Reasonable returns expected from European fixed income

Published: January 11, 2013

Written By:

|

Gunther Westen |

As 2012 approached its end, it appeared to be one of the best “worst” years for Eurozone bonds. Neither market fears of a Eurozone collapse, nor growth dwindling from already anaemic levels, deterred markets. Gunther Westen of Meriten Investment Management tells us more.

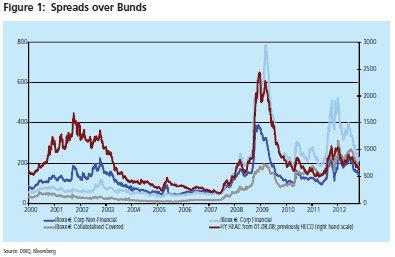

As of the end of October, performance for Eurozone government bonds ranged from 27% for Irish government bonds to 8% for French government securities. Investment-grade corporate bonds scored 11%, while high-yield investors fared even better at more than 18%. German 10-year Bunds, the default “flight to quality” investment, languished with a 3% return¹.

While this might seem at odds with the newsflow, we think that some investors had positioned themselves for a market fall that simply did not occur. Instead, the European Central Bank (ECB) flooded the markets with liquidity and stabilised confidence.

Performance masked both volatility and strong spread dispersion across sectors, issuers and countries. Spanish utilities, for instance, ended October with lower spreads against Bunds compared with the start of the year. At the end of June, spread levels were trading at nearly double those seen in January.

More of the same

Although the spectacular performance of many fixed income Eurozone assets is unlikely to be repeated in 2013, corporate bonds and some segments of the government, as well as the covered, bond markets still appear attractive.

We expect the ECB to keep interest rates low for the time being. As a result, liquidity should remain ample at almost zero cost, creating a positive backdrop for bond investments that offer some yield advantage over cash. Research has consistently flagged demand from cash-rich investors. In particular, any new supply from corporate issuers perceived as relatively safe has been oversubscribed. Although new issuance picked up in 2012 compared to 2011, we believe this supply/demand imbalance will provide a tailwind for corporate bond prices.

Draghi’s “put” removes euro breakup premium

Since July, when the ECB president Mario Draghi announced plans to buy bonds from troubled Eurozone countries, spreads for peripheral markets have rallied substantially, without the ECB actually having to act. Moreover, countries like Spain and Italy have agreed to various fiscal consolidation measures to manage their debt. We believe this may yet be rewarded by the markets.

Today’s relative stability in spread levels might be tested in the coming year by frictions among Eurozone members, a lack of further integration, Spanish reluctance to join the rescue scheme or simply the poor economic backdrop in the periphery. However, with the Draghi “put” or guarantee in place, potential spread widening should be limited and this could lure investors back into the market.

Economic weakness should not threaten corporate spreads

Even the weak economic environment is unlikely to spoil the party. As fiscal consolidation in peripheral countries takes hold and dampens GDP growth, it is likely to hover around the zero mark for some time. However, barring shocks, we do not expect a severe recession. Risk premia have room to fall from stillelevated levels as long as GDP remains low, since investors demand less compensation for holding risky securities. In addition, corporate bonds tend to fare well even in a moderately negative growth environment, because cash flow, not earnings momentum, is the crucial factor.

With yields of core investments (like Bunds) at record lows and negative in real terms, we think that even very risk-averse investors will have to creep back into riskier asset classes and segments to achieve nominal return requirements.

Corporate bonds in particular should benefit, even though valuations for some well-known issuers from core countries are stretched. We think that other parts of the credit spectrum still offer very attractive spreads. For example, peripheral utilities, telecommunication companies or some senior financial bonds that are still trading at a high premium to industrial bonds despite various government-driven banking backstops. While risk aversion during the first half of 2012 affected all issuers indiscriminately, the market is now focusing on fundamental strength. Thorough credit analysis and selectivity should, therefore, be back on the agenda.

We think that European high-yield bonds may be more vulnerable to recession risks than investment grade bonds, but still offer a generous 550- 650 basis point spread over Bunds². Given a recovery rate of 40%, the spread level suggests an implicit default rate of roughly 7%. This compares with a rate slightly above 3% as at the end of October 2012, anticipated by Moody’s on a one-year forward basis. We believe that highyield bond spreads could tighten by 100-150 basis points, which continues to make them an attractive investment and a cushion against any unexpected deterioration in the economic backdrop. Most peripheral sovereign bonds offer value relative to their corporate or covered bond peers. In our view, they should be considered as part of a well diversified Eurozone portfolio. If progress on fiscal consolidation becomes visible, the Eurozone economy bottoms out and the ECB is ready to act, we could see yield convergence across the Eurozone. In this scenario, peripheral bonds should rally significantly, while the flight-to quality bid for Bunds and core markets may reverse quickly.

Having said that, volatility is most certainly here to stay for some time as the road to fiscal integration in the Eurozone continues to be bumpy, economic visibility is low and the investor base for peripheral bonds has declined sharply. Risk premia have room to fall, however, as the market completely prices out the tail risks of a systemic meltdown and euro break-up. Current valuations of credit, peripheral sovereign and many covered bonds are looking fair to cheap against a backdrop of abundant liquidity and investors’ search for yield. We think this combination bodes well for returns in 2013.

1. Source: DBIQ Bloomberg, IBOXX Index, in as at 30/10/12

2. Source iBoxx as at 30/10/2012

CP is CP9396-10-01-2013(3m)

More Related Content...

|

|

|