Return to lender

Published: June 1, 2014

Written By:

|

Simon Perry |

Changes in banking regulation and solvency requirements are driving a new wave of demand for European direct lending from outside the traditional banking sector. Here, Alcentra Managing Director, Simon Perry, reflects on the changing face of European credit and the growth in investor opportunities for direct lending to mid-sized companies

The aftermath of the 2008 financial crisis saw a wave of new regulation sweep the banking sector as legislators sought to repair a damaged financial system, learn from previous mistakes and protect against future crises. Regulations requiring banks to maintain higher capital ratios while derisking their balance sheets – such as the US Dodd-Frank Act and Basel III requirements – have prompted banks to offload unwanted financial assets onto capital markets and limit, or in some cases even withdraw from, traditional lending.

With European banks increasingly limiting lending to medium-sized corporates (whose enterprise value we define as about €500 million or below) the traditional loans sector is facing a potential dearth of capital. However, while banks continue to scale back lending and are being disintermediated, this presents new opportunities for institutions and investors willing to step in and fill the gap to support loans.

Market demand

Is this a short-term phenomenon? We don’t believe so. Some regulations such as the Basel III rules will not fully come into effect until 2016-2019, and we do not expect to see any relaxation in the capital requirements placed on banks in the short term. Meanwhile demand remains high. In the US market, we have seen changing regulation and market needs drive a structural shift where direct lending has now become a core asset class. We anticipate that this pattern will most likely be emulated in Europe over time.

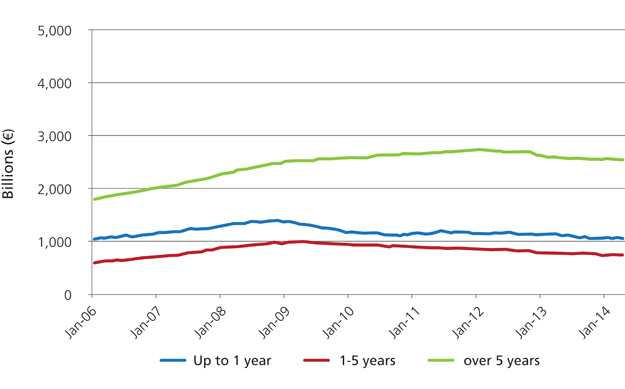

From a loan demand perspective, borrowers come from across a wide range of industry sectors and regions. The main European countries for this type of business are the UK, Germany and France. Scandinavian banks are generally better capitalised than elsewhere in Europe so continue to serve a large part of their domestic markets. The maturity of corporate loans is typically quite long in the EU¹ and it is worth noting that most European banks are generally less competitive relative to private lenders in the longer-dated loan sector due to increased capital charges on longer duration loans.

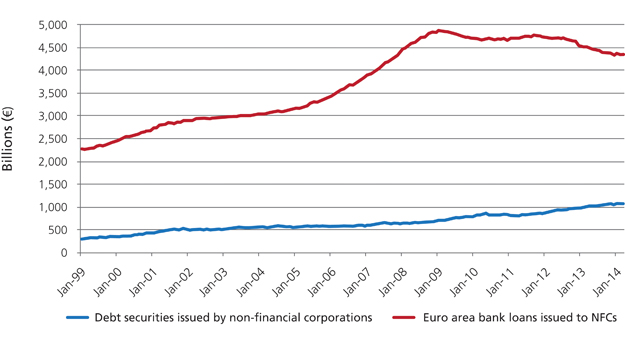

Loans are far more important in financing “non-financial corporations” in Europe than bonds, and many middle market companies and small to medium-sized enterprises (SMEs) have difficulty accessing the bond market. Some companies also choose not to enter the public markets as they wish to remain private. While the stock of corporate bonds in the euro area is gradually increasing from current levels of €1 trillion², we believe increased liquidity in the bond market is unlikely to erode direct lending opportunities.

Figure 1. Maturity structure of EU bank loans to non-financial corporations

Source: ECB, June 2014

Pipeline growth

From a business growth perspective, we are seeing a growing pipeline of investment opportunities in the direct loans sector. This business looks primed to expand further thanks to the growing disintermediation of lending banks, and also growing corporate demand. According to a recent study by consulting firm Deloitte, loans by non-bank lenders to European companies more than tripled to 56 in the fourth quarter of 2013 from 18 in the first quarter, and a healthy loans pipeline continues to build. Maturities in the institutional direct loan market combined with private equity capital commitments means the market should continue to see very healthy supply in this area in Europe over the next two years.

While some investors commonly assume they have missed the main market opportunities in the sector, we do not believe that is the case. In fact, direct lending remains a relatively new asset class in Europe. Many potential borrowers are only just starting to realise they can access credit via other channels than traditional banking relationships.

Key attractions for investors in the direct loans market are the wider spreads loans offer compared to other fixed income asset classes. Quantifying the exact returns for direct lending is difficult because the asset class itself is still in its infancy and largely consists of private companies with no single public market for direct lending arrangements.

However, we estimate that by blending senior and mezzanine loans, investment managers can target returns of 10-12% for their underlying clients. A similar mix of senior and mezzanine loans in the broadly syndicated market can deliver returns in the 5-7% range – providing investors with attractive yield whilst benefiting from comparably stronger deal structures.

The combination of low interest rates and tight credit spreads in the current market means that direct loans are also competitive compared to high yield bonds on an absolute basis as well as adjusted for risk. At Alcentra, the floating rate nature of our loans and short-term interest periods mean any interest rate uptick will benefit our loans quickly, unlike fixed high yield investments.

Figure 2. Euro area bank loans and debt securities issued by non-financial corporations (Jan 1999-Mar 2014)

Source: ECB, June 2014

Stable fees

While we feel loan margins have tightened slightly in recent months deal fees have remained very constant and those fees provide funds with healthy incremental value. Increasingly, institutional, including pension funds and insurers, are using loans as part of their allocation to fixed income markets as a way of generating higher returns.

From an investor standpoint, it is worth noting that direct lending to medium-sized companies does come at the expense of some liquidity and the direct loans market also presents fairly high entry barriers. Typical fund structures will require the investment to be locked up for a number of years and minimum investment sizes are often counted in the millions rather than thousands. But, in the final analysis, direct loan investments are not retail products. They are designed chiefly for institutional investors with longer time horizons – such as pension funds, insurers or sovereign wealth funds – to allocate a sub-sector of their portfolio that they can afford to be tied up in for a significant time period.

No financial market or asset class is entirely risk free. Thankfully the high degree of leverage seen in credit markets before the financial crisis of 2008 is no longer favoured by market participants, eliminating much of the risk it once injected into the loans sector. We expect default rates in the direct loans sector to remain modest.

While a significant downturn in the economic environment could potentially lead to a pick-up in defaults, we anticipate European default rates for direct loans will remain benign throughout 2014. As a senior secured asset class, we continue to believe that high rates of recovery, and therefore low loss rates, will continue throughout this year in Europe. In general, European companies accessing the direct loans sector are in good health and corporate earnings remain comparatively strong.

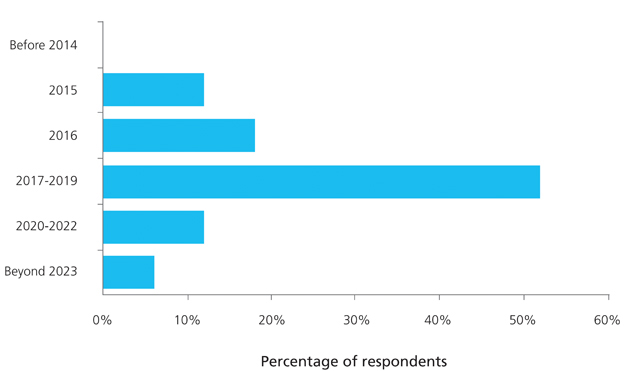

Figure 3. When will European bank de-leveraging conclude?

Source: PriceWaterhouse Coopers, June 2014

European benefits

In terms of investor protection, the European direct lending sector compares favourably with the broadly syndicated loans market, particularly in the US, where sheer demand can dilute the protection on offer for some loans, squeezing out covenants. To avoid this, investors do have the option of shifting focus to the direct lending market where the lack of competing market participants means established direct lenders can still insist on a strong covenant package.

In terms of other risks, the biggest market concern facing the direct lending sector is whether the growing popularity and amount of investor money going into the direct loans sector might ultimately create too much demand for the product, causing spreads to look less attractive and deal terms to weaken. However, at Alcentra, we believe we are quite a long way away from that scenario.

There is clearly still a significant amount of bank deleveraging to come and the supply/demand balance remains favourable. From a macro perspective, the global inflation picture also remains benign, and there are no signs yet of any major interest rate rises which might negatively impact the lending market.

Given the demand for financing among mid-sized European companies we therefore believe the current direct lending market offers an attractive opportunity to institutional investors and lenders who have a strong level of protection through covenants and higher margins than in other areas such as the broadly syndicated market. However, this is a highly-specialised area requiring dedicated expertise from experienced managers who can provide the investment selection and credit analysis to maximise returns while minimising risk.

1, 2. European Central Bank statistics

More Related Content...

|

|

|