Longer leases, broader horizons and higher yields

|

Written By: Christopher Head |

As competition for alternative income-producing assets hots up, investors will need to broaden their investment horizons to achieve higher yields, says Christopher Head, head of UK local authorities at BlackRock

The investment case for alternative, income-producing assets will be familiar to LAPFs: they generate bond-like, inflation-linked yields at a premium to Gilts, which are currently trading at record lows. However, in many cases, these alternative assets – often called Secure Income Assets (SIAs) – are so highly sought after for their liability matching properties that the yield premium has been significantly compressed. This is particularly evident in the case of long lease property and, in this highly competitive landscape, investors will need to be more selective to find yields of 5% or more.

A recap of the SIA investment case

Since the advent of quantitative easing, government bond yields – even long-dated bonds – have traded at all-time lows, making it harder for LAPFs to find sufficient returns to meet their liabilities. Investors looking to hedge against inflation have also seen yields plummet, with index-linked Gilts currently trading at negative real yields. Against this backdrop, investors of all kinds are looking beyond traditional investments at other income-generating asset classes such as SIAs that typically offer higher yields than government bonds over long time frames.

SIAs typically refer to long lease property, infrastructure and renewable energy, which share key investment characteristics: they generate steady, predictable income streams of long-dated, fixed or inflation-linked cashflows, secured against underlying assets. Typically, they have a marginally lower credit rating than Gilts; however, default and recovery rates can be clearly ascribed to each SIA using a credit assessment of the underlying asset, and have a high probability of payment of cashflows at pre-specified dates. They offer diversification benefits against traditional assets but crucially, they also offer a yield pick up over government bonds. These attributes make them ideal for liability matching purposes in a low yielding environment.

Investors are able to command the yield premium over bonds because of two distinct factors. First, for real estate, infrastructure and renewable energy debt opportunities, traditional sources of funding, namely banks, have pulled back from these markets, following stricter capital requirements and a challenging banking environment. With traditional sources of capital dried up, these asset operators are aiming to actively attract institutional investors such as LAPFs with competitive income rates. Secondly, investors can demand higher yields given the long-term nature of these investments, which can often require long lock up periods.

Long lease property

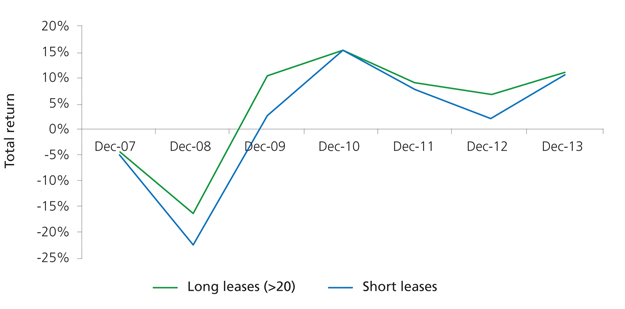

A different dynamic is at work for long lease property investments. Owners of alternative, commercial properties in the UK retail, leisure, healthcare or student accommodation sectors are vying for institutional investment by offering more attractive income streams than the mainstream commercial property market. Strong covenants with high quality tenants on longer-than-average lease terms mean that they can offer premium levels of income, inflation protection and guaranteed (or inflation-linked) rent uplifts for up to 20 years. This is in contrast to traditional UK core opportunities that feature open-market rent reviews. Moreover, as a real asset, the physical property not only acts as collateral to the income stream (in the case of tenant default the property can be re-let) but also gives exposure to gains in the underlying asset price. Figure 1 shows how the long lease property market has delivered more stable total returns than the broader UK property market over the long term.

Figure 1. Performance of long vs. short leased properties 2006-13

Source: IPD, August 2014

Unsurprisingly, these investments continue to be a big hit with institutional investors with long-dated, inflation-linked liabilities, and many of the traditional long lease markets have matured as a result. However, a by-product of this demand is that yields in many popular sectors have been compressed and investors can often find themselves waiting long periods to invest. This is not ideal for investors looking to deploy capital efficiently in investments that yield competitive returns. As popularity for this asset class continues to grow, investors will need to be more discerning in order to find the kinds of yields that were on offer in more popular sectors six years ago.

Maturing sectors mean lower yields

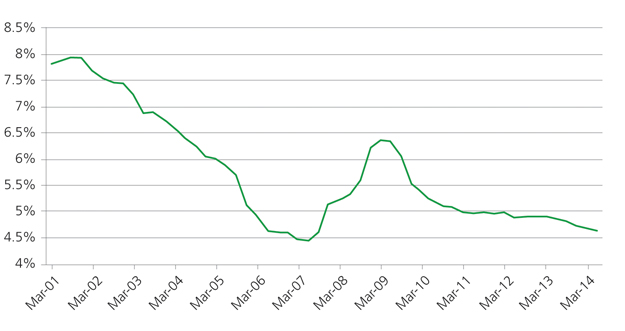

The out-of-town supermarket retail sector is a good example of a sector that was once “alternative” but now mainstream, having seen considerable institutional demand over the past decade. Figure 2 shows how yields in the sector, most of which are based on long leases, have compressed over time. One leading property research house benchmarks prime, inner London supermarket yields at 4%. However, some lease investments on quality tenants such as Waitrose and Sainsbury are generating yields as low as 3.7%1, a far cry from the 6+% yields that investors received in 2009.

Figure 2. Supermarket yields

Source: IPD, August 2014

The student accommodation market is another example of a sector that has matured significantly. Initial institutional investments were on the basis of long-term direct leases to universities or nomination agreements whereby a university guarantees a number of lettings. Subsequently a range of investment options have become available, from 100% guaranteed occupation and income to 100% direct let to students, giving investors greater choice over the risk/reward profile of their investment. However, strong year-on-year rental growth has attracted many new investors to this sector, with competition driving down yields to 5% for the best assets.2

Looking further afield for yield

Even in this oversubscribed environment, 5+% yields are still available in long lease property investments to investors who know where to look for relative value. Core to any sound investment is a deep understanding of the tenant’s credit strength and the intrinsic value of the property. With this in place, investors can begin to look beyond traditional assets for opportunities overlooked by the wider investment community.

Understanding a tenant in the current climate requires a combination of rigorous due diligence and an ability to bring together a broad range of expertise across both equity and fixed income. It is not sufficient to simply consider historic data – a real-time view needs to be constructed. For example, there are a number of tenants in the market place who, despite showing weak historical data, are actually fundamentally robust. We believe that tenants with strong, recovering fundamentals, but which are overlooked by the wider market, present a strong investment thesis.

Along with this approach, relative value can be found in “alternative” asset classes. Sectors such as healthcare and leisure are more complex and harder to analyse due to less available data, and therefore attract less competition. However, with the right investment partners, forward-thinking investors can collate enough data to generate the deep insights required to invest in these sectors before they enter the mainstream.

The right investment partner

Long lease investments trade on private markets, making it harder to source investment opportunities. They also exhibit a mixture of property, equity and bond characteristics, as well as the idiosyncrasies of alternative sectors. Successfully tapping this rich seam of opportunity requires an investment partner who has the breadth of market expertise across multiple asset classes, the investment experience in alternative markets, and the pipeline of opportunities to find the best deals with the best terms as they arise. Of particular importance is the ability to assess the credit worthiness of all parties involved in a deal.

1. CBRE Ltd, August 2014

2. CBRE Ltd, July 2014

More Related Content...

|

|

|