Infrastructure debt – the new “I” in LDI

|

Written By: Nicola Beretta Covacivich |

Infrastructure debt provides an opportunity to invest in non-correlated real assets with an attractive risk/return profile. Nicola Beretta Covacivich of ECM explains more

Investing in infrastructure debt – vital facilities such as hospitals, airports, roads, water & renewable energy including wind farms, and solar plants, oil & gas, telecoms and other utility companies – is a relatively recent but fast-growing opportunity for credit investors with a number of investment opportunities brought to market so far during 2014. Infrastructure debt can give institutional investors an opportunity to invest in new infrastructure projects, privatisation and acquisition finance, debt refinancing and utility debt across continental Europe and the UK.

Infrastructure providers are typically monopolies with regulated revenues. As such, their financial performance should not be heavily influenced by economic ups and downs.

Consequently, infrastructure debt is a solution for investors seeking stable, long-term cash flows to match long-dated liabilities.

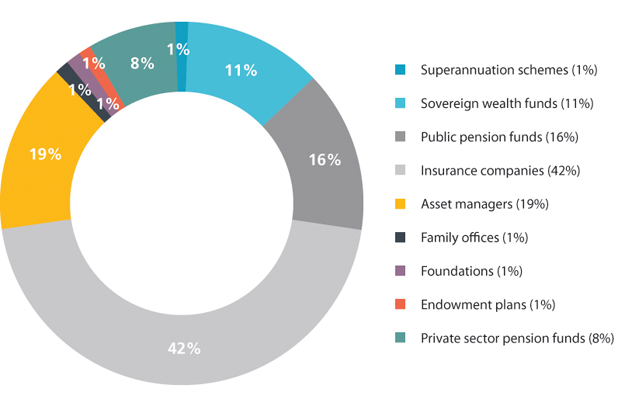

Figure 1: Breakdown of institutional investors active in infrastructure by type and aggregate AUM

Source: Preqin Infrastructure Online, Standard & Poor’s 2014

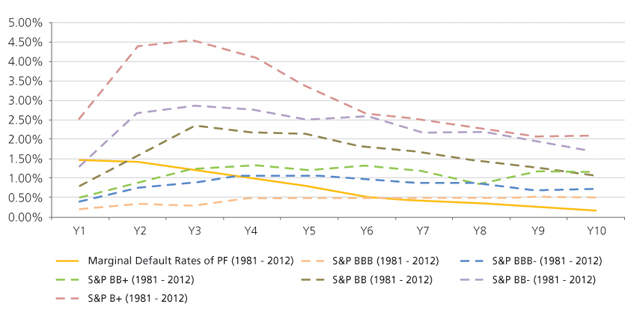

The nature of the organisations issuing the debt means the infrastructure sector has a lower default rate than other forms of corporate debt, decreasing significantly over the life of the asset. In addition, spreads are less volatile – even during financial crises – implying that infrastructure carries a lower risk than other debt with a similar credit rating. This is why banks have historically been the largest lenders to the sector – and why institutional investors’ appetite for infrastructure debt is now increasing. The pressure for banks to reduce the amount of debt on their balance sheets due to the Basel III capital and liquidity rules is one of the factors transforming the market, along with government funding reducing globally. At the same time, there is a growing need for long-term finance, notably in Europe where much of the infrastructure investment over the coming years will be in renewable energy, as the power generation mix shifts towards cleaner and more sustainable sources.

Figure 2: Default rates for 6,000 infrastructure loans made by Santander in the period 1981 – 2012

Source: Credit Pro, S&P Capital IQ

The OECD has estimated global infrastructure spending requirements to 2030 to be around $50 trillion, while estimates for Europe alone show a total of €2.5 trillion by 2020 with a clear global supply and demand gap of around $50 billion a year according to S&P. This offers institutional investors a new opportunity. However, while banks are stepping back from long-term lending, developers and equity sponsors have not yet adapted their offering to satisfy the requirements of pension funds and other institutional investors. The problem of market dislocation is most acute in Europe and the UK. Here, there are large debt requirements but limited access to funding because of budget cutbacks and restrictions on bank lending, which accounted for 90% of funding before the crisis struck.

The complexity of the market during this transition from bank lending to institutional capital markets is driving change.

Some institutional investors are making direct investments, although originating such deals can be challenging. Many others are using third party investment managers. Clearly, the change is creating new investment opportunities.

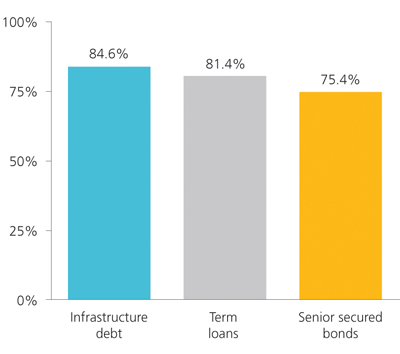

Figure 3: Average recovery rates, % over defaulted debt amount

Source: S&P Capital IQ’s Annual Project Finance Default and Recovery Study 2012; Moody’s Default and Recovery Rates for PF Loans Review, 2012

To be successful in this market, investors must be diligent. It is imperative that they undertake a robust credit assessment to ensure they are accessing the highest quality debt. The individual characteristics combined with active management of the infrastructure debt by an experienced investment team and a strong pipeline is the key to strong performance.

Investors with real liabilities are currently facing a tricky market environment with many bond yields at historic lows. This is driving down expected returns and raising future liabilities. And the increasing correlation across many listed markets makes it difficult to achieve real returns.

Infrastructure debt is an attractive opportunity to invest in non-correlated real assets with an attractive risk/return profile, and delivers enhanced diversification. Investors can also use infrastructure to help match their liability profile with a predictable and partly inflation-linked distribution stream, complementing lower yielding, long-term government-type bond investments.

More Related Content...

|

|

|