LGPS: A call for (active) evidence

|

Written By: Jeff Houston |

The topic of active investment, and the use of such strategies in the LGPS, has once again reared its head in the corridors of power. Jeff Houston of the LGPS Advisory Board writes here to open a discussion on the subject with local authority pension funds that have track records in active management

An apparent contradiction

“Moving all listed assets (quoted equities and bonds) to passive management could reduce the cost of investment management by around £230 million p.a.”

“For the LGPS in aggregate, equity performance before fees has been no better than the index. Listed assets such as bonds and equities could have been managed passively without affecting the Scheme’s overall performance over the last 10 years.”

Hymans Robertson LGPS Structure Analysis May 2014

“The majority of equity investment is undertaken through global mandates. A third are managed passively whilst the remainder are managed on an active basis.”

“Most bonds are managed on an active basis and the move towards absolute return portfolios (all of which are managed actively) has meant that the level of passive management within this group has declined further in the latest year.”

PIRC Local Authority Pension Performance Analytics 2017-18

Given the disparity between the above quotations it would perhaps be understandable for some within government, for whom the 2014 report was commissioned, to be raising an eyebrow, or two, in the face of the LGPS’s continuing commitment to active management.

Thanks in no small part to the problems of a certain Equity Income Fund, the drumbeat in favour of a shift to passive has gotten a little louder recently. Perhaps, therefore, this would be a good time to revisit the evidence, not only to look at the obvious cost/performance balance but also at other elements which go towards a full value assessment of investment outcomes such as risk and volatility, together with the ability to target investments and engage with companies in line with the scheme’s variety of ESG policies.

The active vs. passive debate

Of course this debate is not unique to the LGPS and has been furrowing the brows of investors worldwide since the launch by Vanguard of the first fund to track the S&P index in 1976.

In short the debate rages between those who profess the market to be efficient with all reasonable outcomes priced in by rational investors who allocate capital to companies who will best use it and those who see opportunity in the poor pricing, irrationality and inefficient capital allocation of that same market.

Perhaps the most famous proponent of passive management is Warren Buffett who advises that… “Both large and small investors should stick with low-cost index funds.” A sentiment that investors, recently at least, seem to share. In 2018 US active managed assets dropped by $150 billion while inflows to passive funds were $395 billion.

All, however, is not so clear cut. Warren Buffet’s investment vehicle Berkshire Hathaway is by no means entirely passive. And despite the flight of assets from active management, a little over 50% are still managed in that way.

Also, active strategy had – and continues to have – its nexus of celebrity protagonists including John Maynard Keynes. While developing the economic theory that bore his name, Keynes found the time (over 20 years) to very actively and very successfully manage the Kings College Cambridge endowment fund consistently outperforming the UK equity market by over 5%.

Is passive cheaper?

The evidence would appear to be conclusive, passive management is relatively cheap compared to active: bordering on free in some situations. Yet the last part of that statement in itself should at least raise a few questions. Why would an asset management company perform a service for next to no fee? Is there something we are missing?

Since the 2014 report, which could only reach conclusions on the data available, we have seen the rise of investment cost transparency via pressure from investors, pension fund members and trustees. In the LGPS this has taken the form of the SAB Code of Transparency, of which almost all listed managers, active and passive, are signatories.

What does that transparent cost data tell us about passive and active investment? Do annual management charges in themselves tell the story or is there a more complex narrative involving transactions and stock lending?

Is there really no difference in performance?

The 2014 report looked at the ten years up to 2013 and concluded that in aggregate LGPS listed equities did not outperform the relevant geographical indexes. If such an outcome can be evidenced on a consistent basis then the case for active investment in order to achieve outperformance would appear to be severely lacking.

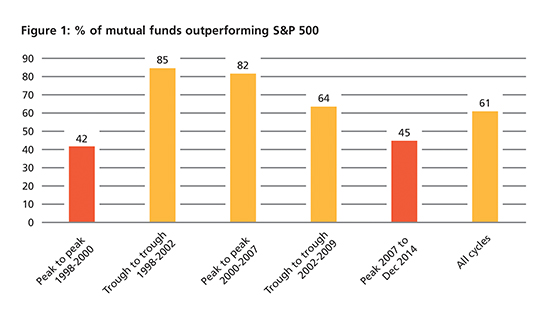

However in an Invesco study of 3,000 mutual funds over 20 years to 2014 a slightly different picture emerges. When compared to the S&P 500 over the five market cycles in the period the majority of active funds beat the benchmark index in three cycles with over 60% of funds outperforming the index across all cycles.

Figure 1: % of mutual funds outperforming S&P 500

Sources: FactSet Research Systems Inc

Does active involve more risk and greater volatility?

If a fund’s long term return requirement is matching a global equity index then it stands to reason a passive mandate would be the lowest risk way of achieving that target. However life is never so simple. Deficits, the need for income, and changes in the make-up of liabilities will all make different and sometimes competing demands on return. Could LGPS funds have achieved their performance objectives passively over the last 20 years or would such a target have left them in deficit and short of cash? Tracking the index means riding the market rollercoaster whoever it goes. What would have been the headlines at each valuation if returns had tracked the market?

Finally what about the impact on individual LGPS funds? Even it were true that average performance would not suffer from going passive that means there would be winners and losers. Who would the losers be, what would be the impact and how would the employers in those funds feel about increased employer contributions for the greater good?

Can I implement my climate risk and ESG policy passively?

Turning our gaze toward future investment objectives different questions emerge. Can a passive strategy deliver when it comes to minimising climate risk and implementing ESG policies? Is the market capable of efficiently managing climate risk by effectively pricing it into every company, sector and region which will be impacted? Or do institutional investors like the LGPS need the flexibility of active strategies to avoid, invest and engage with the market in order to manage their own risks? Similarly can an LGPS fund implement its objectives regarding environmental or social impact passively?

Although there are passive and quasi-passive products available that appear to answer some of these questions, is there the range, scale and ability to quickly respond to investor demand necessary to meet the requirements of the LGPS?

A call for evidence

The investment landscape in 2019 is a different country to 2014 – with different pressures and demands for the LGPS. Rather than just rehearsing the same arguments on active vs. passive, isn’t it time for another look at the evidence? If you agree, and you represent an LGPS fund willing to provide the data needed for that evidence, please get in touch.

More Related Content...

|

|

|