Long-term real estate investing: focus, control and optionality

|

Written By: Julian Agnew |

Julian Agnew of LaSalle Investment Management outlines the factors considered by LaSalle as they determine strategies to navigate the current uncertainties over property values engendered by BREXIT

When considering how we invest for our clients, investment strategies are typically impacted by three major forces; cyclical, structural and secular. We are all used to living with business cycles, as economic growth ebbs and flows, usually mirrored by investor sentiment and building activity. Structural shifts tend to occur more abruptly, but are not necessarily distinct from the cycle. Arguably, years of economic austerity have fuelled anti-globalisation rhetoric that directly contributed to two relatively recent structural shifts; the Brexit vote and the Trump victory. Secular trends are longer-term in nature and we identify the key drivers, in so far as they impact real estate, as demographic, technological, urbanisation and environmental (DTU+E). Long-term strategies need to filter for all of these.

Set against the backdrop of pooling and the potential for increasing the scale of property investment, how might these forces impact strategies for LGPS pension funds given their long-term investment horizons? Indeed, where are we in the property cycle? What does Brexit mean for property strategies? How do you invest in order to benefit from, or mitigate, the secular DTU+E themes?

Where are we in the cycle?

Property is cyclical, driven by:

- The economic cycle

The stronger the economy, the stronger the demand for commercial space as businesses expand. In turn, rents and prices rise, although not always in tandem. As economic growth eventually slows, tenant demand eases and rents follow. - The amount of development

Notwithstanding planning or political pressures, developers typically react to rising prices by building more. This introduces the risk of over-supply when the economy slows, exacerbating potential for downward pressure on rents. - Availability of credit

Credit acts as a magnifier both to development activity and pricing. - Pricing in other assets classes

Property pricing can move simply because property looks cyclically attractive relative to the returns available elsewhere.

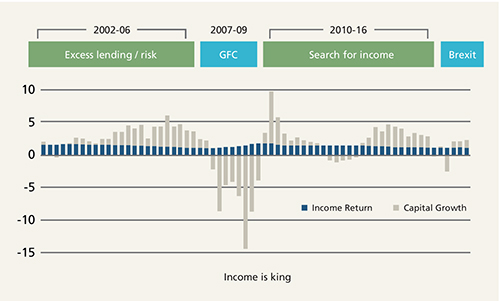

Since 2001 – when the MSCI/IPD Quarterly Index started – there have been three distinct phases to the property cycle (Figure 1) (1) excess lending and rising willingness to take on risk that was halted by (2) the global financial crisis (GFC). This was followed by (3) a recovery phase and a search for yield in the low interest rate environment of the post-GFC world, and then (3b), life after Brexit. Throughout, one thing that has remained relatively stable is the income yield property delivers. As we will come on to, the ability to generate sustainable income underpins our investment strategies for long-term investors.

Figure 1: Where are we in the UK property cycle?

Source: MSCI Quarterly Index

LaSalle Investment Management. LOCAL GOVERNMENT PENSION INVESTMENT FORUM

The chart also demonstrates the benefit of having a long-term perspective. Despite the intervening volatility, if you had bought in 2001 and held throughout, commercial property would have delivered an average annual income return of nearly 6.0% and capital appreciation of 1.7% per annum; a total return of 7.7%, just out-performing index-linked Gilts, which returned an average 7.6% each year. This compares to annual returns to UK equities of 5.2% and 6.2% for UK government bonds.

Economic forecasts have clearly taken a hit since Brexit, but notwithstanding the uncertainty, the economic outlook is currently subdued rather than recessionary. Furthermore, there has not been the same level of over-building in this cycle as in the late 1980s. Over the next two years, the City of London is the only major office market expected to see development completions above the historic average. The fact that development has been kept in check has in part been the result of a more restrained and regulated lending environment since the GFC.

In terms of current pricing, even after Brexit, which prompted a short-term dip in prices followed by more modest returns compared to recent history, property yields are low by historic standards. However, when compared to other asset classes, particularly index-linked Gilts, the case for property continues to look compelling. But given the uncertainty brought about by Brexit, how do we at LaSalle navigate this uncertainty and invest when property still looks expensive relative to its own history?

What does Brexit mean for property?

The extent of the uncertainty surrounding the UK’s withdrawal from the EU means that making predictions with confidence is challenging. There are however a number of themes we expect to play out. Uncertainty is rarely good for businesses and this will hamper decision-making. The knock-on effect will be subdued letting markets, meaning less upward pressure on rents. Financial services occupiers are particularly vulnerable to this as the debates over passporting and the role of London as a financial centre continue. We do though believe that London will retain its position as a major financial centre. We are not alone and since the vote, a number of major financial services occupiers have confirmed their plans to remain in the capital.

Occupiers will be more selective and slower at making decisions; space will have to be “just right” and on flexible terms that suit the tenant. The decline of the “squeezed middle” retail locations – those offering neither convenience nor an “experience” to shoppers – will accelerate, as rising inflation places pressure on retailer margins, bringing forward rationalisation plans.

We expect below-trend economic growth and consumer spending over the next three to four years. Our forecasts are for modest, “income only” returns to property over the next five years, although that timeframe misses the point – and this is the key to our view of Brexit – investing for the long-term needs to look through the cycle and structural uncertainty, and instead focus on secular themes.

What are the secular challenges out there?

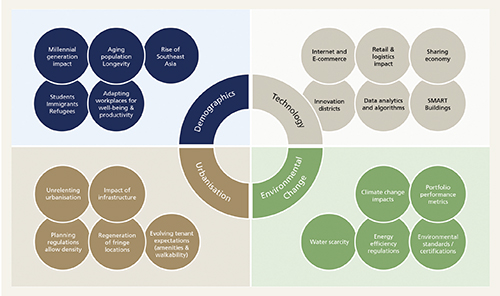

We believe four key secular trends – demographics, technology, urbanisation and environmental change (Figure 2) – will fundamentally shape the demand for physical real estate over the long-term.

The demographic shifts are many and varied, but examples include ageing populations placing unprecedented pressures on healthcare provision and the millennial generation challenging the way we work, live and shop. The most immediately obvious technological impact continues to be the role of the internet and concerns over whether some “bricks-and-mortar” retailers will provide sufficient “experience”. But also artificial intelligence, driverless cars and how these changes will impact the demand and role of physical property. A recent survey1 found that by 2025, 60% of respondents expected the use of predictive analytics to optimise hot-desking to be commonplace; 82% believed grocery-ordering systems that predict household needs based on habits, weather, time of year and consumption will be standard. Both have implications for how we use office, retail and logistics space.

Figure 2: Secular DTU+E themes

Source: LaSalle (01/17)

The trend towards urbanisation continues apace, raising the importance of transport nodes, regeneration, and walkability, while buildings with poor environmental credentials will increasingly fall off occupiers’ radar and in time become unlettable. On the flipside, we believe that the most sustainable buildings will command a premium rent, though cost pressures driven by Brexit uncertainty may delay this.

The demand for physical property will evolve and in some cases, fall. What this means is that DTU+E trends will drive above-average leasing activity and value increases in dense, walkable micro-locations that are dominated by millennial workers. The key of course is identifying the winners and losers.

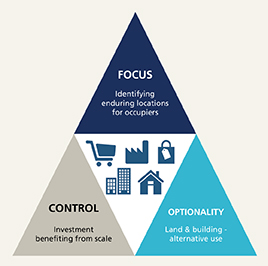

If you are a growing pension fund and have scale, as well as a long-term perspective, these trends translate into a strategy (Figure 3) that should:

Focus on enduring locations

Focus on locations where capital will be preserved. We expect that towns and cities with an irreplaceable difference and good connectivity will continue to attract workers and thrive as a result. Retailers are already recognising this and typically now focus on far fewer locations than they might have done 10 years ago. Any strategy would focus on existing transport nodes and also where transportation will continue to improve over the next 20 years.

Embrace optionality

Changing technology has the potential to affect the asset class in many ways so buildings should be located in areas that can support a range of uses and offer optionality. This builds in longer-term resilience to evolving shopping, working and lifestyle patterns. The goal should be to acquire assets that you have no need or desire to sell. For instance, in the right locations, retail parks are effectively urban logistics offering the benefits of both direct sales and “click and collect”. In major towns they have long-term optionality for alternative uses, particularly residential, assisted living and social housing, able to provide solutions to the demographic themes we see playing out. This also means being prepared to look at alternative sectors.

Figure 3: What does a long-term strategy look like?

Source: LaSalle Investment Management. LOCAL GOVERNMENT PENSION INVESTMENT FORUM

Exploit scale

Scale gives you greater opportunity to control the surrounding environment and tenant mix and create influence in engaging with the local authority and community, ensuring you are giving something back. At scale you are also competing against a smaller pool of capital when acquiring properties. It has always been LaSalle’s belief that scale can introduce greater efficiencies; the government’s pooling proposal is aligned with our belief that portfolios can be more effectively managed with fewer, larger assets.

DTU+E is much more about mixed-use investing than it is about single-sector picks, the traditional approach when managing a portfolio against an MSCI/IPD benchmark focusing on short-term performance.

What does this mean in practice?

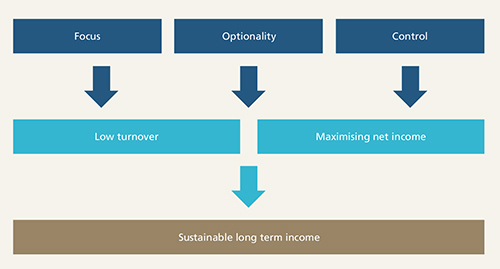

Focusing on enduring locations keeps turnover in the portfolio negligible and minimises the drag of property trading costs. This, rightly, focuses you on maintaining and growing income. The aim should be to create a portfolio where there is the least amount of income leakage and minimal capital commitments from the owner needed in order to maintain the assets’ income production over a medium- to long-term basis (Figure 4).

Figure 4: Long-term investing in practice

Source: LaSalle Investment Management. LOCAL GOVERNMENT PENSION INVESTMENT FORUM

How do we identify these opportunities?

Recent work by our Research & Strategy team has quantified some of the secular DTU+E themes through a measure of human capital (LEHCI)2. Knowledge is the catalyst in driving innovation, competitiveness and growth. Population density and education levels increase in areas where there is a higher stock of human capital, whilst it also enhances creativity and cross-collaboration between industries, attracting talents, jobs, and investments. As such, areas with higher levels of human capital have better long-term economic prospects and thus possess higher attractiveness for real estate investment.

The combination of these tools and themes help us to construct portfolios that have assets in resilient locations and are able to better perform during downturns, delivering sustainable long-term income in a way that benefits both investors and local communities.

1. Marketforce: A World Shaped By Predictive Analytics – A day in the life in 2025

2. LaSalle European Human Capital Index (LEHCI) defines human capital as the level of skills, knowledge, creativity and innovation enhanced by investments and embodied in the ability of the labour force of a region to produce economic value.

More Related Content...

|

|

|