Pooling and private markets

|

Written By: Sam Gervaise-Jones |

Sam Gervaise-Jones of bfinance looks at how the LGPS funds are approaching investment in private markets while the pools become established

Many of our LGPS clients have pushed ahead strongly with investing in new asset classes, particularly within private markets, rather than “waiting for the pools”. 2018 has brought several high-profile examples, including a private debt search by five London boroughs who are also members of the London CIV group.

Indeed, this segment has proven to be one of bfinance’s busiest during the past two years – a fact which may surprise those observers who expected LGPS funds to press pause on innovative activity while the pools set down their foundations. In the period September 2016-18, the team has carried out 23 private markets manager searches for LGPS investors across five pools, with mandates totaling nearly £2.6 billion in private debt, infrastructure, real estate and broad real assets.

Why has there been so much new activity around illiquid investments during this interim phase? To what extent have the funds been working together on these projects? Has the implementation complemented or contrasted with the steps taken by the pools?

Looking back

The launch of the pooling process coincided with another significant, though far quieter, event in the LGPS community: a full valuation and review of all authorities in the scheme. This periodic assessment, which takes place once every three years, is designed to shine a light on LGPS financial health, assessing projected investment returns alongside the scheme’s liabilities.

Conducted in Spring 2016 and released late that year, the review helped to drive changes in investment strategy at many local authorities, amid a climate of low fixed income yields and high equity valuations. In a significant number of cases, these changes included new or increased allocations to illiquid asset classes such as private debt and infrastructure.

The choice at hand: wait several years for the pools to establish investment options for these asset classes, presuming of course that the options would be suitable, or press on with implementation during the interim phase. For LGPS funds, this choice carries both practical and political implications. The primary duty of each individual authority lies with its members. At the same time, all schemes want to work (and be seen to work!) in a way that complements rather than undermines the pool; all schemes want to capture the much-anticipated benefits of greater scale; all schemes want to establish strong working relationships with their pooling counterparts.

In practice these deployments into private markets frequently involved collaboration with one or more fellow LGPS funds. Yet these collaborations have taken many forms: formal and informal; pre-conceived and ad hoc; proactive and reactive; intra-pool and inter-pool; investor-led and consultant-led.

Collaboration variation

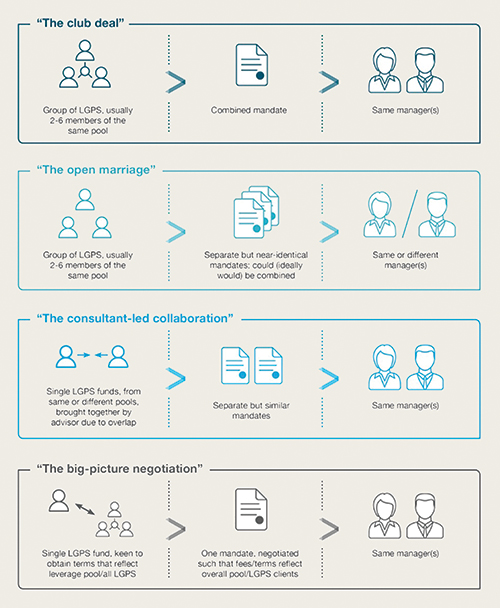

Deploying private market investments during the “pre-pooling” stage should not mean losing out on the advantages that collaboration can deliver. Based on the private markets engagements that bfinance has worked on with UK LGPS funds in the last two years, four distinctive models for such collaboration have emerged. Each of these has proven successful in gaining better fees and terms for investors, such as lower management fees, higher hurdle rates, reduced catch-ups, advisory board seats, increased co-investment rights and more.

Another interesting collaboration dynamic we have observed, not contained within the models pictured above, is the enhanced willingness of LGPS funds to share information, due diligence reports, and research with each other. Analysis conducted by the bfinance team for certain LGPS clients has been shared openly with others in the same pool.

It’s worth noting two features of the models illustrated above. The first: this is not just a “pool” story, although pooling is clearly a major part of this dynamic: managers have been willing to make concessions on fees and terms that take all LGPS clients into account as a group. This is particularly relevant in “consultant-led collaboration” and “big picture negotiation.” In certain cases, managers have first agreed to future fee reductions in the event that additional members of the same pool become clients, based on the understanding that those investments could be viewed as a group for scale discount purposes, and then agreed to extend that arrangement to cover all UK LGPS funds.

The second feature is that these models are not fixed or mutually exclusive: a club deal can morph into an open marriage, as has happened on occasions where different priorities have become more evident during the course of implementation; an open marriage can overlap with a big-picture negotiation; a big-picture negotiation can evolve into a consultant-led collaboration.

Industry interest

The emergence of multiple collaborative models also reflects another key factor: many asset managers in private markets have proven to be highly flexible and receptive in their dealings with LGPS clients during this interim period. The pre-pooling phase is, in many respects, an ideal climate in which to press for better terms. Savvy private debt, real asset and private equity managers have an eye on the implications that today’s concessions may have for tomorrow’s business: as the new pools take hold, those with strong relationships and client bases among the LGPS community will be in a better position to vie for the increasingly large mandates that pooling will produce.

For investment advisers on the other hand, pooling could potentially mean lower revenues over the long-term: fewer clients, fewer hours of work to be gleaned, fewer mandates to handle. LGPS investors should, as a result, be very watchful of the quality and nature of the advice that they are receiving at this time and stay attuned to potential conflicts of interest. Clients should also take care with “consultant-led collaborations” as defined above: the chosen manager and strategy should still represent the best fit for the scheme, after consideration of all potential options and the investor’s specific needs, not simply the best option for the consultant’s bargaining position.

Looking ahead

The different pools are at very different stages in terms of the status of private markets implementation. Some have already appointed staff dedicated to illiquid investments; others are tackling liquid investments now and delaying the illiquid side for another year or more. Some have established investment options for certain private market asset classes, but in certain cases the constituent LGPS funds have not been satisfied with the process that has been followed for these appointments.

There are potential advantages and disadvantages to pooled implementation in private markets, whether as a single pool or in a cross-pool solution such as those pioneered by GLIL and PIP for infrastructure. On the plus side, pool-run private market investments should deliver scale benefits (as long as the number of sub funds is kept sufficiently lean) and reduce the administrative burden. On the downside, reliance on sub-funds can reduce the control that individual LGPS funds can exercise.

Another key advantage of pooling is the opportunity to employ some of the more advanced implementation approaches being practiced by the likes of the larger Canadian pension plans, where investors have moved beyond conventional primary fund (or FoF) investments to make greater use of secondaries, co-investments and ultimately direct investments in assets. These three strategies require progressively greater experience, expertise and in-house capability, as well as larger allocations. They also carry a greater governance burden.

Interestingly, LGPS funds have the opportunity to “leap-frog” through some of the evolutionary stages that international peers have followed.

Going forward, we envisage rapid developments along these lines. Yet we also anticipate that independent or informal collaborative approaches will remain a popular alternative means of capturing scale benefits, although we also anticipate that they should reduce in number as time goes on and the pool private markets teams become more well established.

More Related Content...

|

|

|