Playing the long game

Published: October 1, 2014

Written By:

|

Martin Grosskopf |

Martin Grosskopf of AGF Investments discusses why environmental themes should be front and centre for institutional investors

Two decades after world leaders gathered at the 1992 Earth Summit in Rio de Janeiro, Brazil, the signs of impactful action on global warming are still sparse despite the rising involvement of the financial community. While some continue to debate the science and ultimate impact of human activity on temperature trends, rapid innovation in the field of sustainability has been disrupting the status quo, pushing the boundaries of traditional industries and producing compelling and marketable solutions to the climate change challenge.

Asset owners like pension funds must revisit and adapt their investment models to both foster and benefit from this fundamental transformation of the global economy and the capital markets that serve it. Sustainable themes are now an important opportunity set in global markets as investors seek out companies and trends that will innovate and drive economic growth in the future.

Disruption in action

The rationale for sustainable investing is clear: the global population is growing and resources must be used efficiently to meet increased demand while ensuring environmental impacts are minimised. Over the last 10 years, ample support has emerged for fiduciaries overseeing long-term assets to consider these material risks within their investment decisions. But asset owners also need to understand that sustainable investing isn’t just a means of risk reduction, it is an opportunity to invest in those very areas of the economy that will drive growth in the decades to come. Consider just a few of the many booming sectors that are responding to growing demand and rapidly transforming traditional industries in the process.

- Lighting: The widespread ban on incandescent light bulbs is one of the many forces transforming the lighting field. Smart lighting, dominated by solid-state technologies such as LEDs, has been growing rapidly as policymakers push builders and consumers to adopt energy-efficient practices. It is projected that LEDs will represent 45% of the global lighting market by 2015 (Source: Phillips, as of April 2013), and residential LEDs could represent 70% of the general light market by 2020 (Source: McKinsey & Co., as of 2013).

- Efficient vehicles: In order to meet local air quality concerns and address broader issues of carbon emissions, policymakers have set aggressive fuel efficiency targets for passenger and commercial vehicles thereby creating a surging demand globally for hybrid-electric and electric vehicles. Tesla is the current leader in this disruptive trend sweeping through the industry. In Canada, plug-in electric vehicle sales have more than quadrupled over the past three years (Source: Green Car Reports, as of July 2014), while the US has seen similar exponential growth. Electric vehicle sales have more than tripled from the first quarter in 2012 to the first quarter of 2014 (Source: Stifel Nicolas Research, as of April 2014). Today, consumers can buy electric vehicles not just from Tesla, but from other major auto manufacturers like BMW, General Motors, and Nissan.

- Solar technology: It only takes an hour for the sun to produce enough energy to meet global energy demand for a year and yet solar energy today accounts for a meagre 1% of global power consumption. That is changing as rapid cost reduction and new financing structures improve returns and increase penetration. In an increasing number of regions, solar energy presents a direct threat to conventional utilities.

Despite the obvious disruptive nature of these technologies, expertise in understanding their investment implication largely remains the remit of specialist funds. The financial-industry model of sector specialists is not conducive to the thematic analysis that would place appropriate emphasis on these technologies. For example, should residential solar be analysed as a consumer product, power technology, or financing model?

Still, the relative lack of attention given to sustainable technologies by large asset owners is not entirely explained by an ineffectual organisational structure.

Risk aversion and the funding gap

Many of the most innovative environmental companies receive significantly less attention than their counterparts in conventional industries for a rather simple reason, they are riskier when using conventional metrics. In almost every case, disruption of 100-year-old industries is not only difficult, but capital and time intensive. Post the great recession of 2008-2009, asset owners of all stripes have prioritised near-term cash flows and low volatility over future potential. This is not particularly surprising, at least for pension plans with defined benefit obligations.

It is somewhat difficult to reconcile this risk aversion with the increasing call for a long-term investment focus. While capital rushes towards the conventional energy industry to progress easily-defined opportunities in drilling, mining and transport, environmental innovators, particularly in the public markets, often remain underfunded relative to their opportunity. The few exceptions have been “Yield Cos”¹ that are harvesting cash flows from long-term utility contracts with little or no technology risk. Few investors see it as their role post-2008 to provide risk capital to long horizon themes, regardless of the movement towards responsible investing. When asset owners do make thematic environmental commitments, it is usually within the private market, yet even this strategy has suffered post-recession due to a lack of exit opportunities.

The nuances of capital flows for environmental solutions providers would not be of much concern if it were not for the tremendous level of commitment being made by the financial community to address key environmental issues such as water and carbon emissions.

For instance, the United Nations-supported Principles for Responsible Investment initiative, which encourages organisations to incorporate environmental, social, and governance issues into their investment practices across asset classes, has over 1,200 signatories representing US$45 trillion of assets under management globally, including both asset owners and investment managers (Source: UNPRI.org).

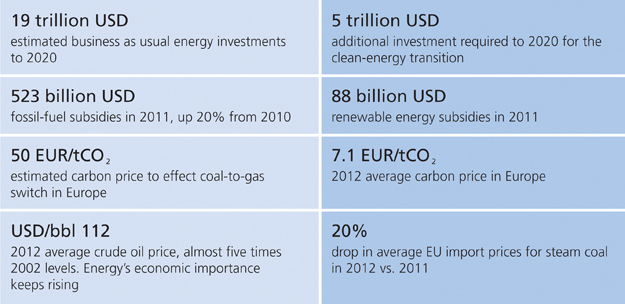

Despite this commitment, investors continue to prioritise stability over transition. So, while US$5 trillion is suggested for a clean energy transition between now and 2020, it is projected investors will pour US$19 trillion into fossil fuel investments. Similarly, an International Energy Agency report in 2013 estimated total subsidies to fossil fuel industries at $523 billion. This dwarfs renewable energy subsidies which totalled just US$88 billion in the same year (Source: European Wind Energy Association, as of February 2013). Most investors will understandably not heed calls for “divestment” of fossil fuel producers given their importance in index referenced strategies but will instead “engage” with their primary portfolio holdings in an effort to improve environmental performance. In effect, the environmental objectives are rather more flexible, nuanced and long-term then the financial ones.

Figure 1: A cleaner future: are investors on the same map?

Source: Tracking Clean Energy Progress, 2013, International Energy Agency (IEA), 2013

The thematic solution

So how can long-term asset owners like pension funds overcome the “short-termism” inherent in global capital markets today? A major part of the solution lies with large institutional asset owners themselves. While many have already signed up to the United Nations Principles for Responsible Investment, very few strategies are funded or evaluated based on their ability to promote long-term objectives such as reduced carbon emissions.

A thematic approach allows investors to go beyond ESG monitoring and to delve into the specific mid- and long-term trends and structural changes that are at play – and perhaps even mould the future in their interest.

We have identified four environmental mega-themes which will remain relevant for decades:

- Energy and power technologies

- Waste management and pollution control

- Water and waste water solutions

- Environmental health and safety

Figure 2: Environmental mega-themes

Source: AGF Investments Inc.

The trends in resource efficiency and environmental mitigation reshaping the global economy are directly challenging existing industries and providing companies with opportunities for innovation to emerge. Within each of these themes, it is possible to find companies at different stages in the value chain and of corporate maturity, resulting in portfolios with high active share and significant diversification benefits.

The solutions are out there, but they require investors willing to match their long-term horizons with a readiness to invest in innovation.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA) and AGF Asset Management (Asia) Limited (AGF AM Asia), AGF International Advisors Company Limited (AGFIA), and Acuity Investment Management Inc. (Acuity). AGFI and AGFIA are registered as portfolio managers across Canadian securities commissions. AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets. AGF International Advisors Company Ltd. is authorised by the Central Bank of Ireland and is regulated by the Central Bank of Ireland for conduct of business rules and by the FCA for conduct of business rules in the UK.

The commentaries contained herein are provided as a general source of information based on information available as of October 2014 and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

Where required the Contracting party may be AGF International Advisors Company Ltd. which sub advises the mandate to AGF Investments Inc. (AGFI). AGFI is an affiliate of AGF International Advisors Company Ltd. and is a wholly owned subsidiary of AGF Management Limited (AGF), a Canadian reporting issuer.

1. Recently, a number of renewable power developers have spun out their long-term contracted assets into ‘Yield cos’ which pay a significant dividend and which are able to grow this dividend through continuing drop downs from the parent company. The Yield cos does not take on development risk which is contained at the corporate level, resulting in a lower risk profile and defined growth trajectory garnering a higher multiple.

More Related Content...

|

|

|