Key investment themes for 2017

|

Written By: Kevin McCreadie |

Kevin McCreadie of AGF Investments discusses what he believes to be the most important themes for investors in 2017

The year ahead faces heightened investor concern related to political uncertainty, turmoil within select markets, and a wavering bond market. These challenges mean that active management may have the opportunity to provide value to investors in 2017.

Opportunities are present across global markets

Our outlook for global markets remains positive for 2017, offering a key element of diversification.

- The US markets have rallied quite significantly since the election and we think that trend will continue

- We continue to favour Japanese equities on the premise that structural reforms are working and the central bank is able to further weaken the currency, thus driving export growth

- Emerging market valuations are attractive and should trade relations hold between the US and China, we expect to see select opportunities within the region

We expect the US market will continue to rally over the medium term, supported by positive sentiment related to the Trump administration’s pro-growth agenda. Whether all of this can be accomplished will remain uncertain, but we are optimistic for overall market growth in 2017. Structural reform in Japan, combined with attractive earnings revisions, creates a positive outlook for the region. Japan has been one of the best performing markets leading into 2017 and valuations remain favourable. In China, we are of the view that growth will reflate towards the government’s target range. Despite bubble fears, we like China over the near-term, though we would cautiously monitor trade relations with the US as a potential headwind. Due to elevated political risk relating to several upcoming elections, combined with a central bank that’s seemingly running out of options, our outlook for European equities is moderately negative.

Profiting from political risk

We view political uncertainty as an opportunity to see through market noise and find undervalued companies to invest in.

- The US could muddle through 2017, depending on what policies the Trump administration enacts, how quickly these take effect and what volatility his active social media presence may cause

- Though the Brexit vote took place last year, turmoil will no doubt continue into 2017 as Article 50 is enacted and negotiations for the UK’s removal from the EU play out

- Both France and Germany will host elections in 2017, defining the direction of those countries and whether they follow suit with the populist movements that have gained momentum recently

While major political events such as Brexit and the US presidential election took place last year, a ripple effect into 2017 will weigh on markets, in our view. And with political uncertainty comes the opportunity to profit from volatility caused by speculation and fear. By staying focused on fundamentals and on a disciplined investment processes, it is our belief that active management can have a positive impact. Regionally, we believe the rally we’ve seen in the US will continue into the beginning of 2017. If pro-market policies can be enacted, as promised by Trump, we could see further growth. Europe, in contrast, is facing consequences of decisions voted on last year that we expect will stem market growth. Coupled with our view of over-valuations, Europe is generally an area we’re avoiding to start the year.

Energy set for a resurgence

Multiple factors appear to be working in favour of a significant rebound for commodities, especially energy.

- Current exchange levels favour Canadian exports with a weak loonie relative to the US dollar. If the US continues to hike interest rates, as they are expected to do three time in 2017, this should move the US dollar even higher

- OPEC members, as well as some other nations, have agreed to production cuts set to begin in 2017. If the terms are adhered to, this should start to tighten supply, moving prices higher

- We think energy, particularly oil, could push towards the mid-US$60 range by the end of 2017 as supply decreases and demand rises

Energy has been a volatile space as of late, with prices coming off of lows reached last year. We think a resurgence in energy, particularly in drilling and mining sectors, is likely, supported by a number of factors. Though Canadian data is still lagging, we think at some point we’ll see the weakened currency relative to the US dollar support exports. In addition, an agreement by several nations to reduce production should bring supply to a manageable level. Due to depressed prices, the last two years have lacked investment in new drilling capacity in North America, which has brought supply down as well. As this starts to balance with demand, we expect to see oil prices rise.

Navigating through higher rate volatility

Central banks face a challenging environment as inflationary conditions move to the forefront.

- Bond yields around the world have been pulled up by higher US rates. The Bank of Japan and European Central Bank, for example, continue to ease, yet their bond yields have actually risen on this fact that the world is reflating

- If reflationary traits continue, fuelled further by US policies, rates could be pushed higher. Yields in Canada are likely to follow US rates higher

Fixed income markets have been particularly volatile, influenced by macroeconomic data and increased political risk. Bond yields around the world have moved up sharply, driven higher by US rates following Trump’s victory. While the US Federal Reserve Board increased interest rates in December, other central banks remain accommodative. We expect that yields will move higher, supported by improved growth and inflation prospects. If the rise in yields is substantial, it will likely crimp economic growth and negatively impact equity markets. In this environment, we continue to prefer spread products such as corporate bonds and select opportunities in emerging market debt.

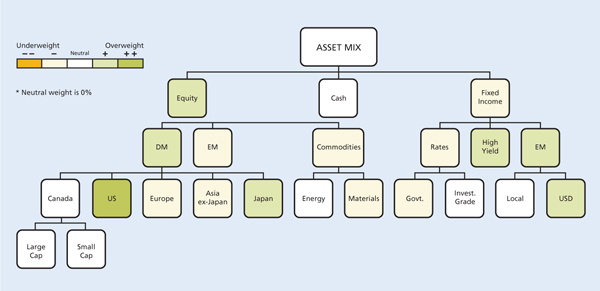

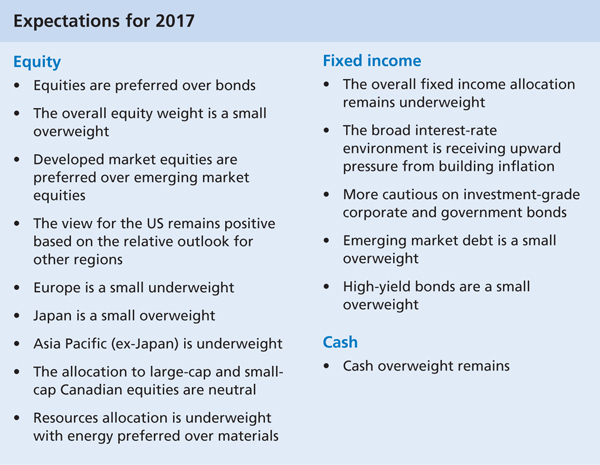

Figure 1: AGF’s view of 2017

Source: AGF Asset Allocation Committee, as of 6 January, 2017

Disclaimer

The commentaries contained herein are provided as a general source of information based on information available as of December 31, 2016 and should not be considered as personal investment advice or an offer or solicitation to buy and / or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Asset Management (Asia) Limited (AGF AM Asia) and AGF International Advisors Company Limited (AGFIA).

AGFA is a registered advisor in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. AGF AM Asia is registered as a portfolio manager in Singapore. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

Effective September 30, 2012, AGF Investments includes AGFIA and AGFIA Ltd. The firm definition was redefined in order to include AGFIA and AGFIA Ltd. under the AGFI brand and to centralize operational functions from a GIPS perspective.

Effective January 1, 2014, AGF Investments includes Acuity. The firm definition was redefined in order to centralize operational functions from a GIPS perspective.

Effective March 25, 2015, AGFIA Limited (AGFIA Ltd.) was deregistered and was removed from AGF Investments (the GIPS entity). The clients and assets managed under AGFIA Ltd. have been transferred to AGF International Advisors Company Limited. The firm definition was updated to reflect this event and the change has no impact on the data of this presentation.

Effective April 17, 2015, Acuity was deregistered and was removed from AGF Investments. The clients and assets managed under Acuity have been transferred to AGFI. The firm definition was updated to reflect this event and the change has no impact on the data of this presentation. For accredited investors only. Published Date: February 22, 2017.

More Related Content...

|

|

|