Low carbon workplaces open up exciting new investment opportunities

|

Written By: Don Jordison |

Socially responsible investment has become an increasingly prominent phenomenon in the investment world, with a particular focus being moves to reduce the carbon footprint of businesses. Don Jordison of Threadneedle outlines the opportunities.

Here in the UK, the government has led the way to a low carbon economy with its commitment to cutting carbon emissions by 80% by 2050, setting up the Carbon Trust and introducing new regulations, notably the Carbon Reduction Commitment (CRC). What might surprise investors, such as UK pension schemes and other institutional investors, are the lucrative possibilities these tougher low-carbon standards actually open up.

UK commercial property accounts for around 20% of the country’s total carbon emissions, so it is no surprise that the government chose to aim legislation at this large, very visible target. Most existing UK offices do not satisfy the new CRC regulations, which are fuelling an increasing demand for carbon-compliant workspace. This current non- compliance, coupled with a vast shortage of supply presents a significant, indeed once-in-a-lifetime, investment opportunity. The Carbon Trust is an independent, not-for-profit organisation that works with companies and the public sector to cut carbon emissions and reduce energy costs. As indicated, property is a key area of focus and in 2010 the Carbon Trust selected Threadneedle Investments, one of the UK’s leading property asset managers, and Stanhope, a renowned property developer with expertise in sustainable refurbishment, to launch the UK’s first Low Carbon Workplace Fund. This new fund is unique in that it is the only property investment fund accredited by the Carbon Trust’s affiliated company, Low Carbon Workplaces.

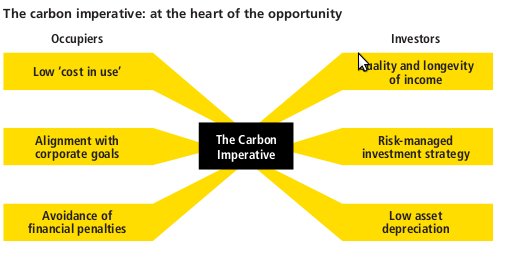

Meanwhile, the growing (and largely unsatisfied) occupier demand for low carbon commercial buildings in the UK will almost certainly increase over time. Aside from CRC, demand will be driven by a range of commercial imperatives, including corporate social responsibility and stakeholder awareness. For office-based businesses, recognition of accommodation as the single biggest contributor to their carbon footprint is placing low-carbon compliant workplaces at the top of corporate responsibility agendas.

What may surprise some is that the government’s legislation need not overburden businesses with costs. Most property professionals agree that the CRC should actually benefit the industry with the creation of a single coherent set of rules to approach the issue. Now, with the introduction of the CRC, energy reduction is in focus and it has elevated the issue from facilities management to top management. CRC employs a cap-and- trade approach that requires participating organisations to monitor their energy usage and buy allowances for each tonne of CO2 they emit. So there is a direct incentive to reduce energy usage to avoid buying allowances. Nevertheless, the Carbon Trust has calculated that the savings gained should exceed both the cost of implementing any improvements and participating in the scheme.

According to Carbon Trust research, latent demand for low carbon work space is around 4.3 million square feet. But new development is sluggish and, in its current state, the UK’s existing stock (80% of which is more than 10 years old) is unlikely to comply with current or future carbon legislation. Completely replacing it is not a viable option – even in good years, newly-built space accounts for only 1% to 2% of total stock.

Under these circumstances, the CRC has brought a welcome focus back onto existing stock. The refurbishment cycle on office properties is typically around 20 years, with a significant proportion of standing properties due for refurbishment in the next 10 years. This presents a key window of opportunity for property owners (and investors) to ensure that their office space meets the CRC standard, enabling them to differentiate themselves from properties that will soon become largely obsolete. The good news is that many city centre buildings can be made suitably energy efficient very cost-effectively, particularly older office stock. This second lease of life will offer owners better security and quality of income as they have the opportunity to attract solid, stable tenants that are likely to take longer leases. Progressive landlords will also benefit from greater capital gain potential, shorter void periods and high levels of pre-let.

Initially, one of the more attractive pools of potential tenants is likely to be private sector organisations – high quality occupiers who have an added incentive to save money and be environmental exemplars, but other ideal early tenants wishing to occupy this sort of property include public sector bodies. As to potential investors in a portfolio of low-carbon compliant properties, UK pension schemes and other institutional investors would seem to be a natural fit because they can combine high return potential and more secure long-term income with a socially responsible investment.

Another significant consideration associated with CRC for property owners is the issue of depreciation. After 10 to 15 years the physical fabric and components of a building have always needed to be refreshed, requiring a great deal of capital expenditure. Now, ensuring that a building meets low carbon standards becomes another element to be factored into accelerated depreciation. Where previously buildings could be functionally or physically obsolete, now they can be environmentally obsolete too; the investment opportunity is in eliminating that part of the equation from an office portfolio.

Looking further ahead, despite the benefits for those investors who move quickly to exploit the rapid advantages to accrue from the CRC that we have outlined above, longer-term benefits will ultimately prove just as appealing – especially for institutional and pension fund investors. Although potential tenants will primarily want to change initially for reasons of reputation and economy, further legislation involving carbon reduction is likely to evolve, increasing occupier demand into the future. The principal thing to remember is that this issue is not a short-term one. These high- quality tenants will continue to embrace the need for energy efficiency and consequently will value the expertise that landlords who have mastered the principles associated with carbon compliant workplaces can offer. This will give them an edge over competitors, because such positive occupier engagement provides the opportunity to build a closer relationship with tenants, thereby increasing the likelihood of leases being renewed down the line.

So for investors, far from being a negative development, the advent of CRC provides those interested in benefiting from investment in the property market a completely new avenue to achieving attractive returns over the medium to long term. The Low Carbon Workplace Fund aims to address this demand, delivering performance through the ability of these uniquely competitive buildings to attract considerable demand from high quality occupiers and secure a long-term income.

For Investment Professionals use only, not to be passed on to private investors. The Low Carbon Workplace Fund is an unregulated collective investment scheme in the UK. As such, units in the Fund may not be offered or sold in the UK except as permitted by the Financial Services and Markets Act 2000 and the regulations/FCA Rules made under it. This document may not be communicated to any person in the UK except in circumstances permitted by that Act or those regulations/rules. The research and analysis included in this document has been produced by Threadneedle Investments for its own investment management activities, may have been acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice. Past performance is not a guide to future performance. The value of investments can fluctuate.

More Related Content...

|

|

|