MENA means business

|

Written By: Fadi Al Said |

Fadi Al Said of Lazard Asset Management explores the opportunities arising from new-found growth in the Middle East and North Africa economies

MENA (Middle East and North Africa) economies are among the richest and fastest growing in the emerging world and growth is not just driven by the oil profits of a small percentage of the population, but by the increased spending power of governments and citizens. This allows for wider participation in broader economies, calling on the services of the many sectors that create the diversity a successful equity market demands. Ironically, governments have succeeded in liberating themselves from a reliance on oil through rising oil profits during the past decade. Higher oil prices in recent years have allowed governments to build budget surpluses and pay off debts. This has led to a steady increase in spending and this spending comes with a high level of visibility. These economies are in a transitional period, with an increasing amount of accountability built into their systems, as regimes hidden behind closed doors increasingly become open-market economies.

Money has pervaded a number of sectors over recent years, with capital more readily available for start-up businesses, housing and education, in addition to large infrastructure investments. The latter is likely to be sustained by Dubai’s successful bid to host the 2020 World Expo and Qatar’s hosting of the FIFA World Cup in 2022. There are also strong signs in MENA countries of revenue increasingly coming from other parts of the economy. The MENA region’s correlation with Brent oil has broken down over a five-year period. The ensuing diversification has made the region less of a risk to investors’ portfolios than it would have been only 10 years ago.

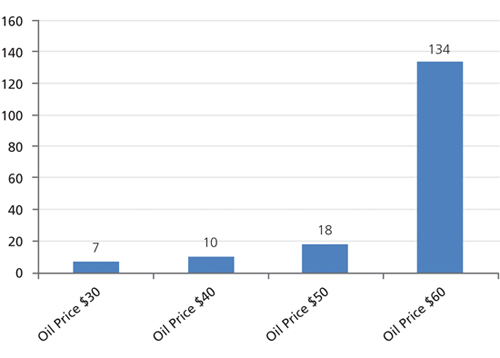

Concerns over the sustainability of investment have been raised following the fall in oil prices towards the end of 2014. However, we are now at a stage where even if oil fell to US$30 per barrel in Saudi Arabia, current spending could be sustained using assets accumulated by the Saudi Wealth Fund (Figure 1). Similar financial reserves exist across the MENA region and have become increasingly important in the face of sustained oil-price declines towards the end of 2014. In addition, post-Arab Spring, there is no turning back from the promises made by MENA governments to address growing calls both for investment in once underfunded sectors, such as education and health care, and to alleviate various economic and social challenges. Saudi Arabia, the UAE, Kuwait and Qatar all have the means to continue with spending programmes, while Oman and Bahrain will need to tighten their fiscal budgets in the face of lower oil prices, primarily due to lower fiscal surpluses and the rising need for infrastructure spending. Either way, there is little to suggest that MENA governments will renege on the commitments they have made.

Figure 1: Number of years the Saudi Wealth Fund can support current spending

Source: Lazard Asset Management

Focusing on Saudi Arabia, according to official numbers, reserves stand at over US$732 billion, which will be of further benefit to the economy, given that debt-to-GDP is very low, at 1.6%, not to mention the strength of the government’s deposits within the banking sector. To put things into perspective, Saudi Arabia would be able to sustain a similar deficit, assuming it keeps to current spending levels and oil remains at US$60 per barrel, for 19 years using its accumulated financial reserves, and an additional 19 years assuming the government taps the debt market to reach a debt-to-GDP level of 100% (still below most developed countries’ debt-to-GDP levels). These numbers are based on the official oil production of 9.5 million barrels per day, compared to a higher actual production level (averaging 10.5 million barrels per day) over the past three years.

In the real economy, set apart from the oil markets and government spending, MENA populations are young, growing and increasingly middle class. In contrast, the developed world has seen populations age, while even the BRICs (Brazil, Russia, India and China) cannot keep pace with the positive demographic changes taking place in MENA societies. In part a consequence of government investment in education, the region has seen literacy rates increase substantially over the past 25 years from 51% to 79%, reaching the world average. MENA also has the highest proportion of people on the planet aged below 30, with 30% of the population below 14 compared to 23% for the BRIC countries.¹ A growing population with a large number of educated middle-class citizens is a cornerstone of economic prosperity.

The importance of population growth, which is now off its recent highs, and should continue to come down as the population becomes ever more prosperous, should not be underestimated. This is known as the demographic dividend, which should give the region a sustained period of labour-force growth, exceeding population growth, and lead to further demand for investment in education, health care and technology. The demographic dividend is defined as a period of 20-30 years where fertility rates fall due to lower child mortality rates. As offspring are expected to survive, people will have fewer children, lowering the number of dependants. The fall accompanies an extension in life expectancy that increases the number of people of working age. With fewer dependants, workers have more disposable income and can help spur economic growth. This disposable income should provide opportunities for businesses in the consumer sectors.

Sector diversity has become increasingly pronounced too during the past six years. Retail, industrial investment, and agriculture and food have all grown in Saudi Arabia since 2008, while the petrochemical industry has fallen by more than 5% to now only make up a quarter of the market. As this process continues, it will allow the region to further de-correlate from oil as the economy branches off in myriad directions. Another indicator of the importance of non-oil sectors on economic growth is the sustained outperformance of consumer companies versus the S&P Pan Arab Composite Large Mid Cap Index.

The exciting changes taking place across the region point to a bright future for investors, as economies commit large amounts of capital to driving growth, while the emergence of an increasingly educated, middle class population signals a key change in spending habits. The evolution of MENA is one of the most compelling investment stories around and hands a bold invitation to investors who wish to allocate to a sometimes misunderstood, but increasingly prosperous market.

1. US Census Bureau International Database

More Related Content...

|

|

|