Looking forward at diversified growth funds

|

Written By: Geraldine Sundstrom |

|

Dan Phillipson |

Geraldine Sundstrom and Dan Phillipson of Pimco consider the likely future of diversified growth funds over the coming decade and identify three characteristics that they feel are important for success

Many local authorities are questioning the role of diversified growth funds (DGFs) within their portfolios, given their performance over the last 10 years. The questioning is natural and appropriate, and yet we believe that the answer may be materially different to the extent one looks forward rather than backwards. Here we look to outline our thinking on the subject and address the characteristics that we expect will be necessary for DGFs to play a valuable role within a Local Government Pension Scheme (LGPS) portfolio over the coming 10 years and beyond.

While there is a very broad array of DGFs exist in the marketplace, we find investors have typically allocated to them in order to fulfill two common objectives: first, as a source of growth or absolute return over time and, second, to the extent that the allocation is funded from equities, as a means of diversifying equity risk within the broader portfolio and getting exposure to different asset classes in an agile manner.

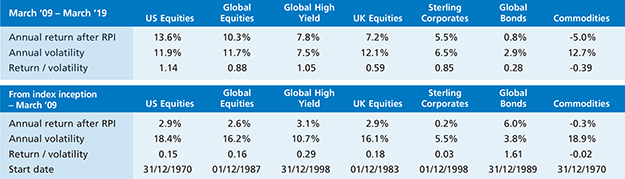

The last 10 years represent a high bar for measuring DGFs versus these objectives. Indeed, general market performance has been extraordinary over the last 10 years, with risk assets, equities and high yield in particular, providing very strong absolute returns net of inflation. Additionally, they have done so with unusually low volatility, as Figure 1 shows. In fact, historically it has been a period of high returns and low volatility for risk assets, and in hindsight, diversifying away from them would not have been the best decision from a pure realised-return perspective.

Figure 1: Return and risk net of inflation

Source: Bloomberg. All figures in GBP. Equity and commodity indices are unhedged. Fixed income indices are hedged to GBP. U.S. equities represented by the S&P 500 Index; Global equities represented by the MSCI ACWI Index; Global High Yield represented by the Bloomberg Barclays High Yield Index; UK Equities represented by the FTSE 100 Index; Sterling Corporates represented by the Bloomberg Barclays Sterling Corporate Index; Global Aggregate represented by the Bloomberg Barclays Global Aggregate Index; Commodities represented by Bloomberg Commodity Index. As of 31 March 2019. RPI is Retail Price Inflation.

However, unlike 10 years ago when asset prices adjusted down sharply after the 2008 financial crisis, asset prices are starting from much higher levels today. Depending on your viewpoint, valuations currently sit anywhere between fair value and expensive. This means that the returns for traditional liquid asset classes over the next 10 years are likely to differ materially from those over the last 10 years. We anticipate not only lower absolute returns but also higher volatility. Ultimately the next 10 years are very likely to be a more difficult environment for investors – but also one where DGFs, if designed appropriately, are likely to cut a better figure and justify the investment rationales for pension schemes to hold them within a balanced portfolio.

Importance of design

We think three characteristics will be important for a DGF to be successful over the next 10 years:

1. Breadth

Because global equity and fixed income markets are starting at relatively elevated valuations, the capability to widen the investment universe and move beyond broad building blocks is likely to add value. Access to a breadth of liquid markets should help diversify overall risk and improve outcomes. These could include real assets such as US treasury inflation protected securities (TIPs), emerging market corporate debt such as US dollar-denominated Chinese corporate bonds, and liquid structured credit such as Danish mortgage-backed securities. Similarly, exposure to alternative betas or risk factors should serve as a source of attractive risk-adjusted returns to the extent that they are well designed and do not ultimately allocate to traditional betas.

In addition, DGF managers that take a more critical view in evaluating the inefficiencies within markets are likely to perform better. Many managers devote a substantial portion of their risk budget to individual equities within highly-developed markets, arguing that they have skill and that this adds breadth to the portfolio. We find the evidence convincing that outperforming equity markets via this approach is difficult; this approach is also likely to become particularly burdensome as many of these funds have grown exponentially in size over time and perhaps well beyond their initial design. We would argue for highly disciplined capacity management and for deploying breadth within a DGF by including less-correlated betas to traditional bonds and equities or exposure to bottom-up, more idiosyncratic markets such as fixed income where greater inefficiencies exist.

Liquidity mismatches can present a risk lurking below the surface if a DGF invests in less liquid or illiquid investments such as direct real estate and private equity. While these allocations can broaden a portfolio and have convincing risk and return dynamics, we would argue that they are better placed outside of a DGF in a vehicle better suited to their underlying liquidity characteristics.

2. Agility

Having an agile DGF that can implement tactical asset allocation and capture market opportunities as they arise is particularly attractive in the context of a typical pension scheme’s governance structure – which is usually better suited to strategic asset allocation decisions. The move to pooling of local government pension schemes (LGPS) should result in faster and more efficient implementation of investment decisions with the ability to shift allocations across a pool’s sub-funds. In fast-changing economic and market conditions, the ability to delegate the tactical decision-making to a DGF (that is able to alter its risk profile in very short order – days as opposed to weeks or months) can be of tangible benefit to the scheme.

This is particularly important taking into account the current economic cycle, as volatility and dispersion across and within asset classes have historically increased at this point in the cycle. We believe this will help not only in improving returns over time but particularly in managing drawdown risk, which leads to the third characteristic of importance.

3. Downside awareness

Many of us recall the uncertainty and pressure placed on an organisation during the 2008 financial crisis as asset prices fell sharply. Since then, we have found that inertia and risk aversion become behavioral responses to the uncertainty, which has at times led to missed opportunities and locking in losses. A DGF that looks to minimise drawdowns via diversification, active risk scaling and selective use of hedging strategies can help moderate these behavioral and organisational risks at a portfolio level – thereby improving outcomes and easing governance related pressures.

Conclusion

In summary, while many DGFs have struggled to meet the bar over the last 10 years, the next 10 years are likely to be very different. To increase the probability of success, investors may want to consider allocations that have the resources and design to incorporate breadth, agility, and a focus on managing downside risk.

Important Information

For professional investor use only.

Past performance is not a guarantee or a reliable indicator of future results.

PIMCO Europe Ltd (Company No. 2604517) and PIMCO Europe Ltd – Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (12 Endeavour Square, London E20 1JN) in the UK.

This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2019, PIMCO.

More Related Content...

|

|

|