Infrastructure secondaries and co-investments

|

Written By: Andrea Echberg |

Andrea Echberg of Pantheon discusses the development of the Infrastructure investment opportunity, and how secondary and co-investment transactions can potentially uncover pockets of value and exploit inefficiencies

Infrastructure is now a well-established asset class and is set to continue to command an important allocation for institutional investors. We believe this is primarily driven by the growing global need for infrastructure investment in combination with strong interest from investors. The potential size of the infrastructure market is substantial. It is estimated that the world needs to invest approximately 3.8% of GDP (or $3.3 trillion) per annum in economic infrastructure to support expected growth rates.¹ With many governments facing budget constraints and therefore unable to fulfil their traditional role as the primary sources of infrastructure investment, the private sector is becoming an increasingly crucial source of capital.

Furthermore, infrastructure assets may combine a range of attractive characteristics for investors, including the potential for stable long-term cashflows, inflation hedging, downside protection and capital growth through value creation. With this in mind, many institutional investors are exploring how best to access and build meaningful exposures to the asset class, which is not without its challenges. The fund manager universe has grown considerably, which has led to a broader range of options but also added complexity and a multitude of unproven platforms. The managers with the strongest track records are also becoming increasingly difficult to access for new investors. Additionally, a highly competitive deal environment has driven up valuations, particularly for the high profile blue chip assets, which is inevitably squeezing returns.

We therefore believe that a differentiated investment approach is very important. In our view, both the infrastructure secondary market (where positions in closed-ended funds are traded) and the co-investment opportunity-set (investments in underlying assets alongside lead fund managers) are benefiting from compelling fundamentals, potentially affording specialist investors to tap into pockets of value and providing differentiated access routes to quality assets.

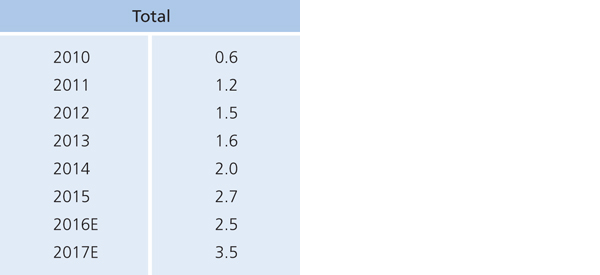

The infrastructure secondary market is fast emerging as it follows in the footsteps of its very well-established private equity counterpart. Since the birth of this market around seven years ago it has grown at a steady rate. An estimated $2.5 billion of infrastructure fund positions were traded on the secondary market in 2016 and the current projection for 2017 is $3.5 billion.² This is still dwarfed by the private equity secondary market, where approximately $40 billion is traded per annum.³

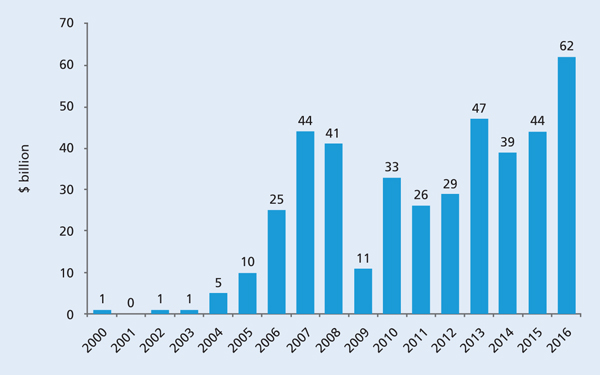

The secondary market is a derivative of the primary fundraising environment. Record amounts of capital continue to be raised by infrastructure funds, with $145 billion raised by closed-ended infrastructure funds from 2014 to 2016.⁴ We anticipate fundraising to continue to increase; a recent Preqin survey found that 88% of investors expect to commit either the same amount or more capital to the asset class in 2017 compared to 2016. While this phenomenon is undoubtedly contributing to escalating valuations and increased competition for deals, we think it will continue to fuel the secondary opportunity-set as a proportion of fund investors seek liquidity solutions.

Figure 1: Infrastructure primary fundraising

Source: Preqin as of December 31, 2016

There are several trends motivating sellers of infrastructure fund positions, which in tandem with the volume of fundraising, we believe will support the continued expansion of the infrastructure secondary market. Banks and insurance companies, who were early and significant investors in infrastructure funds, continue to be forced into selling or reducing their holdings as a result of new regulations. A number of early institutional investors who initially invested in infrastructure via funds, are now looking to invest directly and therefore selling their existing fund positions. As with private equity, investors are increasingly using the secondary market as a tool to more proactively manage and reposition their portfolios. There has also been a marked increase in more complex manager-led secondary deal flow. These types of deals are becoming popular solutions for managers holding quality, long-dated and high yielding assets, but who are also under pressure to find liquidity solutions for fatigued investors as funds reach the end of their terms. In these instances managers are aiming to re-structure their investor base and proactively look to partner with specialist secondary buyers with the ability to execute on these types of transactions.

Figure 2: Infrastructure secondary transaction volume ($billion)

Source: Campbell Lutyens

We believe the infrastructure secondary market is particularly interesting because it is still undeveloped. There are a limited number of specialist buyers, creating a supply and demand imbalance and leading to potential inefficiencies. For example, via the secondary market, we have witnessed the opportunity to navigate the high valuation environment, and build exposure by the back door to the same blue chip assets that are fought over so aggressively by fund managers, sovereign wealth funds and other large institutional investors in the direct market. Furthermore, at the time of entry, in many cases the underlying assets have been de-risked, leverage has been paid down and there is clear visibility on operating and financial performance. Secondary investors may also gain more immediate access to operating and yield-generating assets, certainly in comparison to a primary fund investment where capital is committed and drawn down over several years.

Inevitably, as the secondary market continues to develop, it will likely become more crowded and inefficiencies may become harder to exploit. Large intermediated secondary sales in brand name funds are increasingly attracting the attention of private equity secondary buyers, who themselves have considerable capital to deploy, as well as large institutional investors looking for efficient ways to increase their infrastructure allocations. For these investors, deals need to be of a sufficient size to move the needle for their portfolios, and ideally not too complex and resource intensive. Specialist infrastructure secondary investors will have to work harder to uncover opportunities off the beaten path or with barriers to entry, for example via proprietary sourcing networks or the more complex manager-led transactions. For those investors with deep industry networks, in-house asset underwriting and deal structuring expertise, we believe the secondary market will continue to deliver a compelling access route to infrastructure investments.

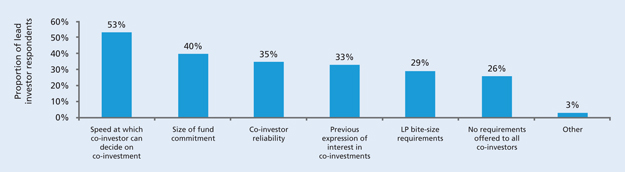

The infrastructure co-investment opportunity is also developing quickly. For direct managers, co-investment capital can be an attractive form of additional financing, particularly for capital intensive infrastructure projects. Offering co-investment opportunities also enables them to build more strategic relationships with their reference investors. For the co-investors themselves, these opportunities can offer the potential to be more targeted in portfolio construction, capitalise on specific market opportunities as they arise, and build direct exposure to a selection of quality assets while still maintaining manager diversification. Additionally the lead investor typically charges no management fee or carried interest on co-investment transactions. Similar to secondaries however, there are significant barriers to entry. We believe strong networks with the best managers are essential, as is the in-house expertise to analyse the merits of each deal and pull the trigger, often within tight timeframes dictated by the lead investor.

Figure 3: Requirements for investors to qualify for co-investment rights – Preqin GP Survey

Source: Preqin Special Report: Private Equity Co-Investment Outlook, November 2015

While we maintain the conviction that secondaries and co-investments are compelling as methods for investing in private infrastructure assets, equally important considerations involve building appropriate levels of diversification across the investment universe, and of course investing in the best assets. We believe that infrastructure portfolios should be diversified globally and across a range industry sectors, including transportation, communication, water, social and energy. We also think it is beneficial to include a mix of “Core” and “Core Plus” investments. “Core” assets are characterised as mature, operating and yield generating (such as schools, hospitals and water networks), while “Core Plus” assets have more potential for capital growth through expansion, refurbishment or operational improvement as well as yield potential (such as toll roads or airports).

We believe investors should be aiming to achieve attractive returns through a combination of yield and capital growth, as well as downside protection, from their infrastructure allocation. With a disciplined and diversified approach; and the requisite skillsets to execute these transactions, we believe there is a compelling case for secondaries and co-investments to potentially contribute to achieving these goals.

1. Mckinsey Global Institute: Bridging Global Infrastructure Gaps, June 2016

2. According to Campbell Lutyens

3. According to Cogent, $37 billion of transactions were completed in 2016, $40 billion in 2015 and $42 billion in 2014

4. Preqin

More Related Content...

|

|

|