ACCESS is a consortium of 11 local authorities, which has proved to be an active and impactful local investor across the ACCESS region, as well as a growth investor across the UK. These administering authorities collectively constitute 1.2 million LGPS members, the largest of all pools, with almost 3,500 employers.

Spotlight: Investing in the UK and the ACCESS regions

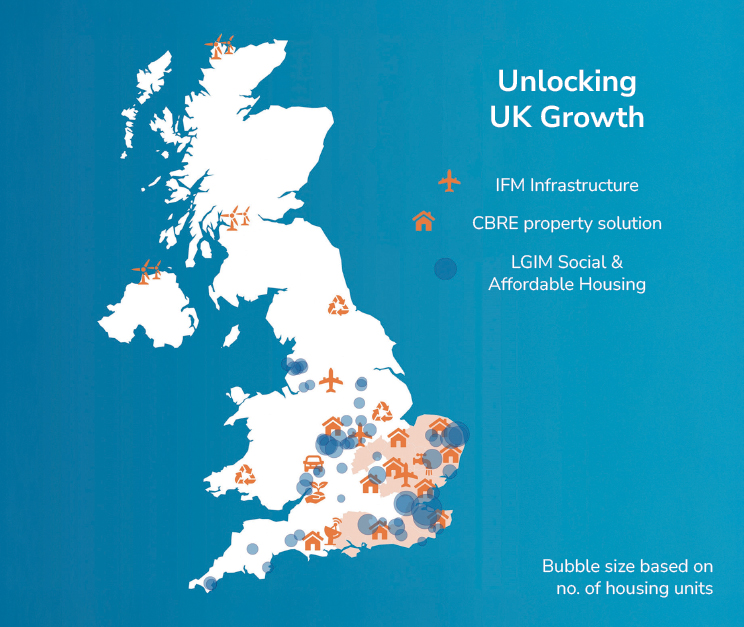

ACCESS has proven to be a consistent investor in the UK and its local communities across the ACCESS region, contributing to both local and regional growth.

ACCESS’s local and regional commitments range across UK equity, both listed and unlisted, to private equity, private debt, UK real estate, both core and impact, UK Social & Affordable housing, and both national and local infrastructure.

- Passive listed assets: £3.3 billion

- Active listed assets: £9 billion

Private equity

When reviewing the UK, the combination of a deep and diverse pool of entrepreneurial talent, a well-established investment ecosystem, and strong regulatory and institutional frameworks continues to create compelling opportunities across the UK. We remain highly optimistic about the outlook for the UK private equity market. ACCESS has committed to £1 billion per vintage year to our private equity allocators, with UK investment included within the investment guidelines of the mandates. We anticipate that total assets across all vintages for both allocators could exceed £4-6 billion over five years.

Private debt

The UK exemplifies the key features of a country that we value when assessing where we invest. With a diverse and well-performing economy and a strong lender-friendly legal framework with embedded structural protections, the UK offers a breadth of high-quality investment opportunities whilst maintaining key legal protections. We view the UK as a country of choice to invest into and expect to maintain and grow our exposure as our AuM grows over the coming years.

Impact real estate for decarbonisation

£275 million committed across the ACCESS region

Property

£4.1 billion UK Real Estate

13% in the ACCESS region

Social & Affordable housing

£125 million invested, 50% UK, 50% regional. Further £75 million committed to ACCESS region

Infrastructure

£1.4 billion in J.P. Morgan Infrastructure Investments Fund (IIF)

6% of the fun invests in the UK across renewables, rail and storage

£1 billion with the IFM global infrastructure fund

£110 million (11%) of the fund invests in the UK across transport, renewables and digital

Further reading

Statement from ACCESS in response to the Fit for the Future policy

Government backstop to encourage Brunel and ACCESS member funds to find a new home

|

|

|