers, sponsors, and governments should help enable infrastructure debt to contribute towards building that future.

Conclusion

As we rebuild globally in the wake of the pandemic, there is a strong desire to do so in a way that is more efficient and sustainable. Investments in critical infrastructure serving global economies are set to play an important role in the economic recovery and the transition to a less carbon-intensive society.

As this transition ensues, the debt-led capital structure of many infrastructure assets means there will be an increase in investment opportunities with resilient income characteristics. But not all opportunities are equal, and having a thorough understanding of the risks, and experience of investing in critical infrastructure sectors globally are key to helping investors harness relative value.

There are many opportunities for long-term investors to generate resilient income by carefully identifying, structuring, and analysing investments transitioning the global economy to a more sustainable future.

Important Disclosures

This article is provided for informational purposes only. It does not constitute an investment recommendation, offer or solicitation and should not be relied upon as investment advice or as the basis for any contract or commitment. This information does not constitute investment, legal, accounting, regulatory, taxation or other advice. IFM Investors Pty Ltd (“IFM Investors”) recommends that before making an investment decision, each prospective investor should consult a financial advisor and should consider whether any investments are appropriate in light of their particular investment needs, objectives and financial circumstances. This information should not be reproduced without the written consent of IFM Investors.

United Kingdom Disclosure

This material is provided to you on the basis that you warrant that you fall within one or more of the exemptions in the Financial Services and Markets Act 2000 (“FSMA”) [(Financial Promotion) Order 2005] [(Promotion of Collective Investment Schemes) (Exemptions) Order 2001, or are a Professional Client for the purposes of FCA rules] and as a consequence the restrictions on communication of “financial promotions” under FSMA and FCA rules do not apply to a communication made to you. IFM Investors (UK) Ltd shall have no liability, contingent or otherwise, to any user of this material or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information in this material.

IFM-3JULY2021-1706207

1. Global Infrastructure Hub, infrastructure monitor, insights, 28 June 2021. https://www.gihub.org/infrastructure-monitor/insights/infrastructure-consumes-more-than-half-of-the-world-s-materials/

2. Global Infrastructure Hub, forecasting infrastructure investment needs and gaps. 30 June 2021. https://outlook.gihub.org/

More Related Content...

|

|

|