Positive background augurs well for commercial property

|

Written By: Don Jordison |

Don Jordison of Columbia Threadneedle Investments explains why the time is right to invest in commercial property

The commercial property market took off in 2013 and the effects of this recovery reverberated throughout 2014. Given the highly supportive background we are confident that the market will continue to make further progress over the next 12 months.

Towards the end of 2013, investors were seeking to hedge against the tapering of quantitative easing and gain exposure to the resurgent UK economy. Meanwhile, the problems that had been hanging over the property market since 2007 in the form of impaired and non-performing loans, which were concentrated on the balance sheets of UK banks, had gradually been resolved. Thus the propellant for the property market to surge forward was placed in the chamber and ignited in 2013 and powered the market throughout 2014.

This strength has continued into 2015 and we believe it is set to continue given that the macroeconomic environment is very favourable for UK commercial property, due to low interest rates (which are likely to remain close to 300-year lows even as the Bank of England steps away from its super accommodative policy stance), and support from the economic cycle and the credit cycle (through attractively priced debt finance). In addition, the supply cycle for commercial property is favourable given the relatively low levels of new space coming on to the market. Consequently, there is currently a tolerance for risk that has resulted in competitive bidding taking place across all categories – retail, office and industrial – in the South, the Midlands and the North.

In other words, there is a positive alignment of forces that should allow the property market to make further progress and this is recognised by almost all investors. Indeed, we have never seen a wider range of investors, from private individuals to sovereign wealth funds, buying across the board in the UK.

Investor flows point to continued gains

There is one key reason why we can forecast with a great deal of certainty that this year should prove another very strong year for commercial property. Our confidence is based on the fact that prices are closely correlated with net flows into the sector and thus we effectively have a forward-looking radar! As mentioned previously, there is currently a great deal of support for very high inflows into the asset class, thus we believe that capital values will rise at a healthy pace over the coming year at least.

Rental growth is often viewed as an important component of returns from property, but this is not borne out by the data. Rental growth, at best, more or less follows GDP. Investor flows, rather than rental growth, are the main driver of capital growth in commercial property markets.

The impact of liquidity on the market is exacerbated by the fact that unlike other asset classes, it is simply not possible to buy the market in property; one can only buy what is on the market. In other words, it is not possible to gain exposure to commercial property in any meaningful way through exchange-traded funds or derivatives. Instead, investors have to buy physical property assets and, when there are more buyers than sellers, the effect on prices can be significant.

Moreover, property is not fungible. If 20 people bid on a property, 19 are going to be disappointed and they will know that they will have to make a higher bid on the next property that comes onto the market in order to be successful. Moreover, when everyone is buying, nobody wants to sell and when everyone is selling nobody wants to buy. These factors underline the fact that property is an illiquid asset and reacts directly to major liquidity flows in and out of the sector.

Our approach

Our investment approach to commercial property has been consistent for over 20 years and will remain unchanged. We focus on rental income, which accounts for c.85% of total returns in the sector. Income is the one constant in the commercial property market cycle, while capital values move in a surprisingly volatile manner, being closely linked to investor demand. Although capital values are rising currently, we believe that investors should focus on income, rather than capital appreciation, as the former is the key driver of total long-term returns.

Not just bricks and mortar

One of the main advantages of commercial property is that it gives investors exposure to tangible, hard assets, in contrast to shares and bonds, which are essentially tradable IOUs or a claim on future profits that may become worthless in the event of corporate failure. Commercial property always has some intrinsic value.

The advantages of commercial property for pension funds stretch beyond bricks and mortar though – property is good inflation hedge as it is a hard asset (nominal values of property will rise when inflation is rising), and moreover it generates stable, predictable cash flows over time (from rental income), which can be used by defined benefit pension schemes to meet their liabilities as they mature.

Investing in UK commercial property (i.e. sterling assets which generate income in sterling) also means that investors avoid the potential currency risks that are associated with investing in overseas property assets where the cash flows from rental income will be in currencies other than sterling. This can leave UK investors vulnerable if the pound strengthens against other currencies. Investing in UK commercial property means that pension schemes avoid unrewarded currency risks.

It is also important to remember that the dynamics of commercial and residential property are very different – residential property tends to be subject to government interference due to concerns over affordability and labour mobility. Commercial property is not subject to the same constraints or the same level of political interference, with upward-only rent reviews or fixed uplifts in rents being commonplace.

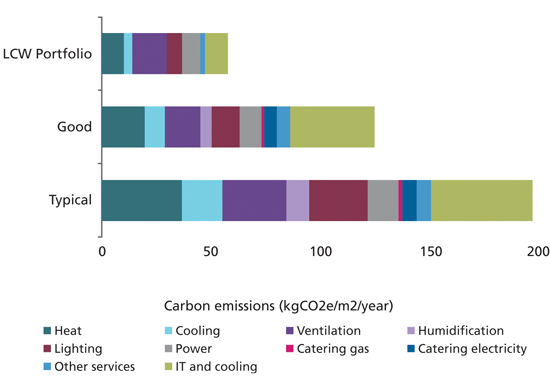

Figure 1: Low carbon workplace (LCW): a significant environment impact

Source: Carbon Trust, October 2014

Towards a low-carbon future

For many investors, the inflation-hedging and tangible appeal of bricks and mortar, combined with a higher yield than is available from mainstream equity or bond markets, mean that commercial property already has a distinct advantage over other asset classes.

However, for pension schemes that are sensitive to or have to consider environmental and sustainability issues, there is also the option of low-carbon strategies – essentially an approach which involves refurbishing existing offices to reduce emissions and then letting them to tenants at market rates. This approach has benefits for occupiers and investors: occupiers benefit from lower running costs, alignment with corporate goals and the avoidance of financial penalties, while investors benefit from quality and longevity of income, low asset depreciation (as low-carbon buildings are more desirable than ordinary ones) and superior rental growth prospects.

The opportunity here is significant, as data from the Carbon Trust suggests that 18% of UK carbon emissions come from commercial buildings, and an 80% reduction in emissions is required to meet longer-term targets. In essence, low-carbon strategies allow pension funds to benefit from all the usual benefits of investing in commercial property, with the added benefit of mitigating some of the risks associated with energy consumption and climate change. To put this into context, low carbon workplace building emissions are usually around 70% lower than a typical commercial property portfolio, and 50% lower than a good portfolio where some steps have already been taken to reduce environmental impacts. For a portfolio of properties, this can translate into CO2 savings of more than 3,000 tonnes per annum.

More Related Content...

|

|

|