Investing for impact through real assets benefits communities and investors alike

|

Written By: Paul Myles |

Paul Myles of Schroders looks at the benefits of pension funds’ investment in local real estate and renewable energy infrastructure

Discussions are ongoing within the LGPS around what will be announced in the long-awaited future of pooling consultation. Expectations are for guidance that the LGPS should consider investing more in UK-based real assets, given their capacity to deliver domestic impact. The need to support UK PLC has been made abundantly clear by the “Levelling Up” agenda.

What does this mean for the running of these pension pots?

Impact and real assets

Impact investments aim to deliver financial return as well as a positive social and/or environmental impact. Opportunities can address a range of pressing challenges, from sustainable agriculture to renewable energy or financial inclusion, and exist in both the developed and developing world.

In developing economies, the opportunities for impact investment often relate to improving, at-scale, access to education, banking or climate resilience. In the developed world, impact investing can be less about country-wide systems and more about physical places; more likely to target individual communities or areas in specific towns. Increasingly, the approach is referred to as “place-based impact investing” (PBII).

Accocrding to the social advisory firm The Good Economy, PBII has the same broad intention as other impact investments, but has “a focus on addressing the needs of specific places to enhance local economic resilience, prosperity and sustainable development.”

In the UK, this style of investing can often be most needed, and effective, in post-industrial areas, rural communities and coastal areas. These areas are often defined as “deprived” (National statistics, “English indices of deprivation”) and the UK is home to some of the widest social inequality in the developed world, on a national basis.

Addressing these local needs and inequalities is a key focus for the UK government’s Levelling Up agenda, which seeks to “create opportunities for everyone across the UK.”

Although Levelling Up was not conceived with exactly the same ideology as PBII, the overlap is clear. But there is only so much central and local government can deliver.

Post Covid-19, government borrowing is at record levels, interest rates are rising and local government budgets have been cut.

The need for private sector capital to address the target challenges of impact investment and levelling up is therefore also clear.

Two asset classes in particular are uniquely aligned with impact, with real asset backing, while prioritising stable income. Here’s how real estate and renewable energy infrastructure can build future prosperity for both investors and the areas where their capital is deployed.

The vital role of real estate

Real estate will be critical to achieving greater social equity. Real estate is an inherently social asset, impacting us directly and indirectly on a daily basis. It is the environment we have created for ourselves, impacting what we do, how we act, what we learn and who we interact with. It even affects how we feel and our living standards, health and prospects in life.

Social and affordable housing

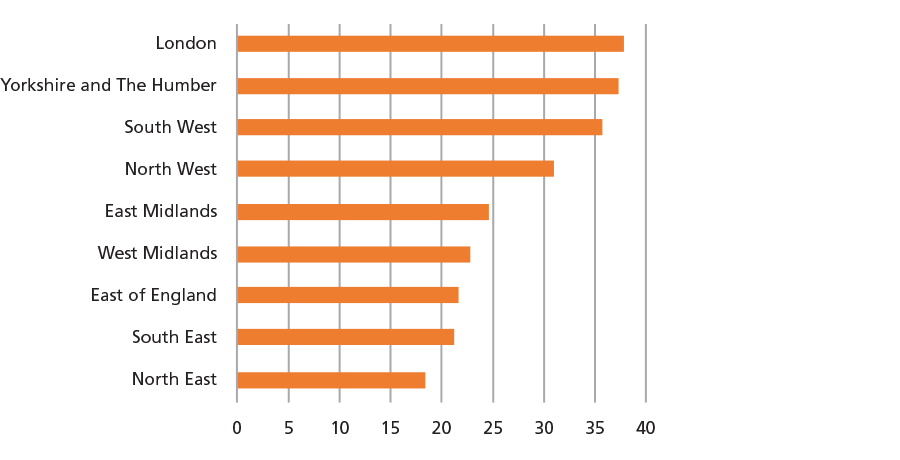

1.2 million households in England alone are now on waiting lists for homes. Those in need are spread across the country, as shown in Figure 1.

Figure 1: Waiting list as % of social housing units

Source: Schroders

These people are often in unsuitable or inappropriate accommodation. This can have profound knock-on impacts on health, debt, work and study, local authority housing budgets, as well as access to healthcare and addiction services. It’s a long list, and investing to increase the supply of appropriate and affordable social housing can have direct positive impact on many aspects of it.

However, traditional providers of social and affordable housing are constrained from delivering new homes. Many need to build up reserves to meet rising interest rates, while facing increasingly stringent building standards and imminent asset decarbonisation bills. This creates a need to form partnerships with private capital to deliver new homes where.

Decline of retail from UK town centres

Competition from out-of-town locations and online retail was exacerbated by the Covid-19 pandemic, leading to widespread vacancy and dereliction and all the associated socio-economic downsides.

26,000 retail and leisure outlets are estimated to have closed since 2014, and unless action is taken, this trend could get worse still. Savills estimates 83% of current retail buildings will fail currently proposed environmental legislation by 2030.

Restoring a sense of community, local pride and belonging, especially in those places where they have been lost, is a key goal of Levelling Up. Satisfaction among residents and engagement in local culture and community can meaningfully improve with a regenerated town centre.

The opportunity in real estate impact

We believe this unprecedented need for private capital to invest in repurposing UK town centres represents a remarkable opportunity. Regenerating town centres with more sustainable real estate can attract new businesses and allow innovation to flourish. The town centre is also where most sustainable transport infrastructure is directed. Residents would be more likely to live in vibrant areas where communities meet and services are available.

Successfully deployed, PBII can improve the place it is focused on, improve the lives of those that reside and work there, and deliver wider, indirect positive impact on economic prosperity.

Approximately £10 billion of public sector funds has been made available to towns and cities across the UK, through Levelling Up awards, the Town Centres Fund and Future High Streets Fund.

More recently, Homes England has created further momentum through re-positioning itself to use its financial clout and tools to deliver new homes as well as the regeneration of places across the UK.

Much more private sector capital needs to follow this public sector investment to have a positive direct impact. We believe investors have good reason to provide it, and now more than ever.

Investment returns from real estate investment in these areas may have been lower than in higher growth locations like London historically, but they have also been less volatile and delivered a higher income return. And with current entry prices well below replacement cost, it provides an opportunity not seen for a generation. In addition to the social impact delivered, investors can receive a low volatility, long-term income stream. Investors can also benefit from inflation tracking over the long-run, and cyclically-insulated returns.

The vital role of renewable energy infrastructure

Another area of critical government focus and investment is the energy transition. Moving energy systems from fossil fuels to renewable and green energy sources will require enormous amounts of capital.

However, while the challenge is one that will require national and even international coordination, a meaningful amount of this vast capital need will need to be invested into local investments.

The way that we generate electricity is changing

Historically, energy generation was heavily centralised. There were few, but very large and energy dense, power stations that produced significant amounts of electricity (generally powered by coal, gas and nuclear).

The electricity transmission and distribution infrastructure was then designed to transport electrons from these behemoth power stations outwards to urban and industrial centres (resembling a ‘hub and spoke’ approach).

The energy system of tomorrow is more likely to resemble a spider’s web, criss-crossing the country. This system will join smaller but well-distributed power stations powered by renewables such as solar, onshore wind and offshore wind. Energy will flow both to economic centres, and other infrastructure that needs to be built as part of the energy transition and to fight climate change.

The impact of renewable energy infrastructure

This greater penetration of renewables in local areas will increasingly offer a number of benefits.

Local climate and environmental goals

Biodiversity in particular is an important element. We are putting beehives onto many of our solar parks to help improve pollination in the area, while re-wilding sites around on-shore wind farms to support local species.

These projects can also engender interest and participation from the local community. We support many community works through our assets. We invested over £5 million in 2021 into local projects, engaging with others by partnering with local schools to educate children about climate change and environmental issues.

Renewable energy infrastructure can also be a source of fixed price power for the local government to buy. This can help provide stimulus to encourage local villages.

Job creation

The most visible aspect of the energy transition from a local impact perspective is the creation of jobs.

The re-jigging of the power infrastructure of the country will introduce both challenges and opportunities across the country from an employment perspective. There are areas where a large proportion of economic activity was or is based around fossil-fuel intensive power stations. Pivoting this into more sustainable forms of energy generation or energy transition-related infrastructure will be important.

As an example of this we have invested into a biomass plant in the Rotheram area that produces base-load electricity – effectively power that is produced 24/7, regardless of the weather conditions. It feeds constant electricity into the system in an area where historically coal-based power stations have produced a large amount of similar electricity, and offers around 35 highly skilled jobs for the area.

In many other areas though (many of which need economic input), we see new jobs being created. We have built East Anglian greenhouses, creating over 200 highly skilled construction jobs, as well as 150 ongoing seasonal jobs at peak, with local economic activity cascading out. Even in off-shore wind, which by definition isn’t local, helps to create local jobs; Mostyn Port in North Wales is the base for the operations and maintenance of the wind farms in the Irish Sea, and has 30 full-time jobs associated with it.

We believe pension funds can invest in local investments that provide numerous social and economic benefits – and contribute to Net Zero ambitions – without detracting from investment return.

More Related Content...

|

|

|