Rolling up your sleeves and getting your hands dirty!

|

Written By: David Crawford |

David Crawford of Nordea Asset Management UK puts forward a case for engaging with heavy emitters

Following intensified governmental regulations and changing preferences in investors’ appetite, the race to reach net zero has resulted in carbon-heavy stocks being avoided and redirected to more environmental-friendly ones. Worldwide, investment in Environmental, Social, and Governance (ESG) equities has observed robust inflows. In 2020, global assets in ESG-dedicated funds reached $1.3 trillion, more than twice the amount in 2015¹. According to a report by Broadridge, these assets are forecasted to hit $30 trillion by 2030 at the current rate.² From decarbonising portfolios to picking top-rated ESG companies, there is a serious commitment to investing in a sustainable future.

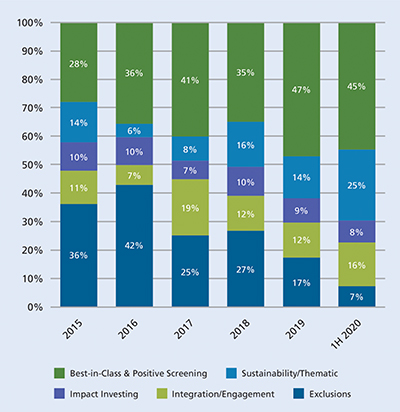

Figure 1: ESG funds by type worldwide, net flows (%)

Source: Broadridge Global Market Intelligence Funds

But ESG-focused strategies are not all comprehensive and unfortunately punish “bad” companies that are essential for the transition – it’s akin to saying Batman is a villain. As attention shifts toward companies with attractive ESG profiles and those with clear solutions for the green transition, grey stocks, which we define as companies 1) with a low current ESG score but the potential for a high(er) ESG score, and 2) essential for the transition, lose their limelight. “Best-in-class” and “positive screening” – strategies that favour companies with the highest ESG score in particular sectors – accounted for 39% of assets under management in ESG funds globally. Meanwhile, active non-ESG vehicles saw significant net outflows of almost $400 billion in 2021. While ESG leaders march forward, environmental laggards are at risk of staying stagnant.

This begs the question, is it worth casting light on the overlooked? Do heavy emitters have a role to play in enabling the green transition?

An argument for “grey” heavy emitters

By definition, heavy emitters account for a considerable part of global pollution. A report from International Energy Agency found that in 2021, the electricity sector accounted for more than 50% of total global emissions, while the industry sector accounted for around 30%.³ This means that a significant part of the current reduction in carbon emissions comes from certain sectors, rendering them relevant and even critical to enabling the transition. Take steel as an example. While carbon-heavy, steel manufacturers physically help make possible the construction of offshore wind farms, electric vehicles and power grids. Rather than abandoning these sectors, a better approach would be to engage with them and push them towards a less carbon-intensive production method. In other words, the link between portfolio alignment and real emissions reductions is the strongest when investing not in leaders, but also improvers within the carbon-intensive sectors.

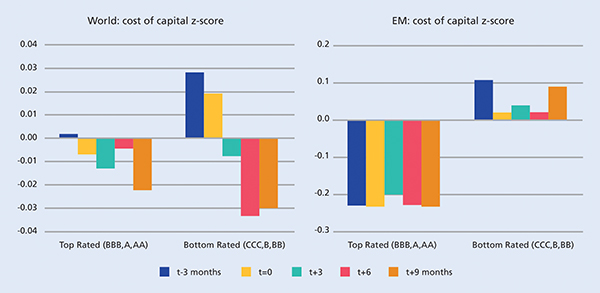

Figure 2: How cost of capital changed for companies that experienced MSCI ESG Ratings upgrades

Source: Companies with MSCI ESG Ratings upgrades in the period from Dec. 31, 2015, to Nov. 29, 2019, with data available from t-3 months to t+9 months were used. We observed 691 upgrades in the MSCI World Index and 248 upgrades in MSCI EM.

High emitters are valuable not only for creating impact – there is the potential for return generation. Businesses with heavier carbon emissions and higher risks associated with the energy transition tend to come with a significant valuation discount. According to the MSCI World Index, the average cost of capital of the highest-ESG-scored quintile was 6.16%, while the lowest-ESG-scored quintile’s was 6.55%.⁴ The findings come as no surprise, since lower ESG scores often interrelate with higher systematic risks. In the same line of reasoning, companies with improved ESG ratings saw reduced costs of capital, as MSCI Research confirmed. By allocating capital to, and being an ESG activist shareholder in, companies that have great potential to better their environmental performance and mitigate perceived risks, investors can capture financial rewards from those which are successfully moving up the ESG ladder.

As many companies in the grey sectors are taking concrete steps, or already have credible plans, for transitioning towards renewables and energy solutions, there are ample opportunities to engage with them and help them fulfill both their environmental and financial potential.

Which heavy emitters?

Not all heavy emitters are alike – companies with activities in coal and oil have little foothold in the green future narrative. Therefore, in selecting which ones to invest, it is crucial to identify those with the potential to improve. As a metaphor, if the outer circle includes those whose businesses are out of scope in the ecological transition context, and the inner circle encompasses companies that are considered ESG winners already, then the middle circle should be the targeted area. This is where we can find companies with a continued role in the low-carbon economy, but need help with their own ESG transition and communicating their potential to the market. Thus far, investors have been excluding the outer circle and embracing the inner circle. The next step is to look for ESG improvers in the middle zone and unlocking their value.

How might engagement look?

A cornerstone of a successful engagement is determining the feasibility of engaging with a company on a targeted topic. Questions that could arise include how cooperative the management team is, whether they can incorporate the relevant ESG objectives in the business model, and their willingness to execute.

As soon as feasibility is established, key performance indicators (KPIs) can follow suit. Depending on how far each company has progressed in its decarbonisation journey, a roadmap with different short- to long-term targets can be drawn to help them achieve their goals. In the entire process, transparency is key. Companies which duly align their reporting with a high-quality and rigorous framework such as the Task Force on Climate-Related Financial Disclosures (TCFD) make it smoother for investors to assess their performance in comparison to peers.

Once engagement efforts begin, an effective monitoring process is to be implemented to keep track of each company’s progress. For companies that have come a long way in executing on their climate strategy, engagement efforts can occur at quarterly intervals. For those that are still at the beginning of their journey, it may be beneficial to leverage from networks such as Climate Action+ or Principles for Responsible Investment to amplify the pressure. While it is always favorable to engage with companies to strengthen their environmental profile, decisions to divest could be considered in cases of failure to make progress.

All in all, the path to sustainability is a continuous journey. Making investment decisions based on a frozen snapshot will not do companies justice if they are well on their way to implementing changes. A 20% carbon reduction compared to the benchmark sounds appealing at first, but is it sufficient to tackle sustainability challenges? While it might be easier to automatically rule out high-emitting stocks in exchange for “best-in-class”, a strategic approach of engagement is more suited to make a real-world impact.

Unconventional as it might seem, investing in and engaging with environmental laggards brings real value. On the one hand, alpha can be generated from efforts of de-risking. On the other, the road to net zero does not only involve today’s ESG winners. Rather than being perceived as threats, with the right engagement approach, ESG improvers will emerge as not only enablers, but also catalysts, of the green transition.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A. and Nordea Investment Management AB (“the Legal Entities”) and their branches and subsidiaries. This document is advertising material is intended to provide the reader with information on Nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. This document contains information only intended for professional investors and eligible investors and is not intended for general publication. © The Legal Entities adherent to Nordea Asset Management and any of the Legal Entities’ branches and/or subsidiaries.

1. https://www.broadridge.com/_assets/pdf/broadridge-esg-white-paper.pdf

2. https://www.broadridge.com/press-release/2021/esg-investments-poised-to-reach-30-trillion-dollar-by-2030

3. https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector_CORR.pdf

4. https://www.msci.com/www/blog-posts/esg-and-the-cost-of-capital/01726513589

More Related Content...

|

|

|