Seeking the best relative value within the infrastructure industry

|

Written By: Pal Sarai |

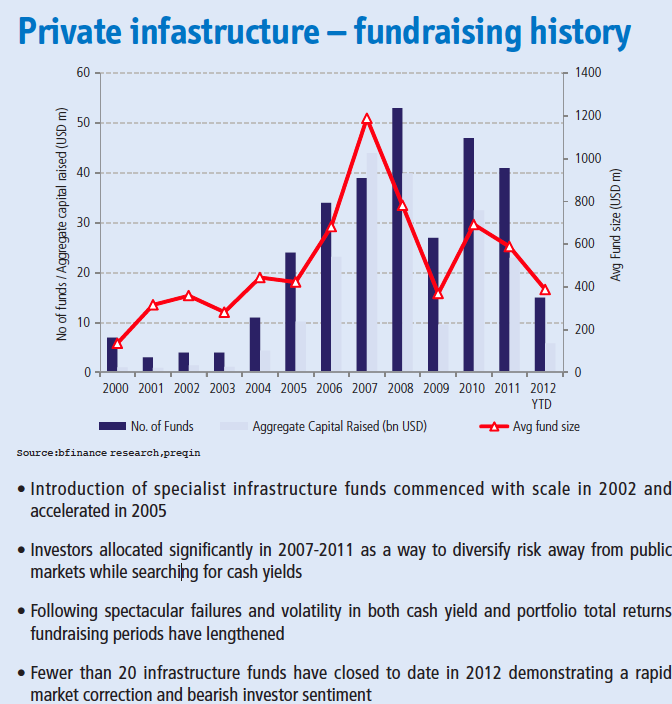

Faced with uncertain and volatile public market investment returns, many institutional investors including pension funds, endowments and insurance companies, have been adding infrastructure to their portfolios. Allocating to private infrastructure assets is often perceived as providing long-term, inflationlinked, stable cash yield and attractive total returns. Yet investors are often confronted with a very different reality including write-offs, significant leakage of value in disproportionately high asset management costs and generally mediocre risk-adjusted returns. Interestingly, in many cases these problems are easily avoidable by using some common sense and adhering to a few basic principles which will ensure that infrastructure investments prove rewarding and appropriate sources of value for institutional investors seeking stable and uncorrelated returns.

1. Select appropriate terms and conditions for the investment vehicles

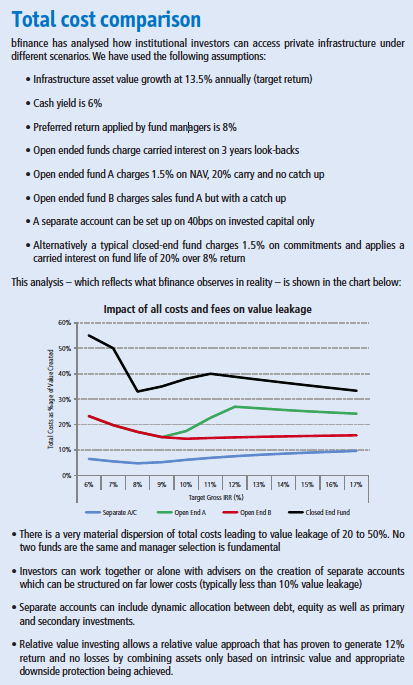

Most investors elect to allocate to infrastructure through investment funds managed by professional fund managers. Myriad investment vehicles now exist including listed funds (ETF, listed holding companies of private assets, mutual funds of listed securities) and private funds (open ended, closed ended or separate accounts). The underlying infrastructure assets can be the same across multiple vehicles – for example Electricity North West, a UK electricity distribution network, is owned by Australian open-ended and closedended funds managed by two different fund managers. Yet, while the asset is performing well and generating both attractive yield and capital value growth to all its owners, different terms and conditions applicable to investment vehicles used to access the asset cause substantially different returns accruing to the ultimate end investors.

How investors access an infrastructure asset can make a very material difference to what returns are ultimately received. Since most infrastructure investments are accessible through different vehicles ranging from advisors, co-investments, open or closed funds etc., investors should take a very active role in assessing which vehicle represents an appropriate way to gain exposure without dissipating returns. Furthermore, listed assets are at times diverging by more than 70% from their fair valuations, allowing for some significant value creation just by opportunistic arbitrage. Fee structures and conditions on which target investments are executed can differ substantially between funds vehicles.

For illustrative purposes, a $50 million investment growing at 11% annually and yielding 5% per annum over a 10-year period would cost investors from $4 million to $22 million in fees depending on whether the investment is undertaken via an open-ended fund charging 0.60% on NAV with no performance fees, or a closed-end fund on a typical 1.5% management fee with 20% performance fees over a 7% preferred return and subject to a standard “catch-up” (in private equity partnership agreements, once the general partner provides its limited partners with their preferred return, it then typically enters a “catch-up” period in which it receives the majority or all of the profits until the agreed upon profit-split, as determined by the carried interest, is reached). Removing a catch up alone would save $10 million of total costs. In terms of investment returns this is the difference between a net IRR of 10% and 5%.

2. Maintain investment discipline: stick to buying cheap

While it is always good practice to focus on value investing, in infrastructure this becomes mission critical. Value creation in infrastructure is limited to cash yield and use of leverage, with minimal ability to influence growth of profitability of what often are regulated assets subject to caps on tariffs or capital growth. Those investors that pay a high price on entry may perversely take more risk from infrastructure investments than from traditional industrial investments where value can somehow be created to compensate for high entry pricing. Interestingly, valuations of infrastructure assets can be very high due to the flood of new capital that has been invested since 2007. Few assets are sold below 10x Enterprise Value to Ebitda despite profitability rarely growing significantly. Those assets that are deemed as growing opportunities, such as Edinburgh Airport, have been acquired at well over that (Global Infrastructure Partners reportedly paid over 17x EV/Ebitda).

High entry prices are perhaps the most obvious cause of spectacular failures leading to loss of capital. Most recently, cases such as Biffa (Global Infrastructure Partners), National Car Parks (Macquarie), PD Ports (Babcock & Brown) and many other previously perceived stable infrastructure assets have led to complete or partial equity write-offs. How can that be possible on such high-quality, supposedly safe and prudent, assets?

Fund managers often tend to look at peer group transactions and discounted cash flows for justification of prices paid for the underlying assets (a classic case of “anchoring”). It is all too easy to fall into a trap of thinking that since market prices are set by the competition, one should adapt and follow what is generally paid for similar assets. Yet prudent investing is subjective and the best investments are often those not done. Investors or their advisers should be very active in monitoring and influencing their fund managers both prior to investing during the due diligence phase, but also post-investment to avoid strategy drift and paying for new riskier transactions.

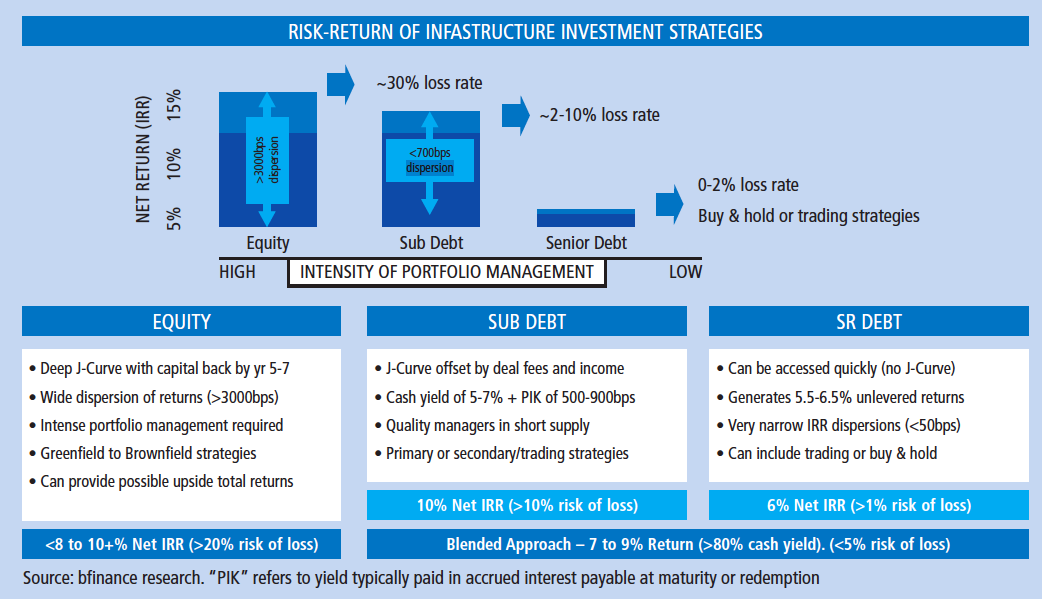

3. Adopt a relative value investing approach to debt and equity

Exactly the same asset can provide fundamentally different returns to its investors depending on what security is used to hold an interest.

For example, a number of different closed- and open-ended infrastructure funds together own Southern Water, a UK water utility business. Several of these funds have suffered from a variety of operational and financial issues on this asset such that gross returns have been close to zero over the last four years. Yet a specialist private debt investor has generated 9% gross IRR from Southern Water by opportunistically acquiring junior debt in the company at 86% of face value.

Interest in infrastructure debt is growing as demonstrated by the recent purchase by Pension Denmark, a €16 billion Danish pension fund, of portfolio of €270 million infrastructure debt assets acquired at 83% of face value from Bank of Ireland. Infrastructure debt investments are well documented as providing predictable yield and very limited risk of capital loss. MetLife reportedly invested over $10 billion in infrastructure debt, generating in excess of 6.5% cash yield on long-term maturities which generated negative to zero loss ratio. Historical data from S&P and Moody’s confirms how senior secured infrastructure debt has loss rates below the already-low corporate loans loss rates level of 1% (net of recovery of capital). Investors can also access debt investments through secondary transactions, distressed investments and through junior debt. All these strategies are opportunistic, but offer substantial downside protection and stable returns in the 9-12% range. Importantly, the cost of accessing debt strategies is far lower for investors (as low as 30 basis points on invested capital compared to the traditional 1-1.5% on committed capital for equity investments).

While private equity infrastructure investors may argue that debt does not provide upside, this is not the case when debt is acquired at good discounts to face value and/or when junior and senior debt are mixed in dynamic capital allocations. Furthermore, when balancing maturities in a well-designed diversified portfolio, debt investments can also be managed to provide liability matching for pension funds. Given that equity pricing for quality assets is often high, debt securities are often – yet not always – a far better alternative to owning equity in a specific asset. Yet choosing whether debt or equity securities provide better relative value on a risk-adjusted basis is highly dependant on the specific asset involved. This has led several investors, including most recently the RBS Pension Fund, to bypass fund structures and focus on relative value investing with the support of specialist advisers.

This relative value investing approach has been adopted very successfully so far by the largest investors including Canada Pension Plan Investment Board (CPPIB) and Queensland Investment Corporation (QIC). Each investor has built balanced portfolios of private direct infrastructure equity and debt (including special situations securities), approaching each asset on a case-by-case basis in order to identify whether value is better accessed through debt or equity. A relative value approach has clear merits: lower asset volatility, better risk capital allocation and ultimately higher returns, with far lower costs compared to committing to rigid geographic or sector-focused funds.

Investors should be aware of why a balanced approach to debt and equity is important. The attractiveness of what security to hold greatly depends on the specific asset and on the availability of the type of security is practically accessible. For example junior debt, which in any case is not widely used, is often far too risky to consider in the primary markets, leaving better opportunities on sporadic secondary transactions. Similarly there are specific situations where equity investments may provide sufficient upside to justify equity risk with adequate returns. Through equity investments, investors are more in control of when and how capital is invested, and what capital structure, including debt securities, is put in place. It follows therefore that investors should balance the pros and cons of each debt or equity security case by case. This is the main reason, alongside lower costs and better transparency, why investors have moved from fund investing to more active hands-on direct deal-by-deal investing, adopting a relative value approach where appropriate.

4. Be highly selective: maintain a high bar for new investments

New infrastructure investors assume that selecting a well-diversified portfolio across countries and industries will lead to stable cashyielding returns with attractive longterm returns. While of course prudent diversification is advisable, investment selection is far more critical than investment allocation decisions given the disparity of performance between infrastructure assets.

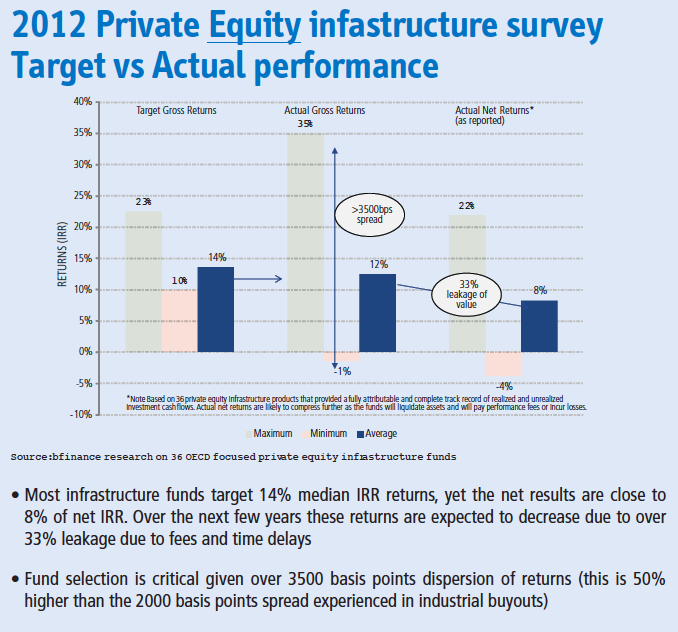

According to research performed by bfinance, an investment advisor overseeing investment allocations relating to €82 billion for 300 investors in 26 countries, infrastructure private equity has generated disappointing risk-adjusted returns. On average, out of 36 funds surveyed, fund managers targeted 14% gross return but achieved 12% subject to a dispersion of 3,500 basis points, a risk of manager selection that is higher than the 2,000 basis points generally experienced with industrial buyout strategies. Furthermore due to timing delays and fee structures applied by private equity infrastructure funds, leakage of return is over 33%, generating net of fees a median IRR of 8%. While as a headline figure this may appear an attractive return during a low interest rate environment, it comes at a very high risk of capital loss. Further research into the portfolios of these fund managers has highlighted how, on average, over 25% of the underlying infrastructure investments did not return its initial capital investment or is held below original cost. A similar proportion of portfolio investments has not paid any yield for 3 years or more. This clearly offers a real risk of capital losses when funds are highly concentrated. Yet, several equity infrastructure funds end up holding 25% to over 35% of the entire portfolio in 1 to 3 assets.

This level of volatility and risk is higher than is typically experienced with private equity industrial buyout investments. When converted into net returns, bfinance observed how net returns from the sampled universe of private equity infrastructure managers generate 8% net IRR. Again, while in absolute terms this may appear attractive in a low interest rate environment, investors are increasingly realising that similar and better returns can be obtained by accessing exactly the same assets through debt infrastructure allocations, where dispersion of returns is minimal and risk of loss of capital is less than 5%. Furthermore, the cost of accessing debt investment strategies can be 50% less than typical fees on private equity infrastructure funds.

This may represent a wake-up call for those investors who might think that allocating to infrastructure means protecting capital and obtaining stable income. Such a significant dispersion of returns calls for far more attention to be put on investment selection in order to avoid getting mediocre riskadjusted returns for what turns out to be high-risk investments.

5. As much as is possible, invest directly or outside fund structures

According to a Preqin report published in July 2012, the world’s largest 100 institutional investors, representing pools of capital from 27 countries, have committed over $200 billion to infrastructure investments. 89% of the largest 100 investors in infrastructure gain exposure to the asset class through commitments to unlisted funds, which is broadly consistent with the other 1,500 institutional investors on Preqin’s Infrastructure Online database. However, 64% of these larger investors gain exposure to infrastructure through direct investments, more than double the proportion of LPs outside the top 100.

Increasingly while investors believe that infrastructure assets on an individual basis may provide the potential for stable and attractive risk adjusted returns, they have also learned that fund structures can eliminate part or all of these benefits. Quoting bfinance: “Due to the high demand for the relatively few true infrastructure assets, pricing is getting very expensive for private equity infrastructure owners. Fund managers often succumb to the pressure to invest on terms that ideally a direct investor would have avoided, including poor warranties, high pricing and weak financing terms. This in turn increases the risk of loss of capital which, when combined with expensive fund management fees often translates to mediocre returns for some private equity infrastructure funds.”

Direct investing in underlying assets outside fund structures provides an efficient and transparent way to construct a relative value quality portfolio. Aside from hiring a dedicated in-house M&A team, which carries its own problems including the need for tight governance to prevent the emergence of personality clashes, investors can rely on outsourced solutions provided by quality advisors including joint venture partners, strategic investors, pension funds or separate account providers. Investing on a relative-value basis, across debt and equity securities, typically costs less than 50 basis points (whether using an in-house team or an external partner), and requires no commitments to rigid fund structures. Importantly, this approach is accessible to small investors if they choose to work together with advisers who are able to club their interests to reach the required scale.

Smaller investors, or investors requiring rapid allocation to infrastructure, should still consider direct investing with the support of specialist advisers. By pooling resources across investors with similar needs, capital can be allocated to existing portfolios of assets (if a short J-Curve is required) and across debt and equity when relative value is considered appropriate. The resulting transparency significantly improves risk management and maintains the quality of the portfolio. Critically, the all-in costs of a dedicated solution can be put in place at a fraction of the costs of a traditional fund (leakage of value for customised solutions can be below 10% compared to 30-50% for traditional funds).

Conclusion

True infrastructure assets, those benefiting from long-term contracted revenues and defensible competitive positions are attractive to investors seeking stable cash yields and capital protection. Even quasi-infrastructure assets, including operating businesses are generally resilient to short-term economic fluctuations and may provide the basis for good downside protection. However the way in which such assets are accessed by their ultimate investors has a direct impact on risks and returns. Investors can at times find better value through public markets (bonds or equities), and when accepting an illiquidity risk, may find that debt investments can provide similar, if not better, returns to equity investments – even in exactly the same assets. However given that no two infrastructure assets are the same investors should be prepared to apply a relative value approach, and to the extent possible, do so without incurring the rigid restrictions and high costs applied by traditional fund managers.

Lorenzo Rossi, head of private markets at bfinance says: “Once you are able to differentiate between the true risks posed by individual infrastructure investments, the key question then arises about how to best obtain appropriate returns to compensate for such risks. Often debt investments may be more appropriate if pricing or terms have squeezed too much risk into the equity. Alternatively secondary investments, such as purchasing units in a fund, may provide a way to de-risk what otherwise would have been a high risk investment based on the original primary investment.” Yet few investors are aware of the choices that exist, and of the fact that even small investors can access such choices when working together with specialist advisors. As most investments are funded with both debt and equity, investors have the ability to access the exact same asset by purchasing its debt or equity securities – be it direct, through funds, or through separate accounts.

More Related Content...

|

|

|