Real assets to beat the yield drought

|

Written By: Matthew Graham |

Matthew Graham of Aviva Investors examines why real assets such as social housing can be an ideal match for the long-term aims of local authority pension funds

A combination of lower equity return expectations and continuing low yields from high quality fixed income assets has intensified funding pressures for local government pension schemes. Schemes have faced the dual challenge of their assets coming under intense pressure from increased volatility and poor performance in equity markets at the same time as liabilities being exacerbated by record low gilt yields. Additionally, a combination of recent austerity measures at local government level and the unknown consequences of the Hutton Report have raised concerns over the health of future scheme cash flows. The last thing schemes will want to do is dip into their pot of assets to pay member benefits.

Notwithstanding the difficult investment environment that schemes have already faced, we believe they continue to be highly exposed to equity market volatility. On average local government pension schemes currently have a 61% allocation to equities (WM Performance Services, second quarter 2012) compared with the 43% allocation (Mercer asset allocation survey, May 2012) for UK defined benefit pension schemes as a whole.

Shifting sands

Since the financial crisis, we have seen local government pension schemes make some movement away from equities and increase their allocation towards mainstream alternative investments. Albeit from a very small level, local authority pension schemes have implemented a four-fold increase since 2007, bringing their current alternative investment allocation to 8% (WM Performance Services, second quarter 2012).

We believe this shift likely represents an increased focus on risk management by schemes as they look to diversify away from equities and reduce volatility; trustees have viewed this as a way of lowering equity market risk without the need to give up too much in expected return.

This latter point is particularly important given that UK government bond yields remain at record lows and, as such are widely perceived as expensive. While liability-matching is a crucial consideration for local authority pension schemes, many are understandably reluctant to increase their allocation to Gilts at the current time.

A realm of opportunities

There is however another option available to pension schemes. We believe the low-risk and long-dated income streams provided by real assets such as social housing and ground rents have a vital role to play in tackling underfunding and providing cash flows that help mirror liabilities. We refer to real assets with these attributes as returns enhancing and liability-matching (REaLM) assets. Crucially, REaLM assets can be inflation-linked, making them an extremely compelling alternative to index-linked Gilts.

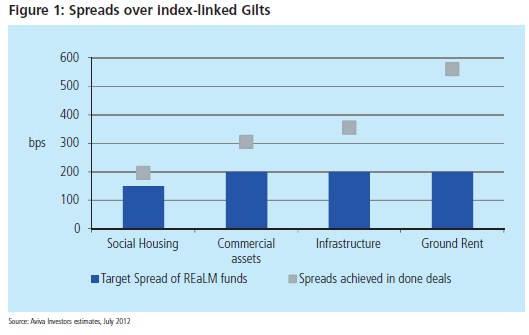

The structure and profile of REaLM assets are broadly comparable to traditional fixed income assets. Nonetheless, such assets can typically offer excess returns over Gilts (see Figure 1), primarily as an illiquidity premium because REaLM assets are comparably less liquid.

We believe the long-term nature of local government pension schemes means that they are especially well positioned to exploit these types of investment.

The appeal of social housing

In our view, investment in UK social housing offers a strong solution for pension schemes and social housing providers alike. For pension funds, social housing can offer secure longterm inflation-linked cash flows. For social housing providers, meanwhile, pension funds are a welcome source of financing at a time when the government and banks are reducing their support for the sector.

The underlying dynamics of the social housing sector are compelling, with demand increasing and unsatisfied demand estimated at 2 million households (Source: Barclays, Social Housing Second Quarter 2011). A large quantity of new social housing will need to be built over the next five years at a time when the sector’s primary sources of capital are being curtailed.

We believe that the social housing sector is among the most secure and conservative industries in the UK. It is highly regulated by the Homes Community Agency, and is also well suited to providing long-term cash flows from long-term leases and to providing indexation through the linkage of housing benefit and underlying rents to inflation.

Under our approach to social housing, the freehold interests in good quality modern properties are purchased by a specialist social housing fund and leased to a registered provider or local authority for 40-50 years. The rent paid to the fund by the registered provider is typically reviewed annually in line with the retail price index, with a 0% floor. At the end of the lease, ownership of the assets reverts to the registered provider so there is full amortisation of the initial investment over the lease term.

We believe this approach can offer advantages to all parties. The registered provider receives long-term finance that is consistent with its own cash flows. Pension funds, meanwhile, have access to what we consider to be a highly secure and stable investment that provides long-term inflationlinked cash flows that provide a return in excess of index-linked Gilts.

Ground rents

Ground rents can also provide steady and predictable cash flows. A ground rent is a rent that is paid under a lease for the right of the occupier to use that land and building. Ground rents are very long-term in nature, with leases normally running for around 100-150 years. They are regular payments made once or twice a year, with increases often set in line with inflation. Ground rents are extremely secure. By law the lessor ranks ahead of any mortgagor or administrator and, because they are relatively small in value and default could mean losing the property on the land, default is extremely rare. Moreover, because the ground rent is only a fraction of the vacant possession value of the property, the investment is very well collateralised.

As individual ground rents are often of relatively low value, a large number of transactions have to be processed and managed in order to invest significant funds. Investment in existing portfolios can be the most efficient means of gaining exposure as it allows large economies of scale in administration and management, risk diversification by sector, tenant and geography, and the smoothing of returns.

For many years, ground rents were largely the domain of small investors and property companies. More recently, however, developers have increasingly drafted leases to suit the cash flow needs of pension schemes. While offering secure, inflation-linked cash flows, ground rents can also provide returns well above those offered by index-linked Gilts.

Navigating new REaLMS

The liability matching characteristics of REaLM assets, combined with strong returns relative to assets with a similar risk profile, mean that strategies incorporating ground rents and social housing could increasingly be used by long-term investors as an alternative to traditional fixed-income assets.

Considering their long-term profile, we believe local government pension schemes are particularly well placed to exploit these opportunities.

Prepared for professional clients only. It is not to be relied upon by retail clients. Unless stated otherwise any opinions expressed are those of Aviva Investors Global Services Limited. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature. The value of an investment and any income from it may go down as well as up and the investor may not get back the original amount invested. Aviva Investors Global Services Limited, registered in England No. 1151805. Registered Office: No. 1 Poultry, London EC2R 8EJ. Authorised and regulated in the UK by the Financial Services Authority and a member of the Investment Management Association.

More Related Content...

|

|

|