No normal cycle, no normal recession

|

Written By: Laurence Taylor |

Laurence Taylor of T. Rowe Price identifies some implications, both short-term and long-term, of the Covid-19 pandemic and gives advice on managing a global equity portfolio in what will be the “new normal”

The coronavirus continues to impact nearly every aspect of society. Financial markets, however, appear to have stabilised and perhaps are looking to the future.

Here, we look at the short-term impact on the economy and corporate earnings, but also at the potential long-term implications for inflation, style reversion, and deglobalisation. Could unprecedented stimulus measures from central banks and governments spark a return of inflation, and hence a style reversion to value-oriented stocks? Also, does the transfer of supply chains back to individual countries help accelerate the pattern of deglobalisation?

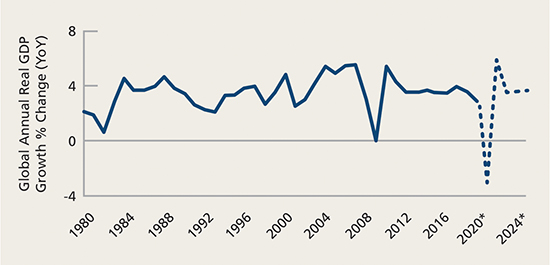

Short-term pain #1: Economies set to contract dramatically

The global economy has entered a recession in the first half of 2020. The unprecedented freezing of global commercial activity in order to stem the spread of the virus was too powerful a force for economies to be able to withstand without a significant impact. There is also the issue of employment and financing. Policymakers have recognised and acted with a speed and magnitude that few would have thought possible in “normal times”.

But this will be a different kind of recession. This is brought about by a natural disaster, not a debt crisis or an economic or stock market bubble. We can’t blame “bad bankers” this time, and certainly not “bad Silicon Valley”, which is helping us through this crisis.

We expect to see disconcerting numbers coming out in the next few weeks and months. If people are unable to leave their homes, economic performance will be awful regardless of monetary or fiscal response. This is no normal economic cycle or recession.

Figure 1: Coronavirus – a monumental economic impact

As of March 31, 2020

Sources: International Monetary Fund (IMF)/Haver Analytics.

*2020–2024 represent IMF estimates.

One cause for optimism is that this contraction should be sharp, but short. Pent up demand, active fiscal policy, and low rates mean that we may see a more rapid recovery from the 2020 crisis than from the 2008-2009 financial crisis.

Short-term pain #2: Forget corporate earnings for 2020

As first quarter earnings have come through, we are already seeing the impact. Corporate earnings have been decimated by the pandemic. However, we believe we need to look beyond the current 2020 price/earnings (P/E) ratio numbers as they are unlikely to be a good indicator of future returns.

How do you manage a portfolio if you have no visibility on earnings? At T. Rowe Price, when we analyse the prospects for stocks individually and collectively, we are thinking much more about normalised earnings into 2021 and onward. What those projected earnings are and how quickly stocks normalise their earnings power will be the keys to recovery. Here, we are optimistic that an equity cycle can be born again from the improvements we expect to occur over the medium term.

For now, surviving the near-term cash imbalance between incomings and outgoings is much more important than P/E levels. Valuations are not defensive in the near term at current levels, but the durability of balance sheets and business models is supportive. Some dividends may be lowered, but if you believe that earnings will recover, and that you may receive an average 2% dividend yield from equities while you wait for that recovery, then we believe that is an acceptable outcome.

While the current earnings season will act as a source of stock dispersion and volatility, we believe the market has done a decent job of writing off a lot of earnings power in 2020. If we are wrong about the pace and magnitude of the earnings recovery, then the recovery may be less V-shaped and more prolonged. The nature of the recovery ultimately depends on the extent and speed of lifting social and economic restrictions over time.

Long-term implication #1: Inflationary and deflationary forces collide

It appears intuitive that some sort of political and societal change will result from the current restrictions being applied to both society and economies. While uncertainty abounds, most of these forces appear inflationary in nature.

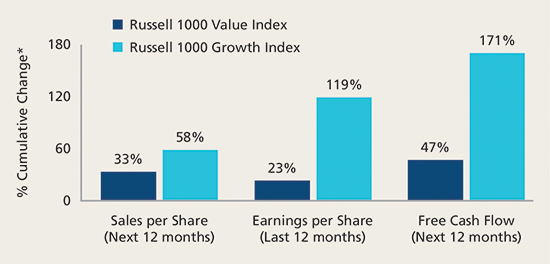

Figure 2: An era of growth dominance

* Cumulative changes represent differences between measures as of June 1, 2007 and March 31, 2020.

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc.

All rights reserved. Russell (see Additional Disclosure).

Accelerating deglobalisation, nationalism/populism (immigration control included), and a mass fiscal experiment to send money directly to individuals from the government would all imply higher inflationary stimulus over time.

If raising wages for society via helicopter money and fiscal deficits can be done once (albeit with the catalyst being a national emergency), the question as to whether governments can do it again to raise real wages (given that wages have stagnated for 12 years, which is the crux of populism) is a sensible one.

The forces opposing higher inflation should not be underestimated, however. Technology continues to unlock capacity, while surplus natural resources and aging demographics remain powerful deflationary forces. These are large and secular trends that will not be steamrolled with ease by fiscal policy.

Long-term implication #2: Style rotation and more opportunity for value and cyclicals?

In terms of market style leadership, growth has materially outperformed value-oriented stocks through this crisis, which is intuitive given the relative impact of economic pain. As markets have risen, investors appear to have doubled down on dispersion between the two. As a result, and combined with the last 10 years of outperformance for growth, we now sit amid a truly unprecedented cycle for growth stocks. Unprecedented in length, but also in the sense that it is supported by incredibly strong fundamentals on the growth side of the equation.

A value cycle emerging would clearly have to have some of its foundations embedded in inflationary forces – forces that have been missing for over a decade. But, if stimulus does indeed push inflation higher, and we must recognise the unprecedented levels of central bank and government measures implemented so far, then a value cycle could finally be spurred on.

While short-term in nature, we last experienced a shift to value in 2016, when it looked like economic growth and, subsequently, interest rates might normalise. However, this failed to materialise due to the long-term secular forces that we have spoken about extensively.

While the sheer strength of growth versus value may create a catalyst for this balance to adjust in the near term, we still struggle to see how a value complex can attain longer-term superiority in this prevailing environment without changes on the inflation front. With interest rates practically at zero for many countries, and no inflationary impulses likely to emerge in the short term, we find it difficult to support a durable style reversion.

Long-term implication #3: Coronavirus accelerates deglobalisation

The coronavirus and the resulting focus on countries being able to be more self-sufficient seems set to accelerate the deglobalisation trend.

One outcome of recent events is the question of supply chain security and the reliance on non-domestic production to meet the needs of society, especially in times of crisis. Think ventilators, personal protection equipment, hand sanitiser, and the struggles of individual governments to provide enough of these products.

The experience of medical equipment shortages, along with the intensifying US-China friction, will make self-sufficiency a more important part of economic policy. Prioritising domestic jobs and production could lead to non-trivial efficiency losses and slower productivity growth, but these forces are unlikely to be enough to cause inflation alone. This will be a significant issue for some business structures, however, especially those with global supply chains as the focal point of populist policymakers.

Managing a global equity portfolio in this “new normal”

There is a growing likelihood that the first wave of fiscal stimulus will be met with a second wave when necessary. Near term, the outlook for global equities is still highly uncertain given the possibility of further drawdowns. No one rings a bell to signal the bottom of the market.

There remains a lack of clarity over the spread of the virus and the eventual decisions that will need to be made to balance a return to work alongside ongoing infection controls. Many signs point toward an ongoing normalisation of economic activity in China from low levels, but we are monitoring the spread of the virus in parts of Asia where there are signs of a re-emergence of infection trends.

Longer-term, there are also real and unanswered questions of how governments will finance stimulus packages and how rising debt levels can be serviced. Despite the near-term uncertainty, we feel optimistic over the medium term (12-24 months) that a new bull market can potentially be born from equity valuations that are lower, as we see stabilisation and then normalisation of economies.

Additional Disclosure

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2020. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell ®” is a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

© 2020 Refinitiv. All rights reserved.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

EEA ex-UK – Unless indicated otherwise this material is issued and approved by T. Rowe Price (Luxembourg) Management S.à r.l. 35 Boulevard du Prince Henri L-1724 Luxembourg which is authorised and regulated by the Luxembourg Commission de Surveillance du Secteur Financier. For Professional Clients only.

Switzerland – Issued in Switzerland by T. Rowe Price (Switzerland) GmbH, Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. For Qualified Investors only.

UK – This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK.

Financial Conduct Authority. For Professional Clients only.

© 2020 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.

More Related Content...

|

|

|