Putting a square peg into a square hole: residential property within a multi-asset portfolio

Christopher Down, Chief Executive, Hearthstone Investments

In recent decades, investors have focused on equities, corporate bonds, gilts and cash to form UK-based multi-asset portfolios. given historic performance and low volatility, Christopher Down of Hearthstone Investments explores how residential property compares to its more traditional counterparts.

A 2012 survey by Reuters found that a typical asset allocation used by leading investment houses was 53.5% in equities, 22.6% in bonds, 17.4% to property and alternatives, and 6.5% in cash. Almost all the property allocation was to commercial – offices, warehouses, retail outlets and business parks.

Although commercial property proved to be an attractive asset class in the early stages of 2001-2010, the even more compelling performance delivered by residential property went largely unnoticed. Commercial property was felt to yield higher income with lower running costs, advantages which led to residential investment being carried out by armies of DIY landlords and their lenders via buy-to-let. It is an amazing fact that over 90% of all Private Rented Sector (PRS) housing – amounting to about £800 billion of housing stock and 4 million households – is owned by landlords who manage fewer than 12 properties. This is in stark contrast to the position in most other developed nations where large residential real estate funds are an established and valued part of the investment landscape. It is only recently that the UK is beginning to catch up, with newly-announced institutional investments into residential property totalling over £125 million in the last quarter.

Asset class returns and risk

The advantages of residential property as an asset class within a multi-asset portfolio are real. Residential property has shown the best long-term performance of all the UK’s main asset classes (13.8% p.a. over 41 years to 2011). In comparison, the equity market (FTSE All-Share) was the next best performer with a total return of 12.3% p.a. Cash, the lowest risk/return investment, recorded only 7.2% p.a. over the period.

However, strong outperformance of residential property is only half of the story. The asset class has also proved to be one of the most stable asset classes in return terms, and it is this stability combined with strong performance which makes it an ideal component of modern diversified portfolios. Figure 1 shows the risk/return characteristics of UK asset classes over the full 41 years of data available. The analysis shows that the standard deviation of total returns, often used as a measure of risk, is significantly lower for residential property than UK equities and Gilts. Although it could be expected that property would prove less volatile than the stock market, it is surprising that it has also offered a more stable return profile than Gilts. This of course reflects the fact that if Gilts are not held to redemption, their prices and yields can fluctuate significantly. Commercial property shows a standard deviation over the very long term similar to residential property, hence its attractiveness in portfolios, but it has actually delivered lower overall returns.

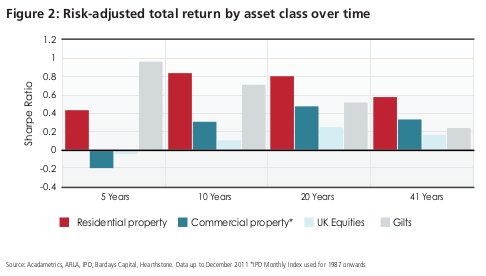

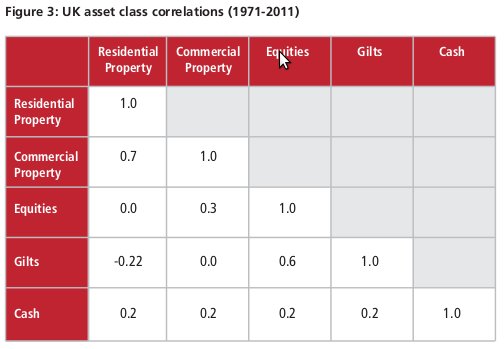

Combining both risk and return measures via a Sharpe ratio calculation allows us to examine how investments perform relative to each other on a risk-adjusted basis; effectively, how much additional return is generated over a risk-free rate per unit of risk taken. The results from this calculation are shown in Figure 2. It is clear that residential property achieves the best risk-adjusted return by a significant margin over all time periods studied – 5, 10, 20 and 41 years. This analysis improves still further if a Sortino ratio is used, which is a similar calculation but focusing on the return per unit of downside risk Figure 3: UK asset class correlations (1971-2011) Residential Property Commercial Property Commercial 0.7 1.0 Equities 0.0 0.3 1.0 Gilts -0.22 0.0 0.6 1.0 Property Cash 0.2 0.2 0.2 0.2 taken – in other words, not penalising the asset class in volatility terms for having high growth periods.

Asset class correlation

Although the risk and return of an asset class is a fundamental driver of whether or not to add an investment into a portfolio, pension schemes and other significant investors also need to consider the relationships between asset classes. Correlations can be used to examine whether assets will move with each other (increasing volatility) or in opposite directions (mitigating downsides in one investment with upsides in another).

Figure 3 shows the correlations table between the UK’s principal asset classes including residential property. As a rule, correlations are regarded as strongly significant when they are greater than 0.6, and assets are perfectly correlated with each other when correlation is equal to 1. There are strong positive correlations between commercial property, as would be expected. However, outside of this, residential property shows little or no correlation with other asset classes. Indeed, it is negatively correlated with Gilts and shows little relationship with equities. This therefore makes residential property an ideal diversifier for a multi-asset portfolio, as it will tend to generate returns based on its own fundamentals, whether or not equity markets are rising or falling. This lack of market risk in residential property is an interesting tool for portfolio managers who are otherwise extremely exposed to market events.

Portfolio optimisation – adding residential property into a UK- based multi-asset portfolio

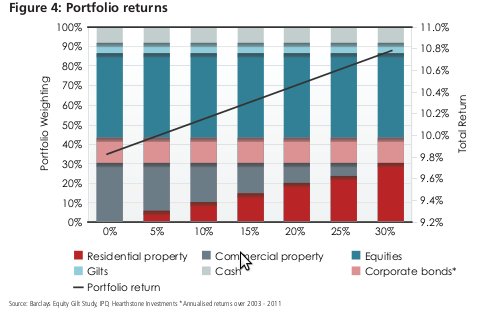

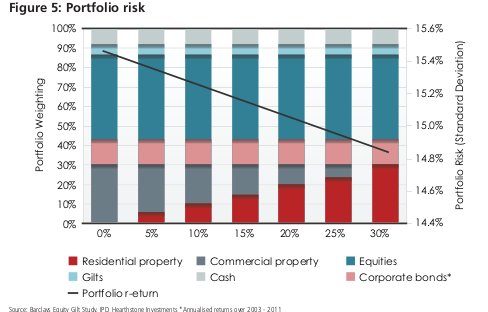

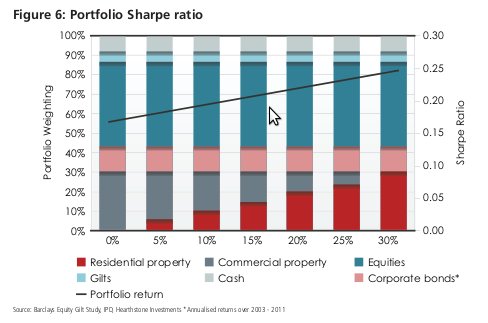

Portfolio optimisation can be used to demonstrate how adding a particular asset class affects investors. It attempts to create a portfolio that will provide the highest risk-adjusted return, as indicated by the Sharpe ratio. The portfolio optimisation exercise was run on a 41-year data set for UK assets (excluding corporate bonds for which only a short time period of comparable data was available) and assumed a maximum possible weighting of 30% for property (whether commercial or residential). Starting from a portfolio with a 0% weighting to residential and 30% to commercial, residential property was then added to the portfolio in increasing amounts until the 30% maximum weighting was reached.

Figure 4 shows the results. As the percentage of residential property within the portfolio increases, total return rises, reflecting the increased return historically delivered by residential investments. Figure 5 demonstrates the reduction in volatility of returns, showing a decreasing standard deviation of return as the residential component increases. And Figure 6, combining these measures, shows that the Sharpe ratio (unit of return per excess unit of risk) rises significantly as residential holdings are increased, indicating a strong-performing portfolio bearing less risk.

Conclusions

The data available for the last four decades clearly demonstrates the performance advantage this relatively unexplored asset class has delivered for some investors. The barrier to generating sizeable investment by institutions has not been the benefits of the asset class itself but rather the type of investments available. These were too often restricted to relatively small schemes focusing on niche asset strategies, or closed-ended products that suffered from poor liquidity, valuation methods and management expertise. That landscape has now changed significantly, and with last year’s launch of the TM Hearthstone UK Residential Property Fund, an FCA regulated offering, investments are now available on a nationwide, diversified scale. This is a major boon to pension schemes, who typically operate bulky, multi-asset portfolios with a focus on inflation mitigation and low-volatility returns. At the very least, these schemes and their advisers should be assessing the performance advantage residential property can give to their investments, especially now that it exists in a format which better suits their needs.

Schemes such as the TM Hearthstone Residential PAIF (Property Authorised Investment Fund), which invests primarily in new-build properties, also present a tremendous opportunity for the UK economy. Local government pension schemes alone control over £150 billion in assets which, if the recent investment made by Islington Borough Council was mirrored across all schemes on a similar basis, would result in new investment equivalent to the construction of nearly 20,000 new homes. It is clear that the emergence of residential property as a viable option for multi-asset portfolio managers represents a significant opportunity for both those investors and the economy as a whole, and I hope that the greater adoption of this new asset class continues throughout 2013 and beyond.

More Related Content...

|

|

|