Mind the funding gap

|

Written By: Mark Fulwood |

Continuing difficulties with bank lending has led to new opportunities in secured credit for investors. Mark Fulwood of Henderson Global Investors takes a closer look.

Many pension funds are natural long-term lenders to governments and companies, and have been doing so for many years through government and corporate bond mandates. The struggles faced by the banking sector – where capital is more constrained and reregulation a big priority for policymakers – has created a structural long-term opportunity for investors to broaden their fixed income portfolios into other types of lending that can offer attractive risk and return profiles in the post-financial crisis world.

What has created the opportunity?

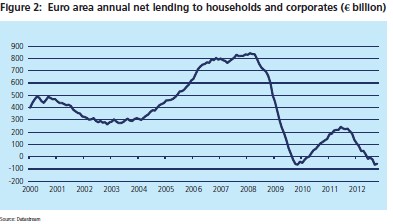

The lending terms offered to borrowers tend to evolve in cycles. The fallout from a period of very aggressive lending practices prefinancial crisis would have naturally resulted in a period of more conservative “lender friendly” conditions. However, the natural evolution of this cycle has been supercharged by the scale of the global financial crisis. The challenges faced by banks in Europe still dealing with large portfolios of mis-priced and/or distressed assets while at the same time struggling to meet new, higher capital requirements means their ability and willingness to lend is severely restricted, and we expect this to continue for several years to come (see Figure 2).

We believe there is a strategic opportunity in senior secured debt, which offers lenders a priority claim on assets or cash flows. This is where the majority of the “funding gap” exists and where the extra downside resilience (or security) in the current highly uncertain macroeconomic environment can provide an attractive trade-off between risk and return.

Opportunities in secured credit

These cover a broad spectrum of asset types, with the main ones summarised in Figure 1.

Look beyond the headlines…

The collapse in asset prices in 2008/09 was a tough environment for all but core government bond markets, meaning that returns even on high quality senior secured assets suffered. In Europe, this was primarily driven by the imbalance between buyers and sellers at that time, as banks and investors who were reliant on borrowing were forced to sell their holdings as credit lines were withdrawn, not because of the fundamental performance of the underlying assets. Since the financial crisis in 2008/09, we have seen a much more balanced market because investors who were forced to sell or unwind positions have virtually disappeared from the market.

The actual performance of the European Asset Backed Securities market is a case in point. Residential mortgage-backed securities, which are backed by pools of mortgages made to homeowners, make up more than 60% of the market, and the bonds have seen total defaults of less than 0.1% (S&P) over the five years since mid-2007 (in contrast to the US where the default rate has been more than 15%). Moreover, all of these European defaults have been in subordinate bonds (lower ranking, first to make loss) rather than the senior bonds.

A similar picture emerges in secured loans. Defaults have averaged 3.8% p.a. over the last five years across the European senior secured loans market as a whole, in what has been a very stressful environment. However, typical recovery rates were 75%, which resulted in credit losses of less than 1% per year for the market as a whole¹. The typical lending terms are much more attractive now than precrisis, with current pricing offering double the return over cash rates compared to 2007. In addition, these new loans should prove less risky as lenders are not prepared to lend as much to these businesses as they might have done pre-crisis.

Commercial property debt is another asset class which exhibits the same characteristics. More than €500 billion of outstanding debt will become due in the next three years, and Morgan Stanley has estimated a €400- 700 billion reduction in lending available from banks to the sector. This mismatch between demand for capital and supply is at its widest in the UK and Germany where many domestic lenders are rapidly downsizing lending. For new lenders such as pension funds, there is limited competition from other potential lenders and a chance to agree strong terms and security packages with borrowers with attractive return profiles.

Accessing the opportunity…

Secured credit assets have some very desirable characteristics – particularly in the current environment of high economic uncertainty and low bond yields.

- Senior secured bonds have a priority claim on assets or cash flows, which can be analysed and stressed to assess value. This security also provides important control in the case of borrower restructuring

- As long-term investors, pension funds can capture a higher long-term return or premium for the generally less liquid nature of some of these assets, which means they can be more difficult to sell on demand

- The interest payments (or coupons) are typically pegged to short-term interest rates (Libor). For investors concerned about locking-in to record low fixed interest rates available on traditional bonds, these assets provide an alternative with some protection against future rises in interest rates

We have seen investors responding to the funding gap opportunity in a variety of ways depending on their size, risk tolerance and timeframe for investment. For many, a well-diversified, packaged solution of senior secured credit opportunities across a broad range of markets has been the preferred route. This brings together a diverse array of exposures that are not found in a typical corporate bond portfolio, improving diversification and allowing investors to take income and deal on a monthly basis. Large pension schemes with a longer timeframe, and for whom frequent liquidity is less of a concern, are more prepared to tie up their capital for five to seven years in closed-ended funds to access the illiquidity premium offered by certain strategies such as property debt. Target returns can be tailored to an investor’s risk appetite, with more defensive strategies targeting a total return in the range of 4-10% p.a. – in our view the sweet spot for investors.

The period of deleveraging and reregulation of the banks will, in our view, result in the continued retrenchment of banks from lending. Long-term, sophisticated investors can step in to fill this funding gap on attractive terms. While these types of investments are not immune to volatility, we believe the combination of investing primarily in senior bonds, and the security provided by a claim on underlying assets, offers good protection in adverse scenarios and a good balance between risk and return.

1. Source: Moody’s and Henderson. 5-year-average Moody’s European Speculative Grade Default data as at 30 November 2012

More Related Content...

|

|

|