Is there a place for LDI strategies in local government pension schemes?

|

Written By: Paul Myles |

Funding levels for local authority pension funds are highly sensitive to factors including interest rates and inflation. Paul Myles of F&C puts LDI firmly in the spotlight as an approach to managing these risks

Local authority pension funds are subject to a range of uncertainties in many different forms, from the affordability of the current benefit structure and funding the scheme over the long term, to the efficient management of existing investment and liability risks.

A pension scheme’s financial health can be measured using a simple metric – “the funding ratio”. This is calculated by dividing the value of the scheme’s assets by the value of its liabilities and converting to a percentage. If a scheme has a funding ratio of 100% it is described as fully funded, less than 100% and it has a funding deficit, more than 100% and it has a funding surplus.

Figure 1: The funding ratio

Historically, the pensions industry has focused on fund assets and on making them grow in the belief that this will, over the long term, lead to a strong funding position. However, the value of the liabilities can be highly volatile, with changes in liability values having a direct impact on the funding ratio. Changes to accounting rules, regulatory pressure and falling real-yields have all put more focus on the liability side of a pension scheme’s balance sheet.

Never before has it been so important to approach pension scheme risk management with an integrated approach using the full range of tools available, with the focus shifting from simply achieving positive investment returns to management of future liabilities. Liability Driven Investment, or LDI, is a key tool to allow pension schemes to identify and limit specific liability risks, through a tailored investment approach. Without tying up significant amounts of capital, LDI is able to counteract significant risks within a scheme, whilst allowing the LGPS to look for other return-seeking opportunities elsewhere.

What affects the value of a pension scheme’s liabilities?

There are three key factors which will affect the value of a scheme’s liabilities. They are as follows:

Inflation

A large proportion of most schemes’ liabilities are linked to inflation in some way. Essentially, they are a promise to pay a fixed future benefit, plus the rate of inflation over the period. If inflation is high, the value of the resulting pension payment will be high and vice versa. When valuing the liabilities, the scheme actuary will use a measure of expected inflation (which can be derived from investment market pricing). If future inflation expectations exceed these, the value of the liabilities will rise and vice versa.

Figure 2: Inflation effects on liabilities

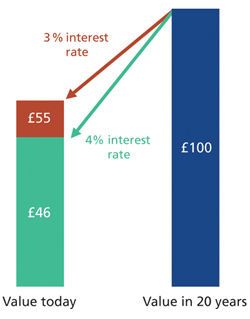

Interest rates

Having determined the likely value of the future pension payment (either a fixed- or inflation-linked payment) we need to convert this into a present value in order to make a direct comparison with the market value of the scheme’s assets. This process is known as “discounting” and involves applying an assumed rate of return to the known future pension payments, in order to work out how much money you need today to reach your target. The greater the assumed rate of return, the less money you need today and vice versa. The assumed rate of return is known as the discount rate. If this rate rises then the present value of the liabilities will fall and vice versa. The rate used by the actuary will be linked to market rates and is typically based on a corporate bond yield, a Gilt yield or a swap yield. Therefore, as markets move, the value of the liabilities will also move. It should be stressed that these are long-term (up to 50 years) interest rates and should not be confused with the short-term central bank rate.

Figure 3: Interest rate effects on liabilities

Longevity risk

This is the risk that the members of the pension scheme live longer than anticipated. If this happens the scheme has to pay benefits for longer and thus needs more money than originally anticipated. Longevity is generally rising, leading to an increase in pension scheme liabilities. There are very few longevity-linked investments, which means it is difficult and expensive to hedge longevity risk. The majority of LDI strategies therefore focus only on managing interest rate and inflation risk.

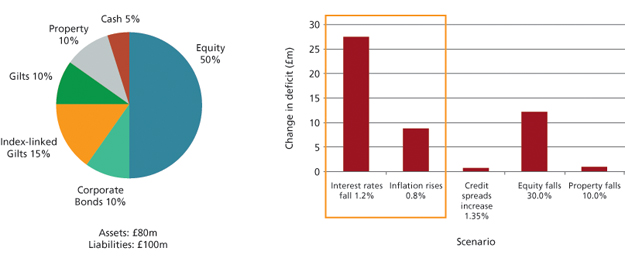

Quantifying the risks

If asked, most schemes would probably cite equity market risk as the biggest risk they are running. However, the impact of changing interest rates and inflation expectations can be greater than the impact of equity market moves. The average time to payment of most pension scheme liabilities is around 20 years. This means that a 1% fall in interest rates results in 1% per annum less for 20 years for the scheme, and a 20% rise in the liability value (i.e. you need 20% more assets today to counteract the 1% pa. lower yield achieved over the next 20 years). This sensitivity is often referred to as duration. The higher the duration (measured in years), the greater the sensitivity to change. If duration is 10 years, a 1% interest rate fall would result in a 10% liability increase and if duration is 20 years the increase would be 20%. The same sensitivity principle can be applied to inflation, albeit not all of the scheme’s liabilities will be linked to inflation.

It is worth considering the impact of equity market moves as well. Equity markets could realistically go up or down by up to 20% in a year. If a scheme has a 50% allocation to equities then this will equate to a 10% funding ratio impact (assuming the scheme is fully funded), which is significantly less than an interest rate change utilising the previous example. We often describe equity market risk as rewarded risk, as the scheme has taken an active decision to run the risk in the hope of generating a premium return. Interest rate and inflation risk on the other hand are often described as unrewarded because they are inherent in the mathematics of valuing the liabilities and are not consciously-sought risks. LDI is therefore, about managing and minimising these unrewarded risks whilst continuing to take and potentially optimise the rewarded risks.

Figure 4 illustrates the impact of a 1 in 20 worst case outcome for each of a range of risk factors, on a typical pension scheme’s funding deficit.

Figure 4: Asset allocation and effect of 1 in 20 worst case outcome for each factor

Liabilities have a duration of 23 years and are 60% inflation-linked. Corporate bonds modelled using the iBoxx Sterling Non Gilts Index, Gilts modelled as the FTSE Gilts 15+ Index and Index-linked Gilts modelled as the FTSE Index-Linked Gilts 5+ Index. Market moves modelled based on 5 years on monthly data to 30th September 2012

Source: F&C Investments

How do we manage these risks?

The best way to manage these risks is to build a portfolio of assets which mimics the sensitivity of the liabilities to changes in interest rates and inflation expectations. The most obvious asset type for doing this would be bonds. A bond’s price rises when yields/interest rates fall and it is also possible to purchase inflation-linked bonds (e.g. index-linked Gilts), whose coupon and capital payments are explicitly linked to inflation. There are however, a number of problems with trying to build a hedge using only physical bonds. The first relates to the availability of the bonds. A pension scheme will have payments to make each and every year for the next 50 or so years. Bond availability is more limited than this, with only 12-15 different maturity bonds available. This means that the scheme will have a surplus of cash in some years (as a bond matures), which will require reinvesting and too little cash in others, forcing the sale of bonds to meet pension payments. Additionally, physical bond hedges are capital inefficient. Most schemes have a funding deficit and need to invest in growth assets (e.g. equities, property, infrastructure etc.) to help reduce the deficit. If a scheme has invested fully in bonds to hedge liabilities, there is no capital left to invest in growth assets.

This is where the techniques used within LDI are invaluable; permitting significant risk mitigation without the need to tie up large amounts of capital, thus freeing up assets for an allocation to growth assets. Derivatives such as swaps behave in the same way as a bond in that the value of an interest rate swap rises if interest rates fall, whilst the value of an inflation swap rises if inflation expectations rise. However, derivatives such as swaps are contracts for difference and thus have zero value at inception. They only acquire a positive or negative value if markets move in favour of or against the holder of the instrument. Because they have zero value on day one no money changes hands at the point of transaction, which makes them highly capital efficient. Clearly, however, the contract could move against the scheme and take on a negative value. In such a scenario this loss would be mirrored by a fall in the value of the scheme’s liabilities and so the funding ratio remains unchanged (all other things being equal!).

Swaps are commonly used, over the counter derivatives that are traded directly with market counterparties, who are typically investment banks. Because they are traded over the counter, they can be highly tailored to the needs of the investor. To limit counterparty risk, trading partners can be monitored and diversified in addition to posting daily collateral.

To better understand how a swap works it is worth considering an example. Let’s imagine a scheme with a £100 liability due in 20 years’ time and £46 in the bank today. Interest rates are currently 4% and if they remain at 4% the £46 will grow into £100 and the liability can be paid in full. However, the risk to the scheme is that interest rates change, in particular that they fall. If they fell to 3% the scheme would need £55 today rather than the £46 it has. To mitigate this risk the scheme could enter into a 20 year interest rate swap whereby it receives fixed interest of 4% on £100 and in return pays variable interest on £100. This therefore creates certainty that the scheme will generate the required 4%. Variable interest rates typically reference 3 or 6 month LIBOR (London Inter Bank Offered Rate) and this may be more or less than 4% but the scheme is entering the swap to reduce risk rather than to reflect a view on the direction of interest rates. It is important that the scheme can pay its side of the swap i.e. variable interest on £100, but one would generally expect the scheme’s growth assets to earn more than LIBOR over the long term.

Figure 5: The impact of changing interest rates – cashflow to be paid in 20 years

LDI for Local Government Pension Schemes

Corporate pension schemes have historically been the early adopters of LDI strategies, partly driven by changes to corporate accounting rules but also in response to trustee concerns around sponsor covenants. However, whilst local authority accounting rules are slightly different and the scheme “sponsor” is the UK government, the same underlying principles apply. Real yields have fallen significantly which has resulted in a material rise in pension scheme liability values. This has highlighted the sensitivity of funding levels to changes in interest rates and inflation expectations, and in turn focused attention on managing these unrewarded risks.

There has been some ambiguity over the permissibility of derivatives and some LDI fund structures for local authorities, which appear to have been obstacles to implementing LDI mandates. As a leading LDI provider, F&C have sought a QC opinion on these points in order to help potential clients move from strategy setting to implementation. This opinion supports our own internal legal team’s view that derivatives can be held by local authorities for risk management purposes (LDI clearly being a risk management strategy) and that our LDI fund structure is a permissible asset for up to 35% of a local authority scheme’s assets.

More Related Content...

|

|

|