Mansion House reforms: implications for UK private equity and venture capital?

Published: August 11, 2023

Written By:

|

Paul Myles |

|

Pav Sriharan |

Paul Myles and Pav Sriharan from Schroders Capital explain the fundamentals of private equity and how – by encouraging capital into the asset class – Jeremy Hunt’s reforms can help boost the UK Economy

The Mansion House reforms announced by chancellor Jeremy Hunt in July 2023 were designed to support economic growth, protect the UK’s status as a leader in financial services and improve pension fund returns.

Among many changes, a key element of the reforms was to remove barriers blocking pension capital from backing unlisted UK companies. By “unlocking” pension capital, the reforms intended to boost UK small business growth, and in turn economic growth, while providing more growth for pension investors.

In order to ensure the newly unlocked capital actually funnels into the right growth areas, the reforms included a compact between the government and leading defined contribution pension investors. The compact commits “many of the UK’s largest Defined Contribution (DC) pension providers to the objective of allocating at least 5% of their default funds to unlisted equities by 2030.”¹

For Local Government Pension Schemes (LGPS), the ambition is for double that allocation to unlisted equities, better-known as private equity.

Given the increased attention towards the area, here we dig into the fundamentals of how private equity and venture capital work and how they can affect portfolios.

Private equity: Buyout, venture and everything in between

The LGPS have been allocating more capital to alternative investments – including private equity – for some time now. For those less familiar with the asset class, certain private equity terms can be confusing so we will clarify one or two important things here.

Private equity (also known as PE) is a catch-all term for owning unlisted companies. In terms of company life-cycle, private investment covers everything from start-up, to locally successful family businesses, all the way up to larger profit-generating businesses. More mature private companies will have refined business models that can be scaled up, acquire other businesses, or become publicly listed on a stock exchange via an initial public offering (IPO).

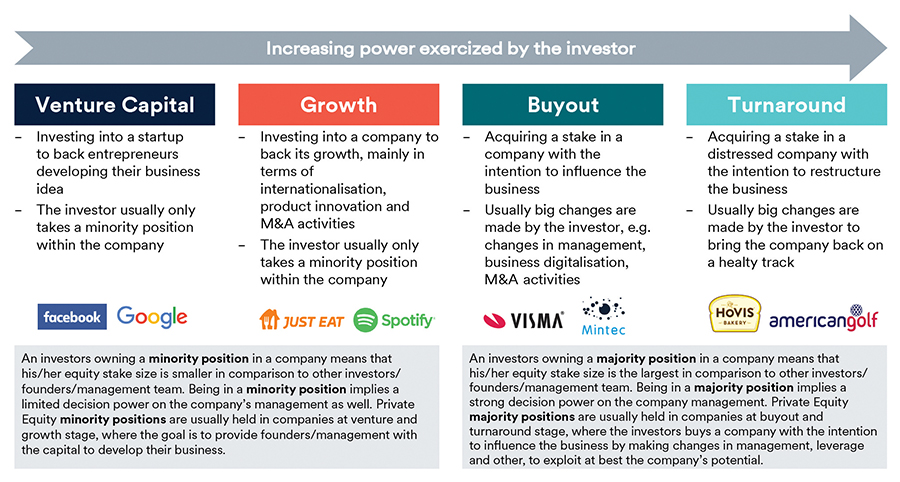

The earliest stage companies in private equity are usually termed Venture Capital (VC). Venture Capital investors typically deploy capital in a larger number of companies than a manager would in the later stages of company growth. In the earlier stages of VC, these companies are often yet to generate revenue but are beyond a “proof of concept”. After venture comes the “growth” stage, which typically refers to companies that are generating revenue, on the cusp of profitability and seeking capital to expand.

Beyond the growth stage, private equity investors will start to talk about “buyout” deals, which can range from small to very large companies. Large leveraged buyouts can be many billions of dollars, and companies can also be taken private having previously been publicly listed on a stock exchange.

There are also “turnaround” strategies, which typically take a majority stake in distressed companies with the intention of restructuring the company and getting it on track.

Figure 1: Navigating the diverse strategies of Private Equity

1. https://www.gov.uk/government/collections/mansion-house-2023

Often cited as a “catch-all” term but investment strategies differ by company lifecycle stage

What routes are there into private equity?

Investing in private equity has traditionally been a collaboration between general partners (GP) and limited partners (LP).

Broadly speaking, GPs are private equity firms, while LPs are typically pension funds, institutional investors and wealthy individuals.

In a conventional PE fund, GPs will raise money during the “vintage year” to create a fund, committing around 5% of the capital, with LPs committing the rest.

This is a “primary” fund investment, and these typically require a substantial minimum investment amount. As with traditional, liquid investment funds, it’s common to use a variety of PE funds for diversification. Not all investors are large enough to achieve this themselves. Combining several PE funds into a “fund of funds” can deliver the diversification required, with lower minimum investment levels.

“Secondaries” has traditionally referred to an LP who sells assets to secondary buyers. The assets can be a portfolio of multiple funds, companies, or a single company. However, “GP-led” secondary transactions have grown significantly in recent years, and now represent the majority of the secondary market. GP-leds allow investors to retain control of select assets they believe still hold potential for value creation. Alternatively, the exit environment may not be right and a GP-led can delay exit until it is.

What are the merits of adding PE to your portfolio?

Past performance for numerous private asset classes compares favourably with liquid investment types, like traditional equities and bonds, over longer investment horizons. Crucially, private markets also have a history of performing differently to liquid markets.

Measuring how different investments move relative to one another – the correlation – is crucial to creating meaningful diversification. Again, data indicates that private assets can contribute to portfolio diversification.

Thematically, large institutional investors have long recognised that private assets are plugged directly into sectors that are harder to access through public markets. For example, the private equity team at Schroders focus on long-term secular trends that can provide tailwinds for investments, which include climate change and decarbonisation, the technological revolution (particularly AI), sustainable living, aging populations and the growth of emerging and frontier markets.

What are some of the risks?

Liquidity and capital call management

Investing in private equity and venture capital requires the investment of a pre-agreed amount of capital (or commitment) over the fund’s life. Investors do not need to provide the entire amount of capital committed up front. Instead, capital is called as fund managers make investments. It takes time for investments to be sourced, improvements made (value created) and exits achieved. This makes it an illiquid investment that ties up capital for a long period of time and therefore the asset class requires patient capital. The secondaries market referenced above has become more mature and can offer a liquidity path for investors seeking earlier exits.

Partnering with the right manager

High-quality fund managers are crucial to the success of private equity and venture capital programmes. The hands-on nature of the asset class means that the skill and experience of the manager can make a substantial difference to returns.

There is a high dispersion between the top and bottom quartile funds by performance. Numerous studies have suggested that there is a persistence of returns, with top-performing managers often outperforming peers over the long-term. However, more recent research points to this persistence weakening following the global financial crisis. This underscores the importance of investors conducting thorough due diligence on fund managers.

Due diligence should examine not just past fund performance numbers, but also dig deeper into individual track records and experience. How has a firm generated its returns? How does it intend to in the future? This detailed undertaking requires experience. Newer investors to the asset class may prefer to initiate their programmes via funds of funds and/or seek help and advice.

Company risks

Fund managers undertake rigorous due diligence before investing to ensure they understand the risks each portfolio company faces and to identify areas for improvement and growth. This helps mitigate the risk of loss of capital, although as with all investment, it does not completely remove it. There remains a risk that a portfolio company does not perform to plan.

The active involvement of fund managers post-investment, including taking board seats, should lower the risk of this happening. In addition, the portfolio approach taken by private equity and venture capital fund managers helps to diversify risk across a number of investments. In a buyout portfolio there may typically be 10 to 15 companies. There may be up to up to 30 in venture capital fund portfolios.

Current backdrop, risks and positioning

Private equity and VC is growing more popular and we expect this to continue. With more investors allocating more money towards the asset class, “dry powder” (cash that has been committed but not yet called upon) has built up in some areas and stretched some valuations as a result of too much money chasing too few deals.

In the next decade we believe that working with managers that have deep experience and well-developed track records will be of growing importance. Building a global portfolio that is well-diversified by investment type, sector, stage and region, structured with a sleeve for investing locally into the UK, would be a good way to navigate the period to come and generate strong returns without necessarily compromising on risk.

In Conclusion

How can the reforms benefit the UK?

We think there were broadly three key motives behind the Mansion House reforms and how they seek to boost asset flows to UK private equity and venture capital:

- To provide higher returns for long-term pension fund holders, as seen in other countries such as the US and Australia where there is a higher percentage of pension assets in private assets

- To stimulate the UK economy. Particularly where there is a funding gap for innovative technology and science companies that require expansion capital for R&D and to scale up their operations

- To help with “levelling up” the UK from a regional perspective, so that private equity and venture capital play a bigger part in the UK outside of London.

Overall, while we think there are some near-term challenges in fully understanding the implications of the reforms, we believe in spirt that they are a net positive for the UK economy in terms of what private equity and venture capital can ultimately contribute.

1. https://www.gov.uk/government/collections/mansion-house-2023

More Related Content...

|

|

|